- Welcome to KuCoin, Binance’s Fiercest Competitor

- What are KuCoin Shares (KCS)?

- Key Features of KuCoin/KuCoin Shares

- How Do KuCoin Shares Work?

- KuCoin User Experience & Interface

- About the Team

- KuCoin Shares Coin Supply and Sustainability

- KuCoin Shares Trading History

- Where Can You Buy KuCoin Shares?

- Where Can You Store KuCoin Shares?

- Conclusion

Welcome to KuCoin, Binance’s Fiercest Competitor

KuCoin is an international cryptocurrency exchange based out of Hong Kong that currently supports the trading of 210 digital assets. What’s unique about KuCoin is that they share 50% of their overall trading fee revenue with users holding their exchange-based token. In a similar fashion to Binance, KuCoin offers relatively low tradings fees and incentives for holding (or trading) its native cryptocurrency.

Back in 2011, the founders started researching blockchain tech and went further to build the technical architecture for KuCoin in 2013. 4 years later, the exchange launched with the ultimate goal of “becoming one of the top 10 worldwide hottest exchange platform[s]” by 2019.

Even with its relatively recent launch in late 2017, KuCoin has already managed to work its way up from an obscure exchange to the 19th largest by trading volume. Many in the crypto community are optimistic about KuCoin’s growth, such as active community member “Crowd Conscious” who on January 5th wrote, “just 3-months into their expedition, KuCoin has attained a whopping 300,000+ user registrations — a growth figure we’ll only hear from Binance Exchange who reached over 3,000,000 in 6-months.”

What are KuCoin Shares (KCS)?

KuCoin Shares (KCS) are the native currency of the KuCoin exchange platform that allows holders to profit from the success of the exchange. KuCoin takes into account the amount of KCS users hold when distributing the various coins. The more KCS you hold, the more dividends you’ll receive.

What if holding 1 coin earned you 200+ different coins every day?

This payout system enables users to receive passive income by just holding. However, while the company currently does share 50% of trading fee revenue with users, it’s important to note that the percentage paid to KCS holders from these trading fees is set to reduce in the future.

The payout enters users balances at 0:00 (UTC+8) every day, done so after the accounting team evaluates the trading fees from each trading pair on the platform. Therefore, it’s possible that when you wake up in the morning and take a look at your overall balance on the KuCoin exchange, you may notice you’re holding a little bit more Bitcoin, Nano, Dragonchain, and a couple other hundred tokens you may not have had before.

[thrive_leads id=’5219′]

Key Features of KuCoin/KuCoin Shares

- Incentives bonus: KCS holders receive daily cryptocurrency dividends

- User-friendly exchange format

- Low fee structure: Same low 0.1% trading fee as Binance (Bittrex charges 0.25%), a trading discount for KCS holders and low withdrawal fees

- 24/7 customer service: Includes webpage, hotline, email, and more

- Exclusive KCS holder rights: Higher ranking KCS users will receive one-on-one consultative services for investment strategies and expedited customer service

