- Leveraging What You Own to Borrow What You Don’t

- What’s Your Score?

- How to Use BTC as Collateral

- Margin calls? Default?

- Additional Choices for Your BCL

- Possible, Yes. But Is it Practical?

- Summary

You’ve got plenty of Bitcoins. You’re confident they will steadily increase in value. There’s no way you want to sell a single one, at least not now. But your savings balance is low and you need cash for an urgent, substantial financial need. What to do? Tap your credit card for a loan? Sweet talk your local banker? Visit the payday loan store? It’s time for you to consider how to use BTC as collateral, securing the loan you need. Here’s a look at a couple of venues that can help you accomplish that.

Editor’s note: investing in and trading cryptocurrencies is an incredibly risky endeavor, and leveraging BTC as collateral can maximize losses incurred when trades go south. The following article is educational, and not investment advice. Tread lightly.

Leveraging What You Own to Borrow What You Don’t

The concept of loans isn’t new. You give custody of valuable, marketable property to a lender in exchange for a loan. Depending on how marketable and valuable your collateral is, the lender may give you better loan terms than to a borrower of an unsecured (non-collateralized) loan. And if your credit score is poor, a collateralized loan may be the only way for you to obtain a loan at all. A

What’s Your Score?

Collateralized Bitcoin loans (CBL) may be a good idea for borrowers who have a less than ideal credit score (in the 300 to 629 range). This zone is considered undesirable and will disqualify you from receiving favorable loan terms. If your score is in the extreme lower end of that range, good luck on getting any kind of a loan, collateralized or not.

Not the End of the Story

However, let’s say you have a credit score of 580. You’re slowly recovering from the Great Crash of 2008, or various previous loans with bad credit. Your job situation is stable. Even better, you bought $500 worth of Bitcoin in September 2013 on a whim. Bitcoin was $125 then and is now going for $6,500, an open gain of $25,500. You may be a poor credit risk to a traditional fiat lender (bank, S&L, P2P), but to a Bitcoin collateralized lender, you’re a potentially hot property.

How to Use BTC as Collateral

Applying for a CBL is simple. Provide your personal details to a CBL lending platform operator (connects lenders with borrowers) and prove how much Bitcoin you own. Choose how much fiat you wish to borrow and for how long. At Texas-based Unchained Capital.com, your loan to value (LTV) ratio will be fixed at 50 percent. This means that if you put up all $25,500 of your Bitcoin as collateral, you may be loaned a maximum of $12,750. Currently, only businesses and individuals in 28 of the 50 US states qualify for loan consideration at Unchained.

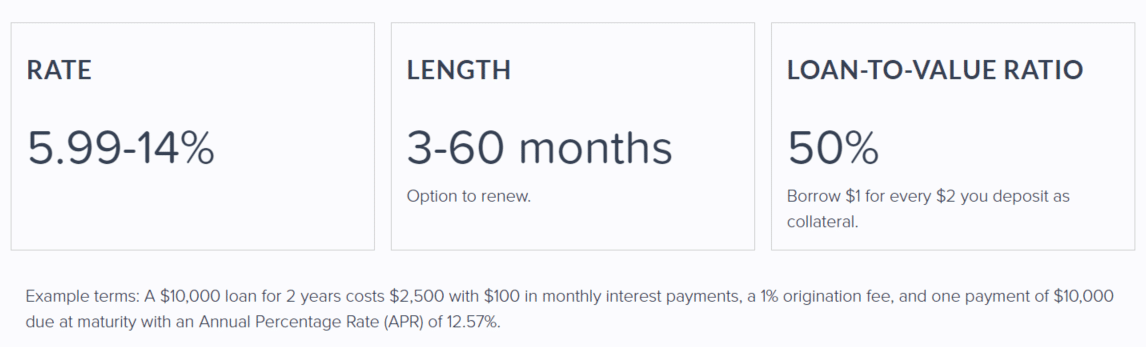

Interest rates range from eight to 14 percent and loan durations of three to 60 months are available. Loan origination fees are listed as one percent. No prepayment penalties are assessed. Unchained accepts Bitcoin and Ethereum as loan collateral. Once approved for a loan, simply transfer your coins to a special cold wallet at Unchained. Upon receipt, your fiat loan funds will be wired to your bank. Unchained makes interest-only loans. You’ll pay an equal amount of interest every month until the loan term is up. Then you make the principal payment, fully satisfying all loan obligations.

Margin calls? Default?

What if the value of your Bitcoin collateral drops significantly? Unchained will request that you add more collateral or make a principal payment. This will restore your LTV ratio and keep your loan out of the principal’s office.

What if you default on your loan? According to the UnchainedCapital.com website:

“If your loan enters default at any time, we will be forced to liquidate a portion of your collateral in order to cover our principal cost and any unpaid interest. Any remainder will be returned to an address of your choosing.”

