- What is Litecoin Cash (LCC)?

- How Does it Work?

- About LCC

- Controversy

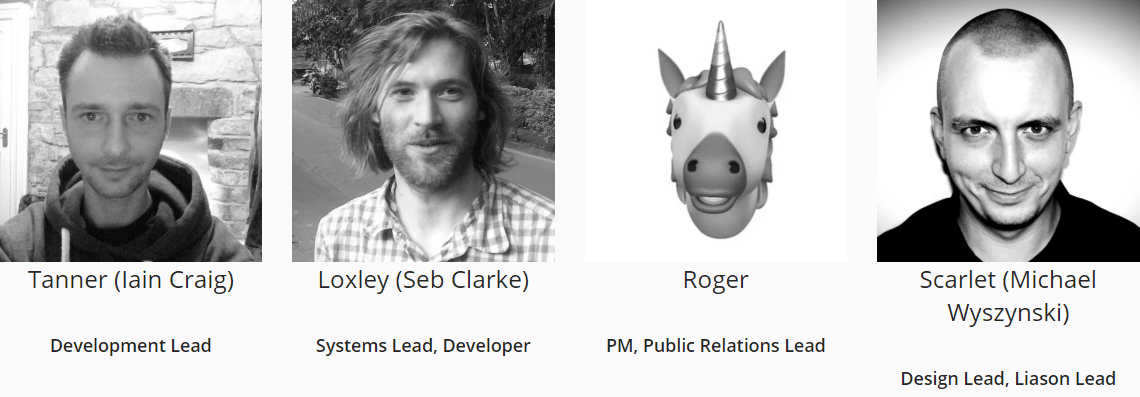

- Meet the Team

- Coin Supply & Sustainability

- Trading History

- Where Can You Buy Litecoin Cash?

- Where Can You Store it?

- Conclusion

What is Litecoin Cash (LCC)?

Litecoin Cash (LCC) is a Litecoin fork that has a higher max supply, runs the SHA256 mining algorithm, and has better difficulty adjustment.

Forks, forks everywhere. 2017 was a record year for cryptocurrency forks. There were probably more forks in 2017 in crypto than you would find in a department store’s cutlery inventory. Initial Fork Offerings or IFO‘s are the new buzzwords among many in the community. It appears that the Litecoin Cash crew are well… trying to ‘cash in’ on this alternative way of raising capital.

Litecoin Cash is a breakaway or fork, as it’s more commonly known, from the original Litecoin project.

Fork it

A fork happens when developers with a different ideology take a snapshot of the existing code from an established cryptocurrency (Litecoin in this case). They then continue development based on their different views to take this newly established cryptocurrency in another direction.

Litecoin Cash sharing their views in the official whitepaper:

With a wide and ready pool of mining power to tap, state-of-the-art difficulty adjustment to react to network hash dynamics, a mature and fair distribution, and a modern feature set, tuned to everyday use with fast transactions and low fees we are confident that the legitimacy of our ideas, will be borne out by success in the wider market.

An initial fork offering is a kind of alternative ICO. Instead of sending funds to the project, you simply need to hold the original coin at the time of the snapshot. You will then receive the new coin at a specific exchange rate set by the developers. In this case, for every 1 of the original cryptocurrency you hold (Litecoin), you get 10 of the new cryptocurrency, Litecoin Cash.

How Does it Work?

The decision behind the 10 for 1 swap was to simplify the mathematics when working with the coin. For eg. in the case of Bitcoin, you often need to work in fractions of a bitcoin when transacting. This is not so much of a problem for the crypto nerd amongst us, but the common man needs a currency which is easy to work with. Trying to work in fractions of a bitcoin (satoshis) is not always practical.

Litecoin cash (known by the symbol LCC) runs on its own blockchain and LCC combines features from several well-established coins:

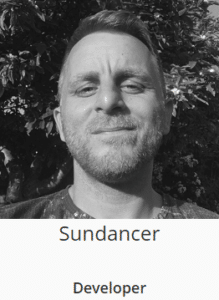

- Lower transaction fees, better difficulty adjustment and mined with SHA256 (compared to Litecoin)

- Faster, cheaper, more bandwidth and better difficulty retargeting (compared to Bitcoin)

- Supports Segwit and has much faster block times (compared to Bitcoin Cash)

Here is a comparison grid outlining these potential benefits versus established coins and other forks:

2 Key differences we’d like to point out are the mining algorithm and difficulty adjustment:

Let’s Get Technical

The Litecoin Cash mining algorithm has switched from Litecoin’s Scrypt system to Bitcoin‘s SHA256. The Litecoin Cash team claim that this will create a kind of recycling of old bitcoin mining hardware which can be used to secure the LCC network.