- KCS is an ERC20 token

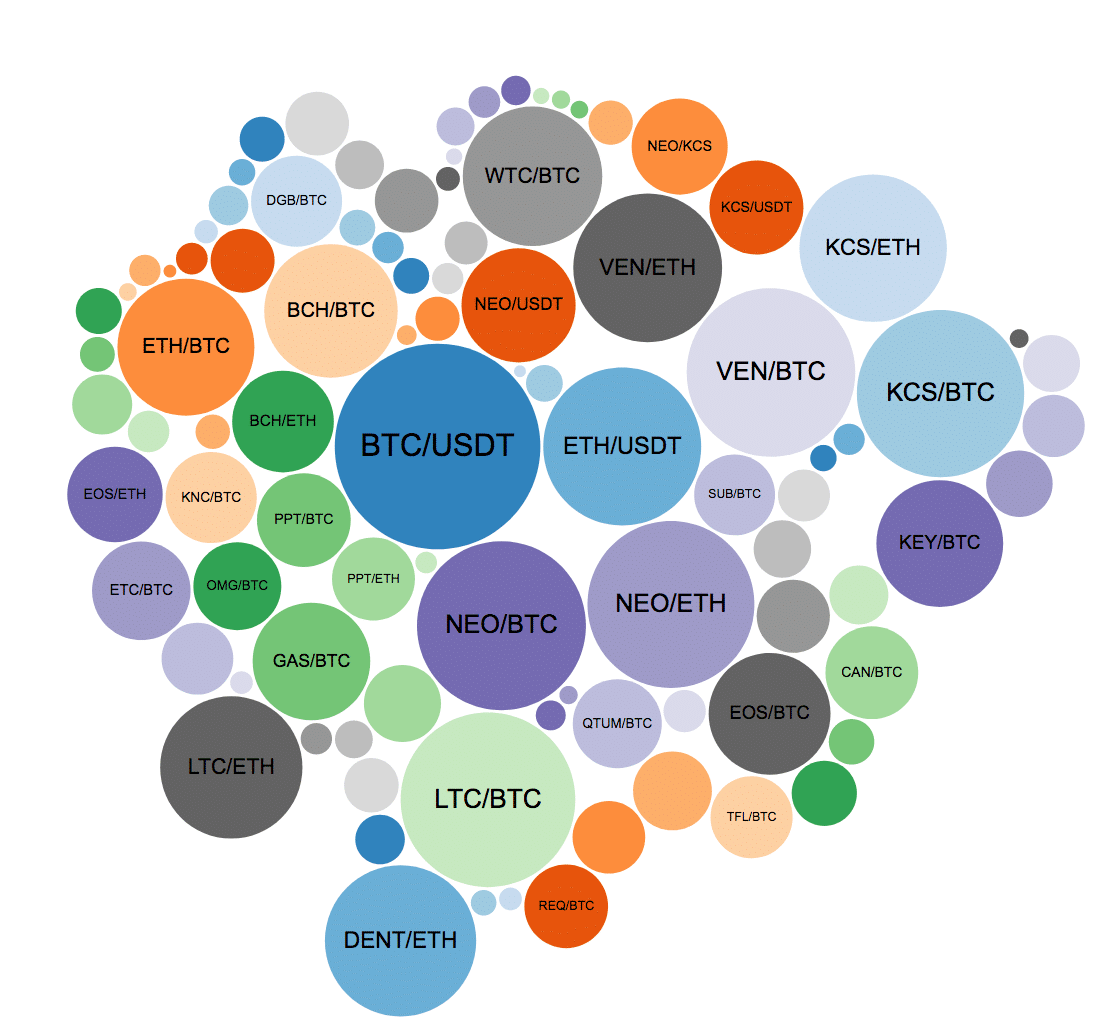

- Numerous Trading pairs: BTC, ETH, NEO, USDT, KCS, BCH

- Exchange security: High-level privacy, asset, and operational level security system based on bank standards. The team even takes disasters into consideration by having three centers and two locations

- Future decentralized exchange

- High-performance engine for scalability: The technology enables hundreds to thousands of times superiority in terms of efficiency compared to normal industry standards, resulting in no delays or lags

How Do KuCoin Shares Work?

