- Gemini Earn Quick Summary

- Gemini Earn Review: Interest Account and Interest Rates

- How Does Gemini Earn Make Money?

- Gemini Earn Review: How Safe is Gemini Earn?

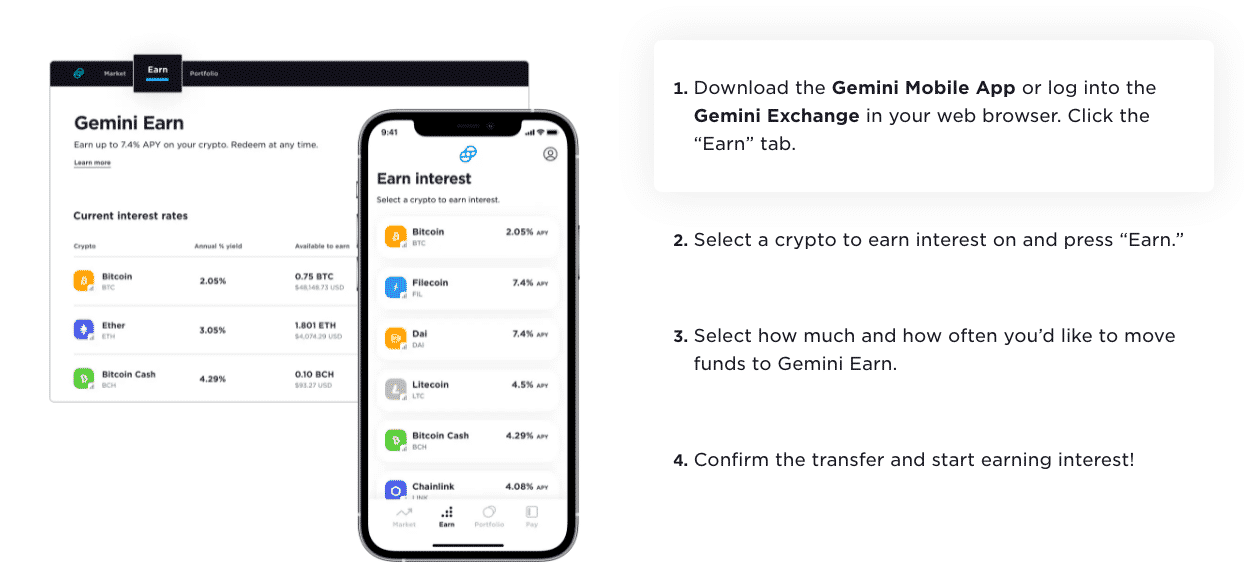

- How to Use Gemini Earn

- Gemini Earn Review: Fees

- Ease of Use

- Promos and Bonuses

- Gemini Earn Review Final Thoughts: Is It Worth It?

Gemini Earn is a cryptocurrency interest account feature on the cryptocurrency exchange Gemini. Gemini Earn enables users to transfer funds into an “Earn” account and get up to 7.40% APY on BTC, ETH, stablecoins, and other altcoins.

Gemini is regarded as a pioneer in the cryptocurrency industry. It has built its reputation with a suite of products and features, such as the Gemini exchange and wallet, a stablecoin GUSD, and Gemini Pay, a feature for users to pay with crypto at traditional businesses like Bed, Bath and Beyond.

With Gemini Earn, Gemini throws its hat into the ring of the world’s best cryptocurrency interest accounts— an increasingly competitive industry that includes BlockFi, Celsius, and competing exchange Coinbase.

The following guide explores how Gemini Earn works, its features, the interest rates it offers on various cryptocurrencies, security, and how it compares to its competition.

Gemini Earn Quick Summary

Announced in February 2021, Gemini Earn is a relative newcomer to the cryptocurrency interest account niche. The parent exchange, however, has been around since 2014 and is founded by Tyler and Cameron Winklevoss.

