TLDR

- 180 Life Sciences to Rebrand as ETHZilla, Backs Ethereum with $425M PIPE

- ETHZilla Emerges: $425M PIPE Powers Bold Ethereum Treasury Shift

- ATNF Drops 6.87% After Revealing $425M Ethereum-Focused Strategy

- ETHZilla to Lead ETH Finance with PIPE Deal, DeFi Council & Rebrand

- $425M Deal Fuels ATNF’s Pivot to ETH Treasury, ETHZilla Rebrand Ahead

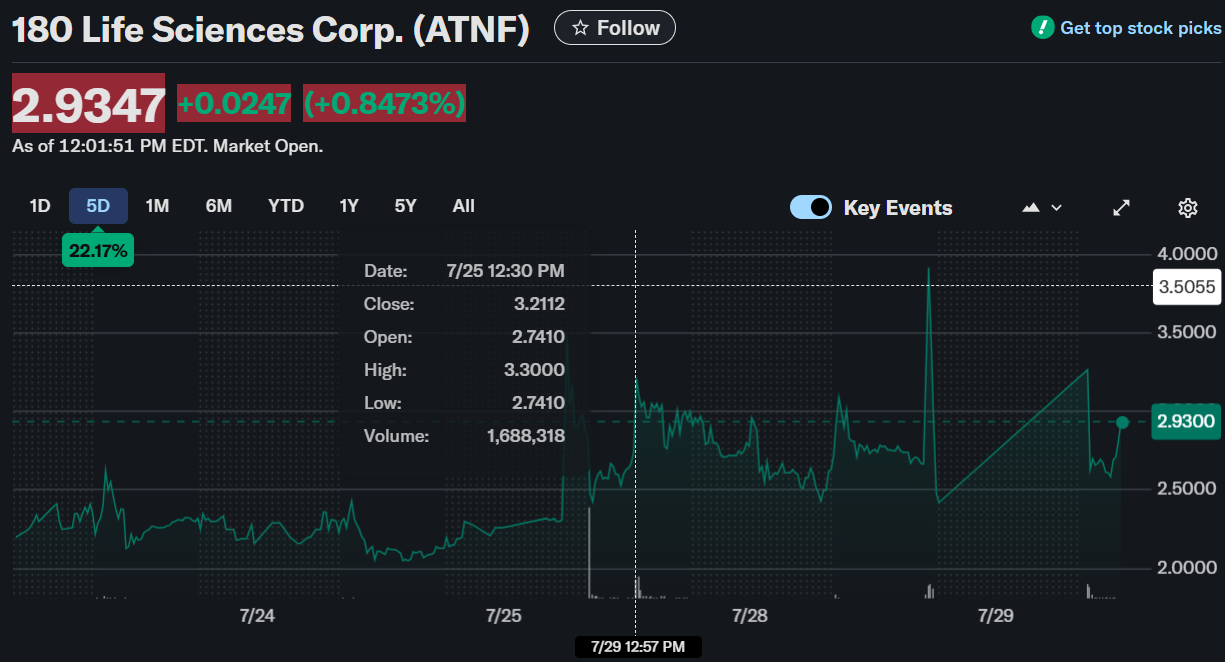

180 Life Sciences Corp. (ATNF) Shares opened with a sharp spike above $3.50 but quickly declined and stabilized around the $2.80–$2.95 range. The price stands at $2.95, showing a modest intraday gain of 1.3746%.

180 Life Sciences Corp. (NASDAQ: ATNF)

The decline follows the company’s announcement of a significant strategic shift involving Ethereum-based treasury reserves and a corporate rebrand. The company confirmed it will rename itself ETHZilla Corporation upon closing a $425 million PIPE transaction.

Massive $425M PIPE to Back Ethereum-Focused Strategy

180 Life Sciences Corp. has entered a definitive agreement for a private investment in public equity (PIPE) worth approximately $425 million. The transaction involves the purchase of common stock and pre-funded warrants at $2.65 per share. Following the expected August 1, 2025 closing, the company will adopt a new treasury strategy centered on Ether (ETH).

The PIPE funding includes over 60 participants, including leaders from institutional and Ethereum-native circles. Key names include Electric Capital, Polychain Capital, Harbour Island, GSR, and major Ethereum founders and DeFi builders. Subject to conditions, the company also plans to raise up to $150 million in debt securities after the PIPE closes.

The net proceeds will primarily support ETH acquisition, as well as cover corporate needs and transaction-related expenses. The existing leadership team will stay in place to guide the transition. Board changes include McAndrew Rudisill, who is set to become chairman at closing.

Rebrand to ETHZilla, Strategic Partnerships Drive Vision

Upon finalizing the PIPE, the Company will officially rebrand to ETHZilla Corporation. This name reflects its long-term strategy to position itself within the Ethereum ecosystem. Alongside the rebrand, it will implement an aggressive ETH treasury reserve program.

Electric Capital will serve as the external asset manager, bringing an on-chain yield strategy designed to outperform standard ETH staking. The firm will apply staking, lending, and liquidity provisioning across both open and bespoke channels. This program targets risk-managed yield generation within the Ethereum ecosystem.

The Company’s future strategy includes collaboration with Etherealize, a group linked to key Ethereum DeFi protocol creators. This partnership aims to provide ongoing strategic input and ecosystem value. ETHZilla plans to leverage this relationship for both marketing strength and capital deployment opportunities.

DeFi Council to Guide ETH Treasury Allocation

A DeFi Council comprising influential Ethereum founders will advise the Company on ETH allocation and yield generation methods. This group includes contributors from projects like Eigenlayer, Frax, Gauntlet, Compound, and Lido. Their guidance will focus on optimizing ETH reserves to benefit both shareholders and the broader ecosystem.

The Company will maintain a transparent approach while balancing risk and returns across staking and liquidity strategies. Strategic advisors will work closely with management to ensure disciplined execution. ETHZilla expects this support structure to set it apart from peers in Ethereum treasury management.

With a strong network of Ethereum builders, ETHZilla aims to align its operations with leading blockchain innovations. The Company believes this strategy supports consistent growth through decentralized finance initiatives. Despite today’s market drop, management remains committed to executing this transformation efficiently.