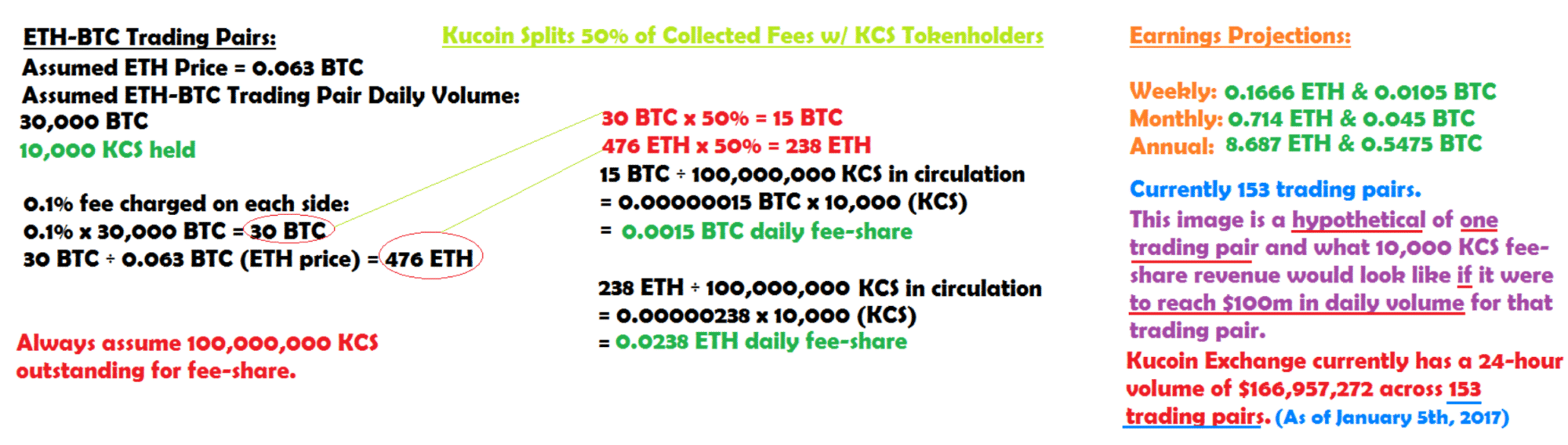

The project’s whitepaper gives a great explanation of how KuCoin Shares are distributed. As stated before, the distribution methods take into consideration the amount of KCS in a user’s exchange wallets. Below is an example used in the whitepapers using the ETH-BTC trading pair if a user is holding the amount of 10,000 KCS.

Above you will notice the earnings projections for a holder of 10,000 KCS (approximately $80,000 at its current value of around $8). The earnings are as follows:

- Daily: 0.00015 BTC & 0.0238 ETH

- Weekly: 0.0105 BTC & 0.16666 ETH

- Monthly: 0.045 BTC & 0.714 ETH

- Annually: 0.5475 BTC and 8.687 ETH

Keep in mind this is just one trading pair out of more than 200 trading pairs on the exchange, all of which collect trading fees that will be distributed to users accounts based on the formula shown in the displayed image. Therefore, a user holding KCS will be receiving dual cryptocurrencies from other trading pair fees (e.g. LTC/NEO).

For every 1000 KCS you hold, you will receive a 1% trading fee discount with the maximum amount capped at 30%. For example, if you hold 20000 KCS you will receive a 20% discount, but holding 50000 KCS will max you out at a 30% discount.