[thrive_leads id=’5219′]

Additional Choices for Your BCL

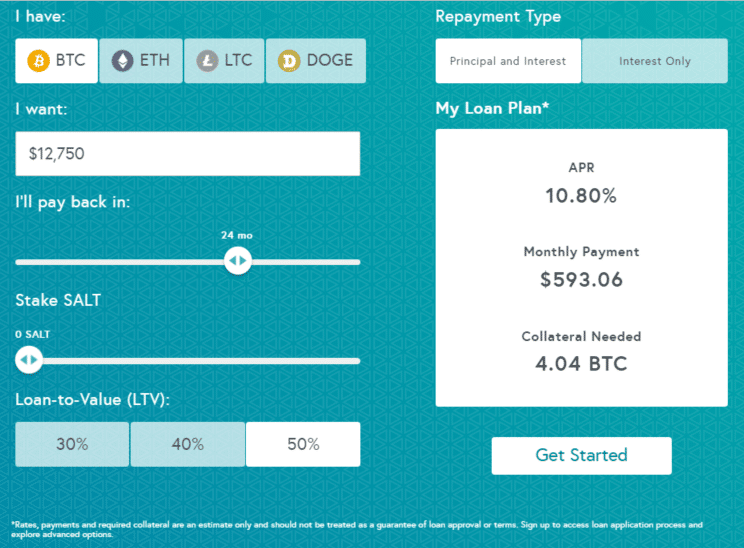

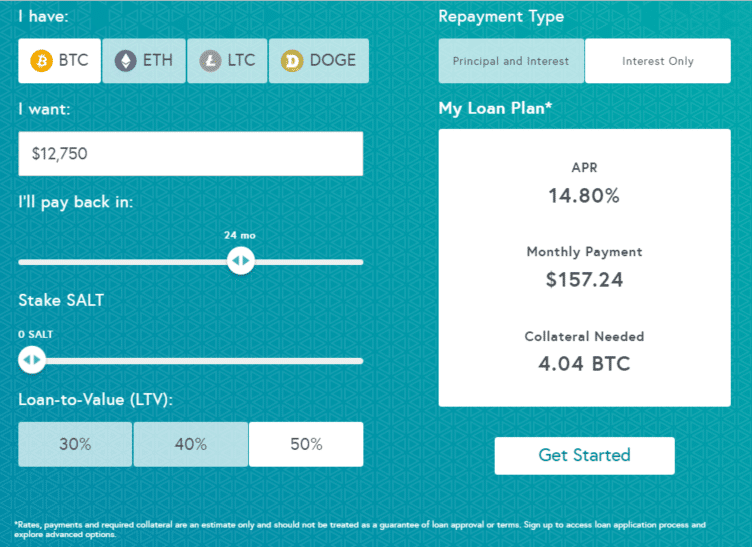

Another competitor in the collateral-coin loan space is Colorado-based SALT Lending.com. Similar loan application, approval, collateral transfer, and margin call protocols apply at this firm. Loans are available to qualified borrowers in the US, Brazil, Switzerland, New Zealand, UK, and several other nations. SALT offers borrowers the option of choosing 30, 40, or 50 percent LTV ratios. For risk-averse borrowers, choosing a 30 or 40 percent LTV ratio may make more sense than a 50 percent version.

A key difference between SALT and Unchained Capital is that the former offers principal & interest loans in addition to interest-only loans. SALT also accepts Bitcoin, Ethereum, Dogecoin and Litecoin as collateral.

Interest rates and loan terms vary; here’s a screenshot of the terms for a $12,750, two-year, principal and interest CBL with a 50 percent LTV ratio:

Here’s the same hypothetical loan, this time in interest-only mode:

Note the Stake SALT slider on the interactive loan calculator. The more SALT tokens that you own, the lower your loan’s interest rate will be. The tokens are trading near .6200 each at the time of writing. Currently, SALT memberships are not required to obtain a loan, per the SALT customer service dept. SALT does not charge loan origination, prepayment penalties or closing fees for fixed-rate loans.

Here’s a look at sample loan terms depicted on the Unchained Capital website as of November 11, 2018:

Possible, Yes. But Is it Practical?

Based on the current info at the SALT Lending and Unchained Capital websites, it certainly looks like a simple process for you to apply, qualify for and then potentially be granted a CBL.

A Perfect World

Here’s a hypothetical scenario that might provide a favorable, rational backdrop for your implementing a CBL:

- Technical analysis suggests that Bitcoin is trading above major support levels.

- The long-term price trend is bullish on the weekly and monthly charts.

- You anticipate that the eventual price appreciation in Bitcoin will greatly exceed the cost of servicing your loan.

- You own a sizable quantity of Bitcoin and do not wish to trigger a taxable event via a sale of your coins.

- Your loan’s interest rate is reasonable, as are your loan origination fees.

