- HitBTC Exchange Key Information

- User Interface

- Security: Is HitBTC Safe?

- HitBTC Fees

- Currency Options

- Trading Limitations

- Customer Service Experience

- Conclusion

HitBTC consistency ranks as one of the top cryptocurrency exchanges on the market in terms of trading volume. Even though liquidity is an important factor, it isn’t the only thing you should consider before using an exchange. In our HitBTC review, we examine all the details you need to know about this exchange.

HitBTC Exchange Key Information

| Key Information |  |

|---|---|

| Site Type | Cryptocurrency Exchange |

| Beginner Friendly | |

| Mobile App | |

| Company Location | Hong Kong |

| Company Launch | 2013 |

| Deposit Methods | Cryptocurrency |

| Withdrawal Methods | Cryptocurrency |

| Available Cryptocurrencies | Bitcoin, Ethereum, Litecoin, + >200 more coins |

| Community Trust | Below Average |

| Security | Average |

| Fees | Low |

| Customer Support | Poor |

| Site | Visit HitBTC |

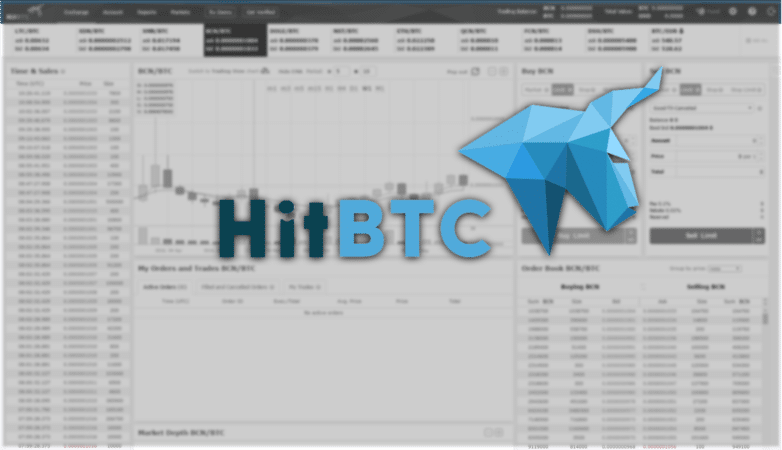

User Interface

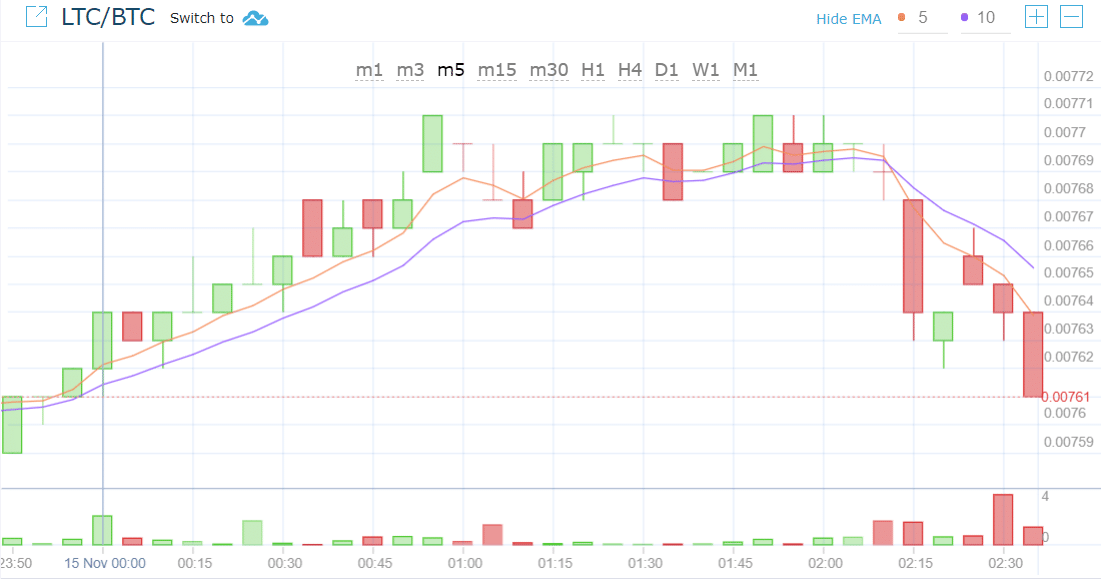

First up in our HitBTC review, we examine the user interface. Compared to most other exchanges, the price chart interface is quite similar. The biggest difference between HitBTC and other exchanges is the way in which funds are categorized on the “account” tab. This is because HitBTC gives each user two accounts (main account and trading account), which both have different functionalities.

The ‘main account’ is designed to be a place where you can store your cryptocurrency funds. If you have funds here, you can not immediately trade them. You’ll have to first transfer them to the ‘trading account’, which is designed specifically for trading and not for storing funds.

After you know this, it’s easy to understand the user interface functionality. However, if you’re a newer user, you might think this is a bit strange. This is due to the fact that almost every other cryptocurrency exchange uses a one-account system. Therefore, having a two-account system does create a little confusion.

Security: Is HitBTC Safe?