KuCoin User Experience & Interface

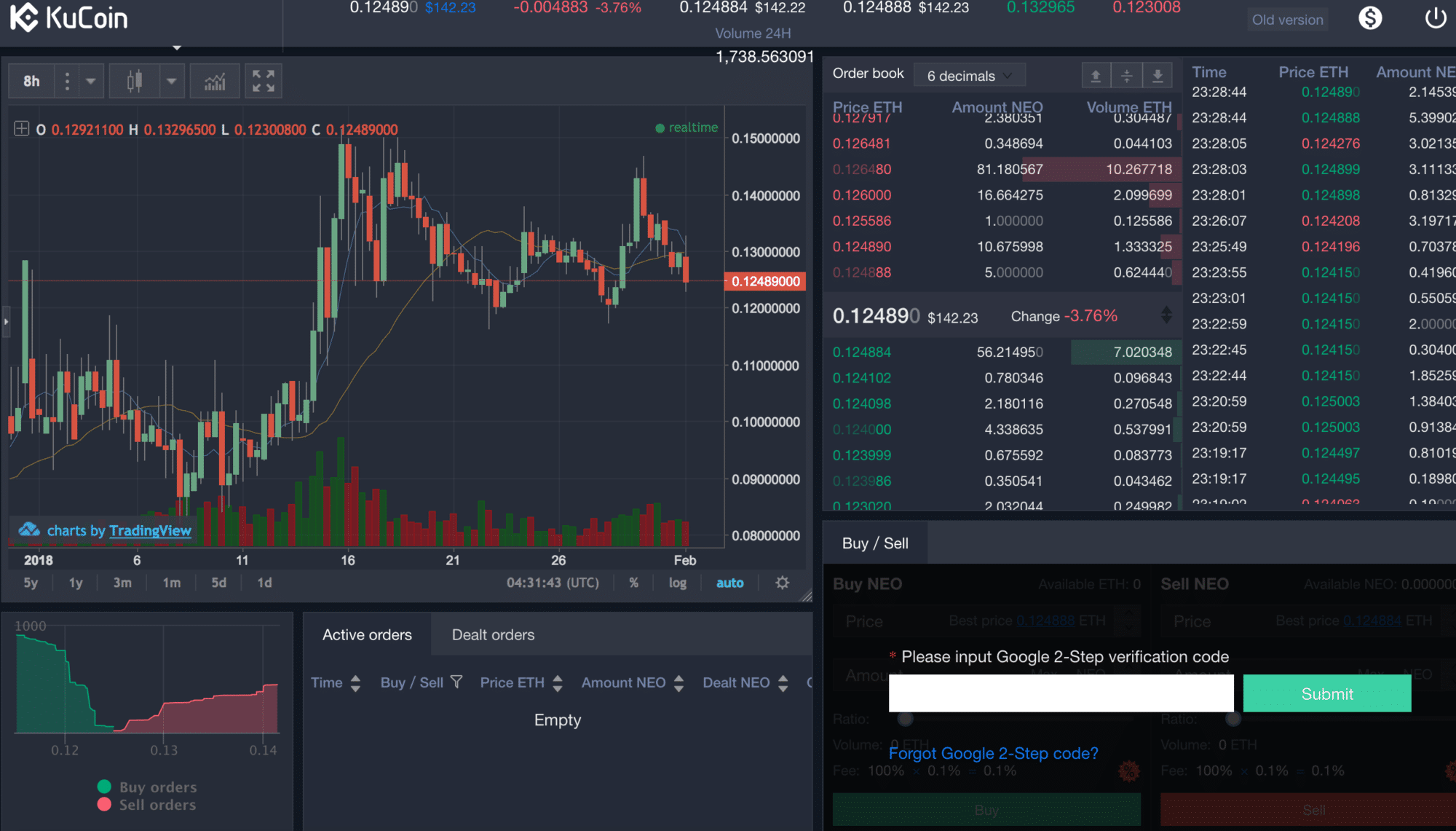

KuCoin has done a great job building a user-friendly interface without sacrificing the charts, graphs, and other information you may want to make informed investment decisions.

