Solana price path garners attention just like the PEPE Coin, in this bull run. Though traders are feeling overwhelmed while selecting the best investment options in this bull run, these two have emerged as the dominant altcoins. Unilabs’ presale mania also keeps traders hooked to this emerging crypto marvel.

The Solana price slump is viewed by savvy traders as an opportunity to buy the dip and become a part of the long-term SOL profits. PEPE Coin’s potential has also kept the investors glued to the altcoin despite a few recent fluctuations, while Unilabs’ historic presale raise has created a buying frenzy in this bull run.

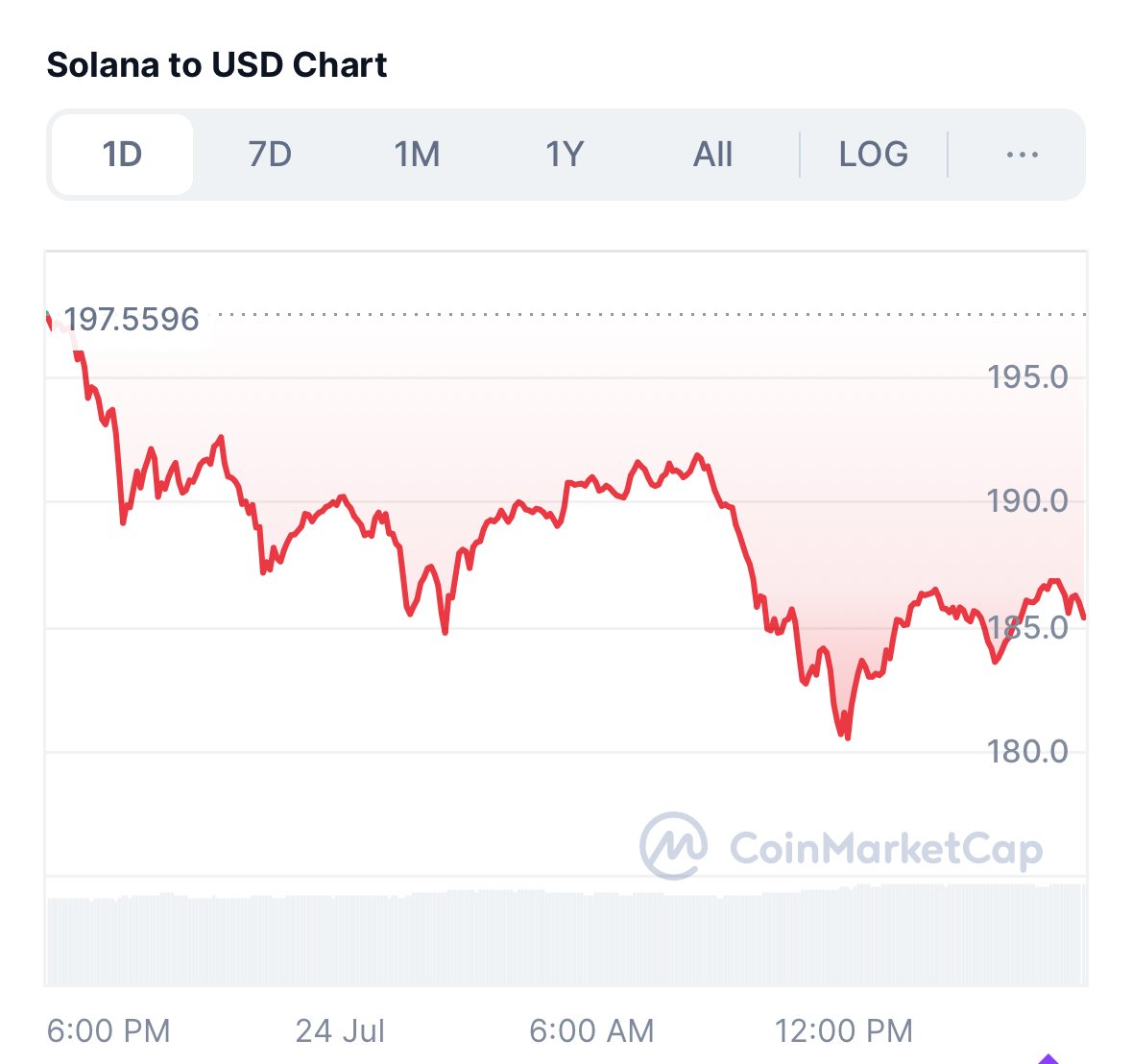

Solana Price Analysis: SOL Trades At $185 With A 6% Dip

Solana price is currently being ruled by the bears as the SOL token shows an intraday slump of about 6% on the daily Solana price chart. The current Solana price marks an 11% pullback from its previous high of $203-$197 price zone.

SOL’s technical indicators hint towards a bullish trend with the RSI value sitting at a neutral zone (60) and the moving averages aligning upward. Traders are curious about the Solana price path as this altcoin never ceases to amuse the traders. Savvy traders view this dip as an opportunity to buy the SOL token at a lower price.

Analysts claim that if the Solana price stays above the $180 level and reclaims resistance around $190-$195, it can reach the $197 mark again. A consolidation above $190 can propel SOL to $260-300 by the end of the year 2025. The increased investors’ interest has made Solana one of the top altcoins dominating the trends in this bull run.

PEPE Coin Breaks From The Falling Wedge Pattern

PEPE Coin has been the focus of traders’ attention in this bull run. Despite being a high-risk investment, PEPE Coin continues to provide high rewards to its traders. It is trading at $0.00001256 with an intraday decline of 7% in this bull run. The PEPE Coin shows signs of rebounding with massive trading volume spikes of up to 37%.

The active addresses of the PEPE Coin have also increased by 3,900+ new active addresses in the previous week, signalling an expanding retail interest. Whale accumulations have also increased significantly. All these metrics hint towards an impending rebound for the PEPE Coin.

PEPE Coin becomes one of the most searched altcoins in this bull run as it breaks from the falling wedge pattern. This suggests potential for a 50% price pump for the PEPE Coin, if the bullish momentum sustains. CoinPedia projects a target of $0.000021 for the PEPE Coin.

Unilabs Finance Presale: Over 1 Billion Tokens Sold In Record Time!

Unilabs Finance presale is setting new precedents of success with its soaring presale. Over 1.13 billion UNIL tokens have been sold, amounting to over $6.6M in presale funding. The accumulation of the UNIL token indicates that investors are now flooding this viral presale with fresh capital.

The price of Unilabs has surged by 85% in stage 4 of its presale. This move reflects increasing confidence in the UNIL token. Investors still have a perfect chance to get in before the next rally to $0.0085 at the current presale price of $0.0074. Unilabs is becoming one of the most searched altcoins in this bull run.

Key Takeaways

The current bull run witnesses the dominance of Solana, PEPE Coin, and Unilabs, with the Solana price path attracting various investors and the PEPE Coin’s breakout potential magnetising traders. Unilabs’ presale touches new highs with a presale raise of over $6.6 million.

Discover the Unilabs (UNIL) presale

Presale: https://www.unilabs.finance/

Telegram: https://t.me/unilabsofficial/

Twitter: https://x.com/unilabsofficial/

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.