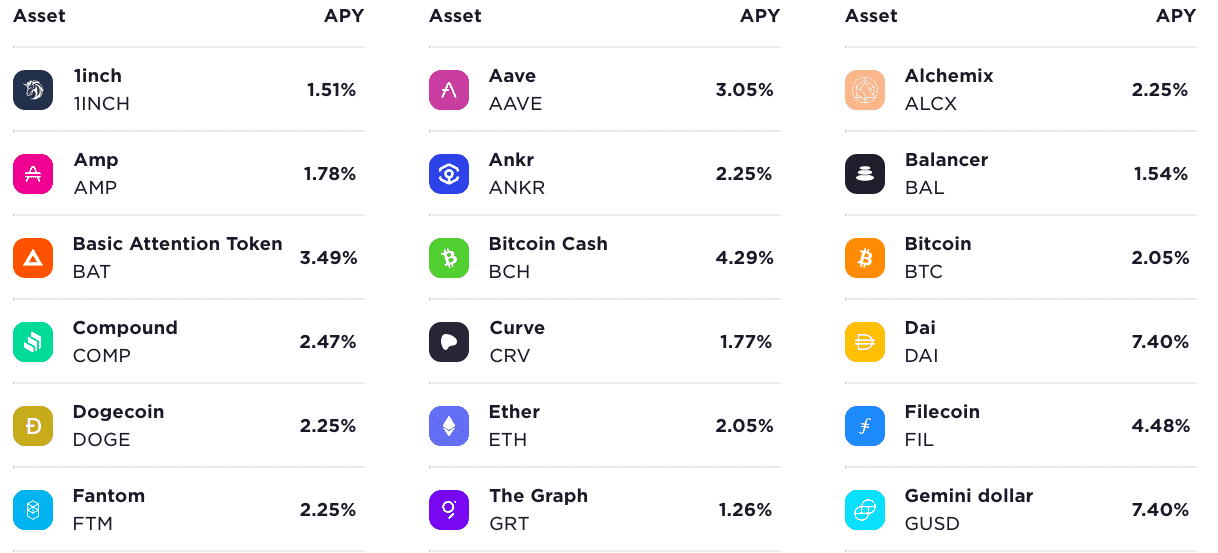

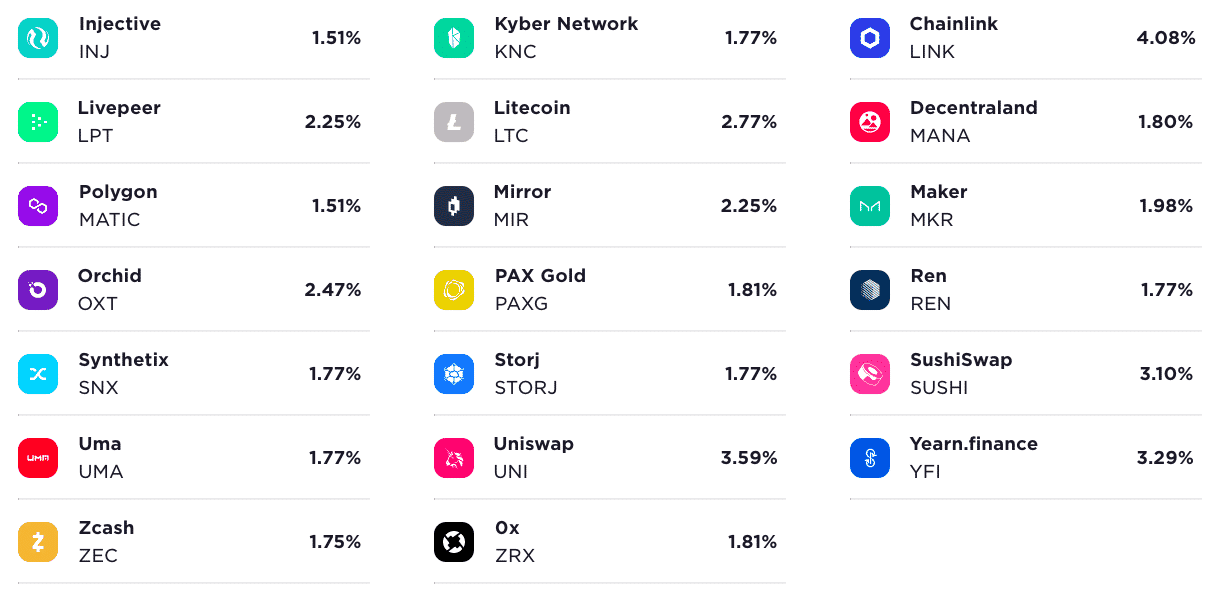

- Gemini Earn lets users earn up to 7.40% APY on 50+ cryptocurrencies, including BTC at 1.65%, ETH at 2.05%, 7.40% on DAI, GUSD, and more.

- Security: Gemini Trust Inc. is Gemini’s custodian. It’s a regulated company with over $30 billion in crypto assets, industry-leading crypto security practices, and only up to some hundred thousand dollars in insurance coverage.

- Gemini Earn is only available to Gemini users in the United States and Singapore.

- Users can withdraw their cryptocurrency anytime, at no fees.

- The platform is beginner-friendly and accessible via a mobile app or a desktop-accessible web app.

Frequent users of the Gemini exchange can seamlessly use Gemini Earn, and they may find familiarity in the established brand. However, if you’re new to Gemini or the cryptocurrency interest account space at large, let’s explore whether either would be a fit for you.

Gemini Earn Review: Interest Account and Interest Rates

Although its rates on major coins like BTC and ETH are not as impressive as those of Celsius or BlockFi, Gemini Earn offers a fairly competitive 7.4% APY on stablecoins.

Here’s a look:

Users can earn 2.05% APY on BTC and ETH and up to 7.40% for DAI and GUSD.