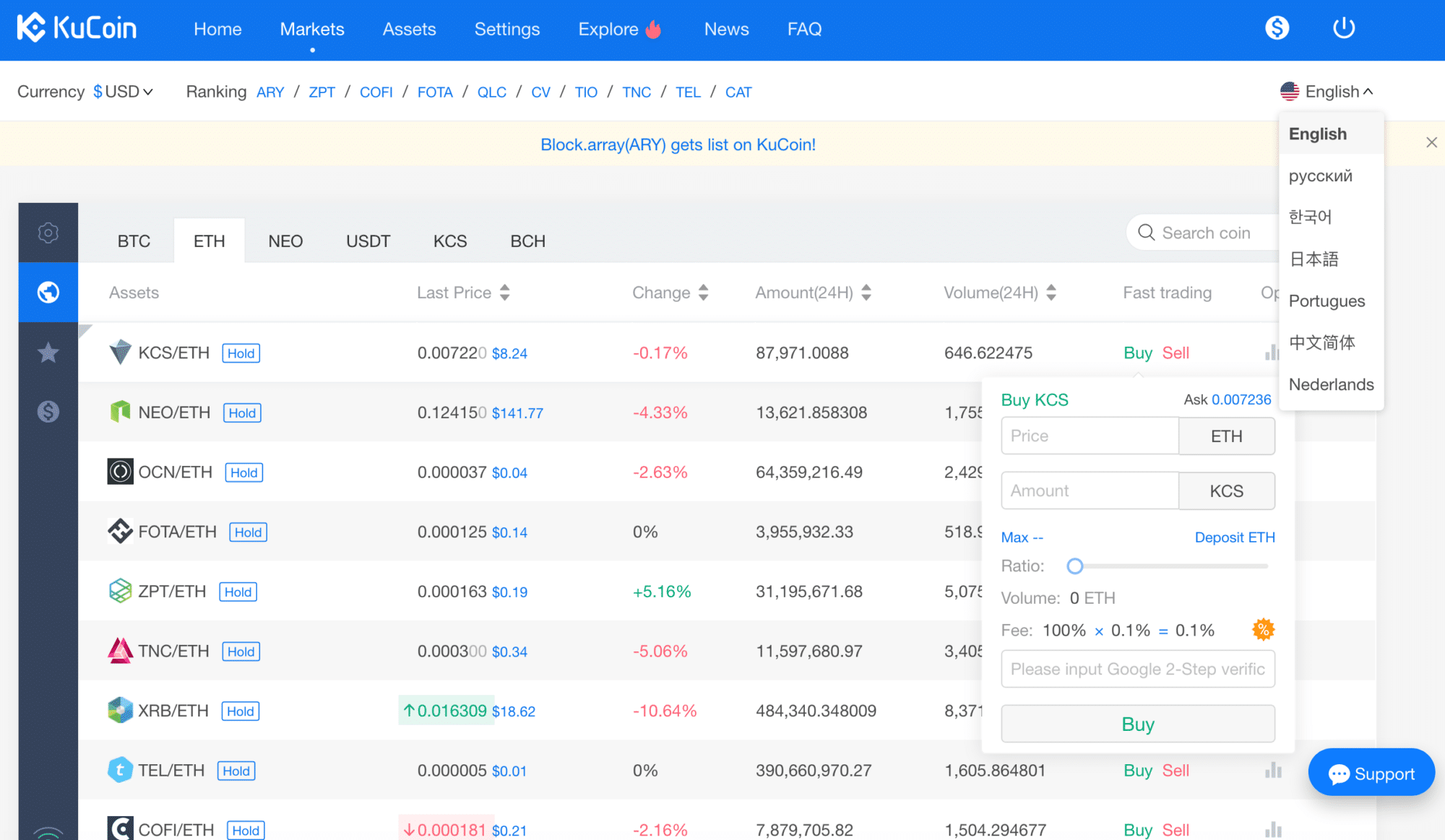

The exchange is translatable to 11 popular languages including English, Portuguese, Dutch, Mandarin, Japanese, German and Spanish. Trading is also made easy and only requires a few clicks after you’ve navigated under the markets tab located on the top of the screen.

In case you need extra assistance navigating the exchange, there is a support bubble displayed on the bottom right of your screen. Finally, by clicking on a certain pair (e.g. KCS/ETH), KuCoin will redirect you to the more detailed view of that pair as seen below.

