- What is a bitcoin transaction?

- How does a Bitcoin transaction work?

- How long do Bitcoin transactions take?

- Transaction fees

- Final Thoughts: What Else to Know About Bitcoin

The short answer: However long it takes to transfer Bitcoin between wallets varies from transaction to transaction.

When you make a Bitcoin transaction, it needs to be approved by the network before it can be completed. The Bitcoin community has set a standard of 6 confirmations that a transfer needs before you can consider it complete.

What determines the Bitcoin transaction times?

The two main factors influencing the transaction time are:

- The amount of network activity

- Transaction fees

The more transactions that the network needs to process, the longer each transaction takes. This is because there are only a finite number of miners to process each block and there are a finite number of transactions that can be included in a block.

Miners on the Bitcoin network prioritize transactions by the fee that they receive for confirming them. Therefore, if you pay a higher fee, a miner is more likely to process your transfer which decreases the transaction time.

How long does it take to confirm a Bitcoin transaction?

As mentioned earlier, a Bitcoin transaction generally needs 6 confirmations from miners before it’s processed. The average time it takes to mine a block is 10 minutes, so you would expect a transaction to take around an hour on average.

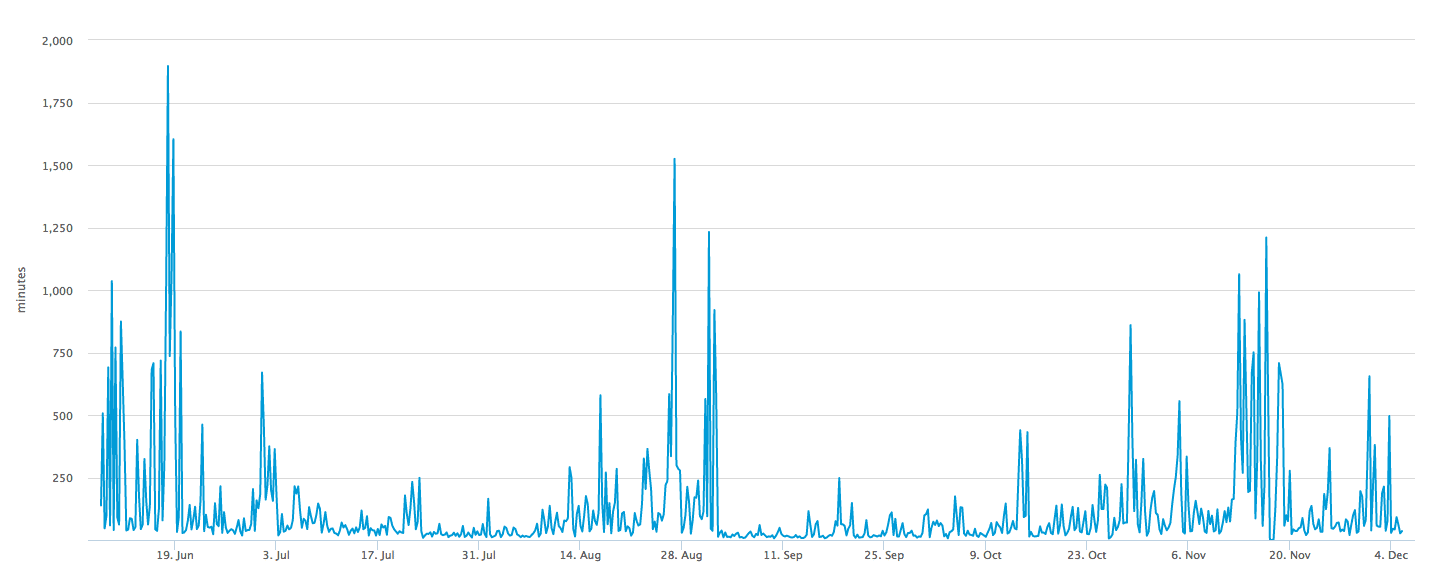

However, the recent popularity boom of Bitcoin has caused congestion on the network.