Although Gemini Earn’s interest rates may be better than nothing, it’s worth noting that crypto interest accounts still pose a risk— not only are your assets under the custody of another platform, they’re also uninsured.

You can earn about 5% on <0.5 BTC on BlockFi, and 6.2% on <2 BTC on Celsius. Still, neither platform comes with as established a reputation for security and custody as Gemini.

However, Gemini Earn is just about a percentage point off of the stablecoin rates on Celsius and BlockFi, so it may be a good holding place for some of your stablecoin assets and collect relatively passive income.

How Does Gemini Earn Make Money?

Gemini, the parent company, has a few distinct revenue lines.

Its cryptocurrency interest account product, however, is able to pay its users’ interest by making loans to corporate borrowers with user deposits.

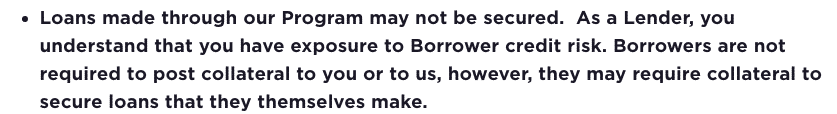

Gemini does not charge any collateral for these loans. Instead, the company performs comprehensive background checks, regular asset evaluations, and in-depth risk assessments on its corporate creditors. It also informs users to whom it lends their funds.

Although well known for its top-notch security and insurance practices, Gemini does not insure funds you use in the Earn program. Here’s how they put it in their terms.

As of this writing, Gemini Earn only has one corporate borrower: Genesis Global Capital, a digital asset lender offering liquidity to large firms.

While earning relatively passive income on cryptocurrency sounds good, it’s not risk-free. Gemini’s terms state that users bear all the risk for its unsecured loans, as there is no collateral incentive to decrease the chances of a borrower default. It‘s essential to consider the risk you may be undertaking.

Gemini Earn Review: How Safe is Gemini Earn?

Assets in Gemini Earn are not insured by the company, which isn’t rare; most crypto interest platforms (with the exception of Hodlnaut) do not offer insurance for your assets after they’re loaned. Users should also take note of the platform’s security. So. Are your Satoshis safe on Gemini Earn?

So far, Gemini passes the safety benchmark. It is a New York Trust company and is subject to the New York Department of Financial Services (NYDFS). Gemini has completed SOC 1 Type 2, and SOC 2 Type 2 exams from Deloitte and earned an ISO 27001 certification.

As of this writing, Gemini’s platform has never been hacked.

How to Use Gemini Earn

If you don’t have a Gemini Earn account, you can make one with this link and get a signup bonus of $10 (in BTC).

To start earning interest on Gemini, you’ll have to move funds (either from your existing balance or by buying new tokens) to an “Earn” account.

Gemini lets users withdraw funds from Earn at any time without charging fees.

You don’t need to hold any minimum balance to use Gemini Earn, although it can take up to five days for Gemini to process your withdrawal.

Gemini Earn Review: Fees

Gemini Earn charges an “agent fee” on each token you earn on. The rate you receive on a given token is a net of this fee, meaning that Gemini’s charges are already subtracted from the interest rates they advertise.

These agent fees may change at any time, and Gemini will notify you of these changes.

Ease of Use

Since Earn is built into Gemini, users can access the crypto interest feature on desktop and mobile.

However, Gemini Earn is currently only available in the US and Singapore, while the exchange is available worldwide, including the US, Canada, Singapore, and the UK. If the Earn feature isn’t in your app, it might not be available in your country.

Promos and Bonuses

CoinCentral readers can get a signup bonus of $10 (in BTC) if they buy or sell assets worth $100 during their first 30 days on the platform.

The platform’s referral program also gives users $10 for each referral they make who does the same.

Gemini Earn Review Final Thoughts: Is It Worth It?

Gemini Earn is a gamechanger for active Gemini users— they can now earn passive income on holdings they may already keep on Gemini’s tried-and-true exchange and wallet.

The stablecoin APY is decent and Gemini offers interest, although meager at times, on a wide variety of cryptocurrency assets. However, we advise you research Gemini’s prospective creditors to completely understand the potential risk you may be undertaking.

Gemini Earn comes with Gemini’s strong brand, its large community, security, and customer support practices, which indicate Gemini has a strong foundation to enhance their cryptocurrency interest product in the future.

Gemini maintains a comprehensive knowledge base featuring FAQs and how-tos, standing out for above-average customer service, making it a great choice for beginners.

The closest comparison to Gemini Earn is Coinbase, which is slowly gathering momentum behind its own cryptocurrency interest account offering. Both are massive legacy exchanges dabbling in this space.

However, if you’re looking for a company that specializes in cryptocurrency interest accounts, we recommend checking out BlockFi and Celsius— both offer higher rates across the board.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.