About the Team

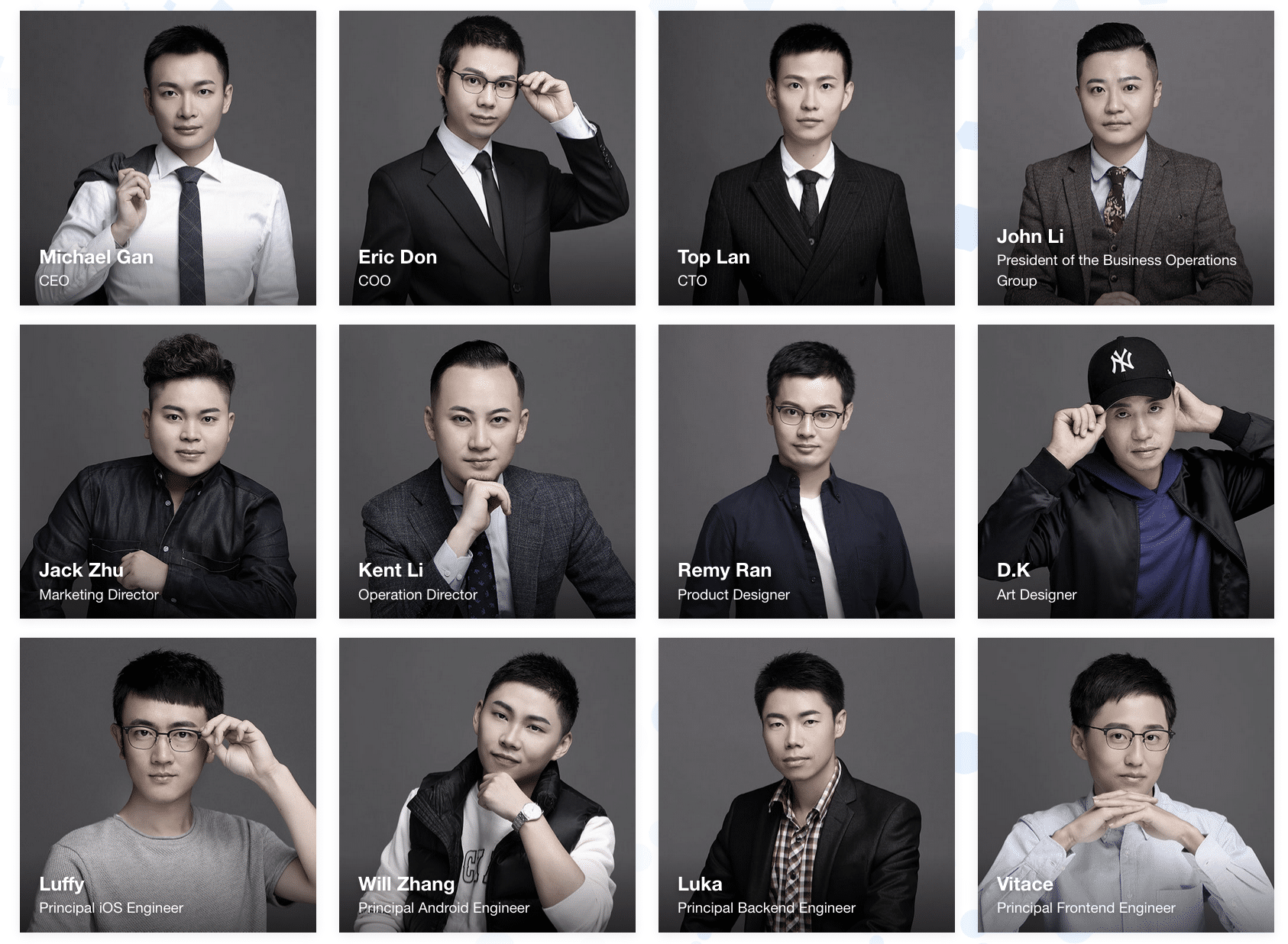

As stated on their official website which lists 12 core members, “Kucoin aims at providing users digital asset transaction and exchange services which are even safer and convenient, integrating premium assets worldwide, and constructing state of the art transaction platform”.

CEO and founder, Michael Gam, is a former technical expert at Ant Financial, an affiliate company of the Chinese Alibaba Group. He was also a senior partner at Internet giants like MikeCRM and KF5.COM.

COO, Eric Don, is referred to as a “senior Internet researcher, systems architect, and Internet industry star”. He is also stated to be the CTO and senior partner of IT companies including YOULIN.COM, KITEME, and REINOT. However, it’s unclear if these websites actually exist as they did not show in a Google search or when entering the website domains. According to his LinkedIn, he is currently CTO at Youlin Network Technologies, yet there is no mention of KITEME or REINOT.

KuCoin Shares Coin Supply and Sustainability

https://files.coinmarketcap.com/static/widget/currency.js

According to CoinMarketCap, there’s a total supply of a little over 180,000,000 KCS with a circulating supply of just over 90,000,000 KCS. While the total issuance amount of KCS was originally 200 million, the KuCoin team has decided to go through with a “buy-back” program that utilizes at least 10% of the net profit every quarter to buy-back KCS and destroy them until there are only 100 million KCS remaining.