The difficulty adjustment is a setting in a proof of work network aimed at miners. As hardware speeds increase the difficulty goes up. This ensures the stability of the network over time and keeps block times at a steady rate. A history of Bitcoin’s difficulty adjustment can be found here.

LCC have borrowed the DarkGravity difficulty adjustment which was pioneered by Dash. This claims to make a network more secure as block times are much more consistent regardless of large swings in mining power as the network grows.

About LCC

History

Litecoin Cash was forked at block 1371111 of the Litecoin blockchain. The creators claim that one of the major benefits of forking from an existing coin includes an even distribution of new coins. Since Litecoin is a well-established brand in the cryptocurrency space, the creators cannot be accused of hoarding coins since new coins are distributed to existing Litecoin holders at the time of the fork.

Key Benefits

- 10:1 Claim Ratio: For every 1 LTC you held at the fork block, you can claim 10 LCC.

- SHA256 Mining: After the fork block, Litecoin Cash switched to SHA256 proof-of-work hashes. This enables a new use for previously obsolete Bitcoin mining hardware.

- Network Resilience: Mining difficulty is recalculated every block, using Evan Duffield’s proven DarkGravity V3 algorithm from Dash. This provides more predictable block times as well as network protection from multipool hopping.

- Optimized for the Real World: Target block time of 2.5 minutes gives 4 times the transaction bandwidth of Bitcoin, while transactions are 90% cheaper than Litecoin.

- Slow-Start Control: To prevent dominant early miners having an unfair advantage, block rewards will start at 0.25 LCC and grow to 250 LCC over the first 2000 blocks after the fork. The first 24 blocks after the fork will be mined at minimum difficulty. After this, DarkGravity will adjust the difficulty based on observed block generation time. The 250 LCC block reward (equivalent to 25 LTC) will be halved at the same chain heights as Litecoin.

- Small Premine: An equivalent amount to less than 1% of circulating money supply (less than 0.65% of total money supply) at fork time was paid to a development fund.

Controversy

As news of the fork was made public, Litecoin creator Charlie Lee swiftly dismissed the project and had the following to say:

PSA: The Litecoin team and I are not forking Litecoin. Any forks that you hear about is a scam trying to confuse you to think it’s related to Litecoin. Don’t fall for it and definitely don’t enter your private keys or seed into their website or client. Be careful out there! https://t.co/qXbiIxp5Al

— Charlie Lee [LTC⚡] (@SatoshiLite) February 4, 2018

https://platform.twitter.com/widgets.js

Charlie’s comments most likely relate to the Bitcoin Cash hard fork that took place last year (2017) and the drama that followed between both the BTC and BCH communities. Charlie’s point is a little ironic though considering that Litecoin itself is a hard fork of bitcoin.

The LCC project, on the other hand, have stated in interviews that re-use of an original coin’s name in a forked coin is simply an industry convention. The point of open-source is, after all, designed for the copy and change of existing code to experiment and improve on the original design.

It would appear that hard fork coins love using the original coin’s name in their own as a way to create credibility for their brand.

Meet the Team

Core Team

Unfortunately, we weren’t able to find much information on the core or associate team via LinkedIn. Providing additional background information to the public via a platform like LinkedIn would add credibility to the LCC project. For now, we’ll provide some info based off of their website.

Iain Craig (Tanner) is the lead developer on the project with 20 years of commercial experience. Tanner has been active in the crypto scene since 2013 with development in multiple altcoins and several blockchain-based services.

The unicorn you see below is known only as Roger. As the public relations guy, Roger has appeared on several youtube videos to address concerns to the community. Roger is an experienced project manager for a major online foreign exchange platform. He’s been involved in cryptocurrency for over 5 years.

The LCC crew have provided several videos and chat interviews to the crypto community via social media. We recommend the reader do a search of these to learn more about the team. This should at least answer some questions for potential users and investors of the LCC network.