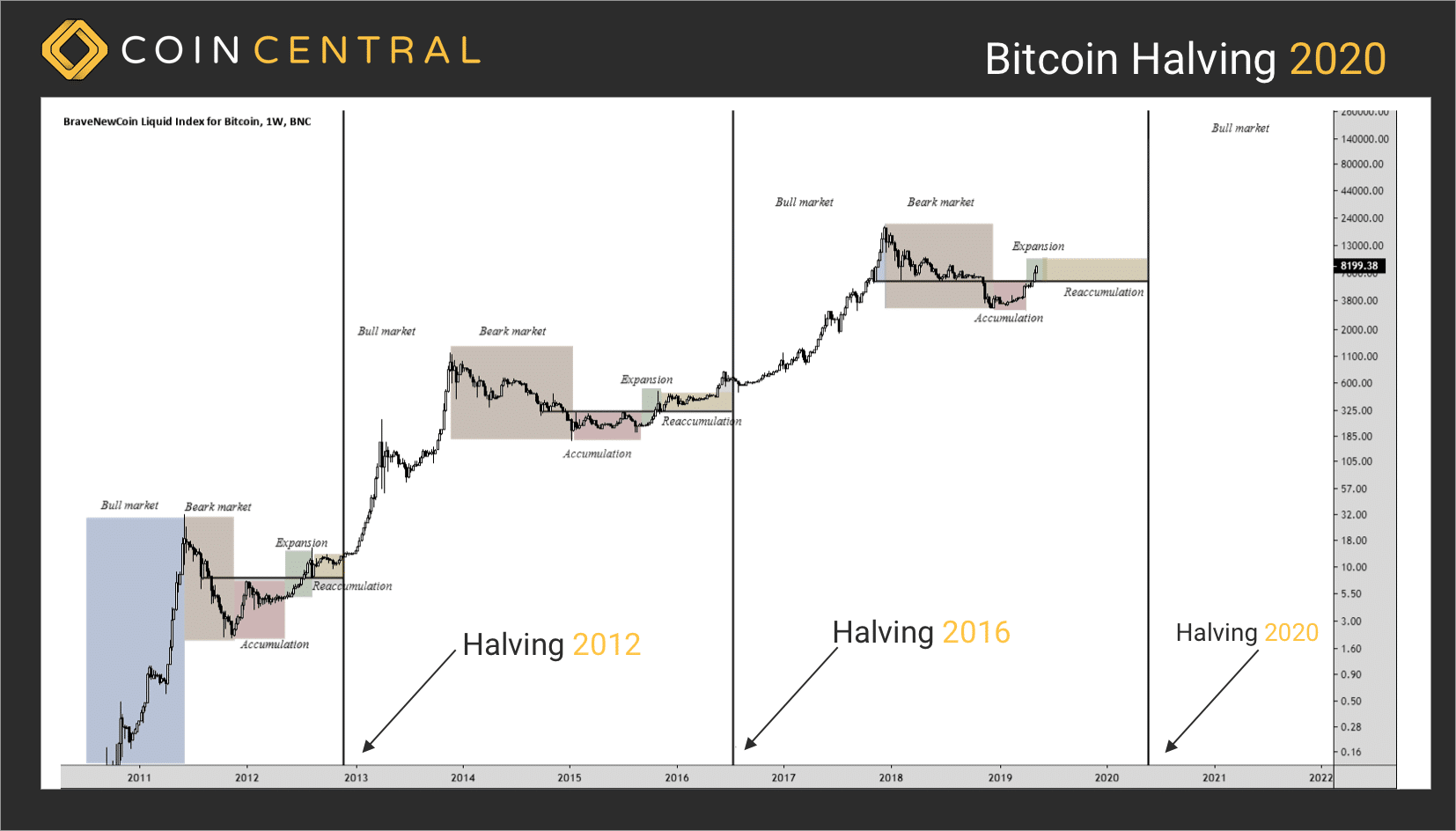

The Uptrend Is Your Loan’s Friend

If you remember nothing else from the points above, make certain that Bitcoin is in a long-term uptrend if and when you decide a CBL is right for you. It’s much harder for your CBL to receive a margin call when Bitcoin continues to make a series of higher highs and higher lows on its long-term charts.

So, put the odds of success in your favor right from the get-go. Only take out a CBL during the early to middle phase of a steady uptrend in Bitcoin. Regular Coincentral readers should already know how to confirm an uptrend and a downtrend.

Summary

If you can’t easily obtain a loan via a traditional fiat lender, a CBL might be a workable alternative. Shop around for the best loan terms and take the time to read through all of the fine print before signing your CBL agreement. Be sure that you take precautions to avoid a margin call, should Bitcoin fall in price during your CBLs term. Stack the deck in your favor for a successful CBL by confirming the existence of a healthy, long-term uptrend in Bitcoin.

Note: Information for SALT Lending.com and Unchained Capital.com was obtained from various sections of each firm’s respective website on November 11, 2018.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.