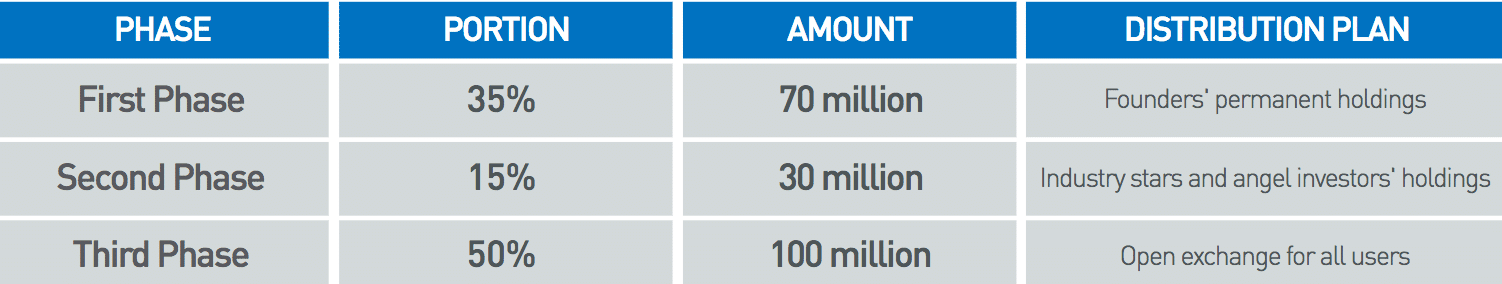

The three phases distributed 35% of KCS to founders, 15% to industry stars and angel investors, and 50% for all users. According to the whitepaper, the 70 million KCS issued to the founders is “subject to a four-year lock-up period from Sep 2nd, 2017 to September 2nd, 2021. Founders are prohibited to assign or sell their KCS holdings in any way before September 2nd, 2018.” The 30 million KCS for industry holders and angel investors follow a similar direction, yet are only subject to a two-year lock-up period. The KCS purchased during the ICO went on the exchange on Sept. 2nd, 2017 as they were not subject to lock-up.

KuCoin Shares Trading History

KCS whitepaper says it began trading in late 2017 for roughly 70 cents and it has remained relatively stagnant until early January. Reaching ATH’s of over $20, the cryptocurrency dropped more than 50% to its current level of trading around $8. This chart reflects the overall volatility of the cryptocurrency market and highlights the bear market that ensued mid-January.

baseUrl = “https://widgets.cryptocompare.com/”;

var scripts = document.getElementsByTagName(“script”);

var embedder = scripts[ scripts.length – 1 ];

(function (){

var appName = encodeURIComponent(window.location.hostname);

if(appName==””){appName=”local”;}

var s = document.createElement(“script”);

s.type = “text/javascript”;

s.async = true;

var theUrl = baseUrl+’serve/v3/coin/chart?fsym=KCS&tsyms=USD,EUR,CNY,GBP’;

s.src = theUrl + ( theUrl.indexOf(“?”) >= 0 ? “&” : “?”) + “app=” + appName;

embedder.parentNode.appendChild(s);

})();

Where Can You Buy KuCoin Shares?

KCS is only able to be purchased on the companies official exchange site. Registration is fairly simple, but you’ll need to deposit initial cryptocurrencies into your KuCoin exchange wallet such as BTC, ETH, NEO, and/or BCH to trade for KCS.

Where Can You Store KuCoin Shares?

KCS is an ERC20 token, meaning you can store it on hardware wallets that support the Ethereum blockchain such as the Ledger Nano S and Trezor. You can also store it on MyEtherWallet (MEW). To check out more wallets, refer to our guide, The Best Ethereum Wallets.

Conclusion

According to CoinMarketCap, OKEx is currently the world’s largest exchange with a 24-hour trading volume of over $2 billion USD. While KuCoin pales in comparison to OKEx with a trading volume of around $128 million USD, it may continue its massive draw of new users and move into a top 10 spot. This would put it close to 3rd ranking Binance ($1.7 billion USD) surpassing the current 10-spot, HitBTC ($475 million USD).

Considering the dramatic increase in cryptocurrency interest worldwide and the fact that exchanges are closing their doors to new user accounts due to a lack of scalability, it would not be unreasonable to witness the success of this exchange and its native cryptocurrency, KCS.

For more information and updates on the project, please click on the links below.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.