TLDRs:

- CATL shares climbed 6% on Wednesday, reaching a record market cap of $257B amid strong battery demand.

- Investor interest shifts from EV stocks to batteries, boosting CATL to China’s third-largest listed company.

- CATL’s 30% monthly gain reflects optimism for its energy storage battery system expansion in China and Europe.

- New European battery variants and €11B investment underline CATL’s global growth strategy in EV and energy markets.

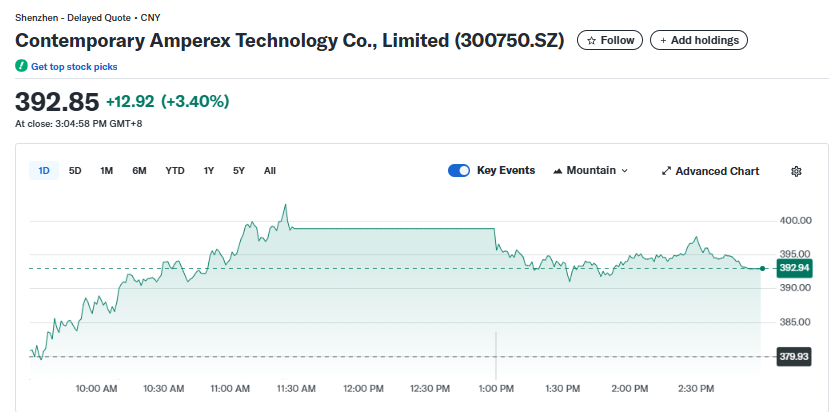

Contemporary Amperex Technology Co., Limited (CATL), the Shenzhen-listed battery giant, saw its shares climb 6% on Wednesday, before extending gains with an additional 3% rise on Thursday, propelling the stock to an all-time high.

This surge pushed the company past Kweichow Moutai to become China’s third-largest publicly traded firm, with a market capitalization of 1.8 trillion yuan (approximately US$257 billion), according to Bloomberg data.

Analysts attribute this growth to strong forecasts for battery demand, combined with an ongoing investor shift from electric vehicle (EV) stocks to battery stocks. The rally reflects CATL’s pivotal role in supplying batteries not only for EVs but also for expanding energy storage systems.

Monthly Gains Highlight Investor Optimism

CATL’s shares have surged roughly 30% onshore this month alone, underscoring strong investor confidence in its growth trajectory. The company, which holds over a third of global EV battery deliveries, benefits from both domestic policy support and rising global demand for energy storage solutions.

Financial note that CATL’s current valuation, trading around 22 times its one-year forward earnings, is relatively modest compared to global peers, suggesting further upside potential.

If CATL can truly mass-produce sodium-ion at lithium parity weight with 1/10th cost, the entire lithium mining boom loses ground.

Chile, Australia, and African lithium juniors would face a brutal reset in valuations.

Sodium’s 25-year life and cold tolerance makes it perfect for… https://t.co/kkJcVf6mKy

— Normal Guy (@Normal_2610) September 25, 2025

Global Market Insights projects the energy storage market will soar from US$668.7 billion in 2024 to US$5.1 trillion by 2034, a trend that positions CATL to capitalize on long-term growth opportunities.

European Expansion Drives Global Reach

In a strategic push into Europe, CATL unveiled two new battery models at the IAA Mobility auto show in Munich. The lithium iron phosphate variants offer either a 758-kilometer range with a 12-year lifespan, ideal for fleet leasing, or a fast-charging option delivering 478 kilometers in just 10 minutes, optimized for colder climates.

The company has invested over €11 billion in European operations, establishing factories in Germany, Hungary, and Spain. It also plans to launch its first European after-sales service center in Eindhoven, Netherlands, providing battery inspection, maintenance, and recycling services.

CATL currently controls only 22% of the European battery market, trailing competitors like LG Energy Solution, leaving significant room for expansion. Analysts expect these new products and local manufacturing to help CATL capture a larger share of Europe’s fast-growing EV market, which saw 26% sales growth in the first seven months of 2025.

Technological Edge Supports Market Leadership

CATL’s continued innovation in battery technology has been a major driver of its stock performance. Its dual-variant strategy addresses diverse consumer needs, from long-life batteries for leasing fleets to ultra-fast charging solutions for individual EV owners.

These advancements, combined with CATL’s aggressive investment in overseas facilities, demonstrate the company’s commitment to establishing a global leadership position in energy storage and EV batteries. The company’s strong fundamentals and strategic positioning have made it an attractive choice for investors seeking exposure to the rapidly expanding battery market.

That said, as global demand for energy storage and EV batteries continues to accelerate, CATL’s strategic expansion, innovative product lineup, and growing market share position it well for sustained growth. The company’s stock performance reflects not only its current achievements but also optimism about its long-term role in shaping the future of energy storage worldwide.