Associates

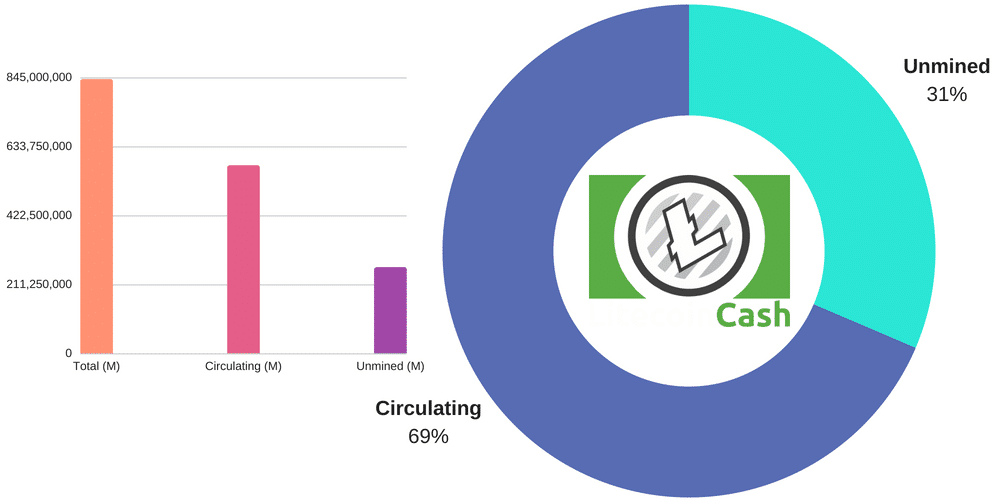

Coin Supply & Sustainability

Mining Sustainability

As we mentioned previously, Litecoin Cash wants to tap into the outdated bitcoin mining hardware market. Bitcoin miners continue to compete at very high levels by bringing out better hardware on a regular basis.

This puts some serious questions out there on the environmental impact of Bitcoin. Both, from an electricity standpoint but also from a hardware waste point of view. If LCC can use this old hardware in a productive way this might be a huge plus for their network in the long run.

Trading History

Litecoin Cash began trading on Feb 20, 2018, around the $5 mark. The price, however, has plummeted since then, trading at around $0.04 at time of publication.

2017 Was a year of feverish speculation and the 2018 bear market to date has not helped with the overall price. Nevertheless, if LCC wants to see the adoption of their coin then we probably need to see renewed buying interest from investors to inspire confidence in their vision.

Where Can You Buy Litecoin Cash?

You can purchase Litecoin Cash at the following exchanges:

Some other exchanges also trade this coin, however, volume overall for LCC is quite low and you’ll probably want to stick with an exchange where it’s easier to get in and out of a position.

According to their site, the LCC team have also applied for a listing on Binance which, if successful, should boost Litecoin Cash trading volumes. They are also looking into adding the coin on decentralized exchanges such as the Komodo BarterDEX.

Where Can You Store it?

The development team has provided both a light and full wallet for storing your coins. The light Electrum wallet doesn’t require the full blockchain to run, however, only a desktop version for Windows and Mac is currently available. Coinomi provides a more practical mobile wallet for those on the go.

Dedicated Litecoin Cash users may also want to download the entire blockchain and store it locally. Links to all of the above wallets can be found on Github via the official website.

In terms of hardware wallets, the roadmap outlines a target for both Ledger & Trezor around the June/July timeframe of 2018. However, the roadmap goals seem to be lagging a bit and we could probably see these dates extended a bit.

Conclusion

The value proposition of Litecoin Cash is certainly an interesting one. One of the major advantages of cryptocurrency is the very fact that new ideas can be built on the back of established ones. As additional forks come to market they will need to innovate to bring real-world benefits to potential coin holders.

By borrowing technology from multiple cryptos, LCC aims to create a Frankenstein style crypto with all the best features patched on. This may prove to be a good strategy however cryptos like Litecoin and Bitcoin already have one major bonus, first mover advantage.

The later you launch your project in the cryptosphere the harder it (usually) becomes to build a meaningful community around it. Time will tell whether this fork can establish itself in the long run. For more information and updates about Litecoin Cash, you can stay in touch on the following channels:

[thrive_leads id=’5219′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.