The average time for one Bitcoin confirmation has recently ranged anywhere from 30 minutes to over 16 hours in extreme cases.

Historically, there has been a divide in the Bitcoin community on how to best address these scaling issues. Some members (specifically those in favor of Bitcoin Cash in 2018) believe that the solution is a larger block size that’s capable of holding more transactions per block.

Other community members debate that improvements such as Segregated Witness (SegWit) and the Lightning Network will speed up the network without having to increase the block sizes.

Only time will tell which solution proves to be the best.

What is a bitcoin transaction?

First, let’s remember that bitcoins don’t physically exist. There’s no solid coin to hold in your hand, nor a token or slip of paper to signify the value of your bitcoin. Instead, bitcoins exist in the virtual realm as a series of transactions that have been verified—in essence, legitimized—on the hyper-secure, public ledger known as the “blockchain.” In other words: bitcoins are a history of signatures, secured with cryptography.

So, if you “have” bitcoin, what you really possess is information: the history of your bitcoins, and a pair of “keys” allowing you to use them—the public key and the private key.

Think of your bitcoin as a collection of information tokens stored in a glass box. The public key is the label of your box—everyone knows this is your box and how much bitcoin your box contains. Like a bank account routing number, your public key is shared so that people can send you money.

By contrast, your private key is safely guarded; it is the only way to open your glass box of bitcoin. Having access to the private key is akin to having control of the bank account, which is why people take great pains to prevent private keys from falling into the wrong hands.

In sum, bitcoins are summaries of transaction information. Public keys allow you to possess that information. Private keys authorize you to send that value to another public key.

How does a Bitcoin transaction work?

Say that you want to give your friend Dave a generous birthday gift of five bitcoin (5 BTC). To do so, you need to use your private key to send a message to the public blockchain announcing this transaction. This transaction message contains three parts:

- Input: the source transaction of the bitcoins you’re sending to Dave. This code explains the history of how the bitcoins came to your public key.

- Amount: the number of bitcoins—in this case, five—that you intend to send to Dave.

- Output: Dave’s public key, or the address to which you are sending the bitcoins.

This three-part transaction message is sent to the blockchain; in reality, transaction involve a lot, for a detailed breakdown, check out this Bitcoin transaction viewer. Once the blockchain receives it, data-crunchers known as “miners” work to verify the transaction. There’s a complicated, very technical background to miners and the work of bitcoin mining, but for the sake of understanding here, we’ll keep it simple. In short, miners solve complex math problems that create new signatures—an updated transaction history—for the transacted bitcoin.

In your case, the miners will verify that you have five bitcoin to send to Dave, then update those bitcoins’ list of past transactions to note that you are sending five bitcoins to Dave’s public address.

How long do Bitcoin transactions take?

Unfortunately for Dave, this process does not occur instantaneously. In fact, bitcoin transactions are subject to delays ranging from a few minutes to a few days. This is because bitcoin requires miners to verify transactions. Transactions are usually lumped into “blocks,” to be verified and added to the public blockchain; according to standard bitcoin protocol, it takes about ten minutes to mine one block.