Not long after its launch in 2015, HitBTC went offline for a short period of time. During this event, some users complained that they couldn’t withdraw funds from the exchange. This was presumed to have been caused by the exchange freezing user funds as a security precaution after another exchange called Bter had funds stolen during a hack. Overall, the HitBTC incident of 2015 wasn’t a major problem. Of course, many people will argue the fact that the exchange can freeze funds whenever it sees fit is a negative when considering security.

For the most part, the exchange has remained relatively secure. Today, the exchange offers two-factor authentication as a security measure. You can activate 2FA for tasks like login, fund withdrawal, and setting adjustments. As a precaution, you can choose how long your account login will remain active before automatically logging out. The options include 30 minutes, 1 hour, 8 hours, 1-7 days, or never.

HitBTC uses cold storage to secure most of its funds. One unique security feature is “whitelist”. With this feature, you can add any deposit addresses that you trust. Essentially, this is meant to prevent someone (even a hacker) from withdrawing to an address that you aren’t familiar with or don’t control. If a hacker breaches your email account and attempts a withdrawal, HitBTC should be able to block this action.

[thrive_leads id=’5219′]

HitBTC Fees

Compared to most cryptocurrency exchanges, trading fees on HitBTC are competitive. For takers, HitBTC fees are set at 0.1%. Makers don’t have to pay any fees. On the contrary, makers actually receive a 0.01% rebate for each trade.

HiBTC fees for withdrawals are unique in the fact that they aren’t based on transaction volume. For example, if you want to withdraw 10 BTC or 0.5 BTC, you’ll be charged the same fee. Fees are dynamic, and adjust with automatically with the market. If you want to withdraw a larger amount of crypto, this is certainly a positive. However, for smaller amounts, this could be considered a negative. When compared to other popular exchanges like Binance and Bittrex, HitBTC fees for withdrawals are lower for some cryptocurrencies and higher for others.

Currency Options

One of the categories that separates HitBTC apart from most exchanges is its number of available currency options. As of November 2018, there are over 200 different cryptocurrencies available on this exchange. Many cryptocurrencies that aren’t available on other popular exchanges can be found on HitBTC. For many traders, this is a good thing as it means greater liquidity for cryptocurrencies across the board.

For those looking to deposit fiat directly via HitBTC, this option is apparently no longer available. There are a few reviews written previously that say fiat currencies (USD, EUR, GDP) are supported. However, the exchange website (in November 2018) now says it does not offer fiat deposits. However, you can buy Bitcoin using your Visa or Mastercard on another exchange called Changelly, which has partnered with HitBTC to offer this service. You could also do this on any other exchange that offers fiat trading options.

Trading Limitations

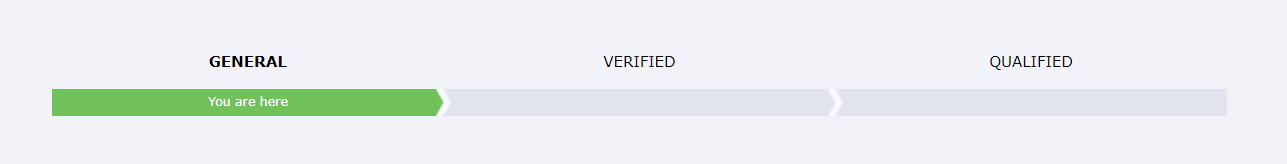

There are three account tiers that determine transaction limits. However, it’s not clear what these tiers actually mean for transaction limits. For example, some have said that verification tiers include the following:

The general account, which doesn’t require verification, has a daily withdrawal limit of the equivalent of 5000 EUR in cryptocurrency. With this tier, you can’t deposit fiat. Verified account is the second tier. It requires a KYC check. You are allowed a 25,000 EUR daily withdrawal limit of crypto. For fiat currency, there’s a limit of $2000 (EUR or USD) per week and $10,000 per month – both for withdrawals and deposits. The third level is a qualified account, which allows you to withdraw more than $25,000 worth of crypto each day. The fiat withdrawals and deposits allowed for qualified accounts are $10,000 per week and around $50,000 (EUR or USD) per month.

However, according to an official HitBTC customer service representative on Reddit, “there is no daily limit at HitBTC”. To add to the confusion, the various stages shown in the graphic below (found on the HitBTC website) are not clickable. Also, no information is provided there that tells the differences between the three account tiers.

Customer Service Experience

In the final category of our HitBTC review, let’s examine the overall customer service experience. According to various customer reviews, HitBTC is relatively slow and sometimes non-responsive to questions from users. For example, a few users have complained that the support team didn’t answer questions beyond the initial inquiry. While it is a positive that HitBTC does have a social media option for addressing customer issues (Reddit), there have often been queues of unanswered questions at times.

Another issue is that sometimes certain coins are “stuck” in the exchange due to technical issues. One specific example of this is when users couldn’t complete any operations with Metaverse ETP funds. By not allowing users to control their own funds and shutting down/freezing certain coins, HitBTC runs the risk of creating continuous issues for some traders.

Conclusion

HitBTC does tend to have competitive trading and withdrawal fees as well as an abundance of cryptocurrency trading options. Nonetheless, there are a lot of issues that the exchange should address. Fund security, customer service experience, and clarification on various exchange policies are all areas that could improve. Hopefully, our HitBTC review can help you determine whether or not this exchange is a good option for you.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.