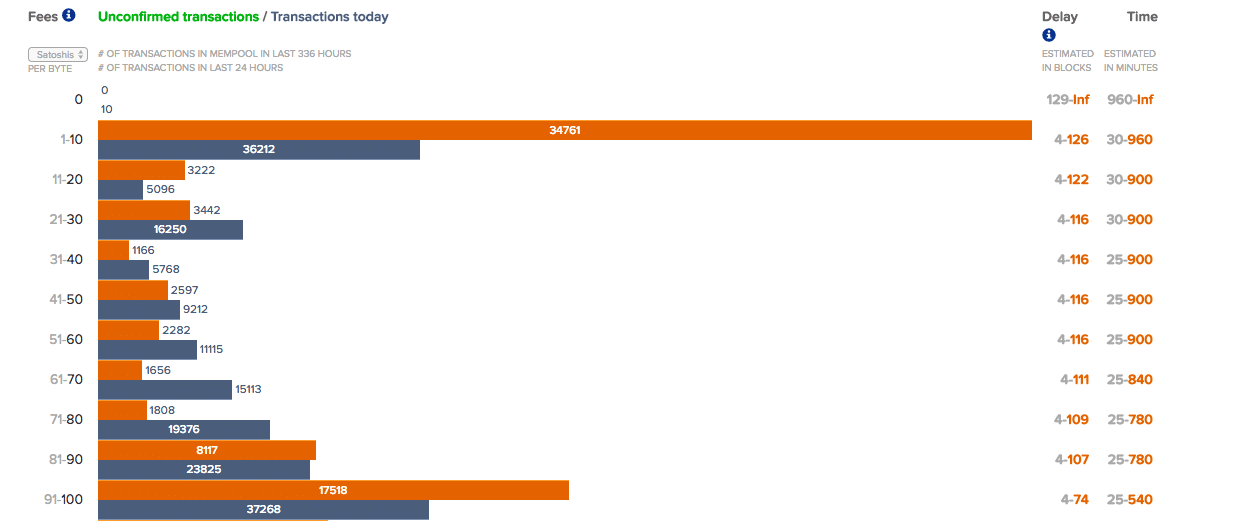

However, due to its rising popularity, the bitcoin network is often backlogged with transactions waiting to be lumped into a block. Block sizes are limited, and those which do not make it into one are lumped into a large queue known as the “bitcoin mempool.” The mempool fluctuates in size, with wait times also dependent on transaction priority and fees, which we will cover shortly. For an idea of the backlog, check out the current Bitcoin Mempool.

Transaction fees

Mining requires significant effort and technology, so bitcoin transactions are increasingly subject to additional fees. Transaction fees help to prioritize the queue—the higher you’re willing to pay miners to verify your transaction, the quicker it’s likely to be processed. Bitcoin transaction fees are usually expressed in “satoshis per byte”. A Satoshi is one hundred millionth of a bitcoin, per byte size of the transaction, which is usually over 200 bytes.

Bitcoin fees aren’t obligatory, though they do incentivize miners to process your transaction faster. Transaction fees are usually set by the user creating the block of transaction data to be mined. These rates and their dependent wait times vary as traffic ebbs and flows.

For instance, you could pay 200 satoshis per byte (which is 0.000002 BTC or 0.01 USD per byte) for your gift to Dave to be placed in the bitcoin queue of the next 1-3 blocks. Your transaction will thus take about 10-30 minutes to be verified.

Alternatively, you could pay a higher fee—say, 300 satoshis per byte—to have your transaction placed in the immediate queue or the next block to be mined. Your transaction will likely be completed in the next 10 minutes.

Bitcoin is a user-based, peer-to-peer system, thus making the system prone to volatility and experimentation. As of this writing, Bitcoin transactions had become alarmingly expensive—at one point, for example, moving 0.01BTC ($42) cost $4 in transaction fees. As bitcoin continues to develop as a platform, the roller coaster of rates, fees, and wait times will likely stabilize.

Final Thoughts: What Else to Know About Bitcoin

Despite Bitcoin’s growing popularity, the actual process of using cryptocurrency remains murky to many people. Transactions—public, yet secure, as they’re reliant on bitcoin’s underlying blockchain technology—are the key to the currency’s future success. They also present some of Bitcoin’s most immediate challenges: wait times, system overloads, and transaction fees necessary to pay “miners” to process the decentralized currency.

Time will tell if the continued use of bitcoin will smooth out the frequently uneven transaction process

This educationally-focused technical article was proudly sponsored by BitScript.app, a Bitcoin educational platform & development environment.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.