TLDR

- Galaxy Digital CEO Mike Novogratz believes the next Fed Chair appointment could be Bitcoin’s biggest bull catalyst

- He projects Bitcoin (BTC) could reach $200,000 if a dovish Fed Chair is selected

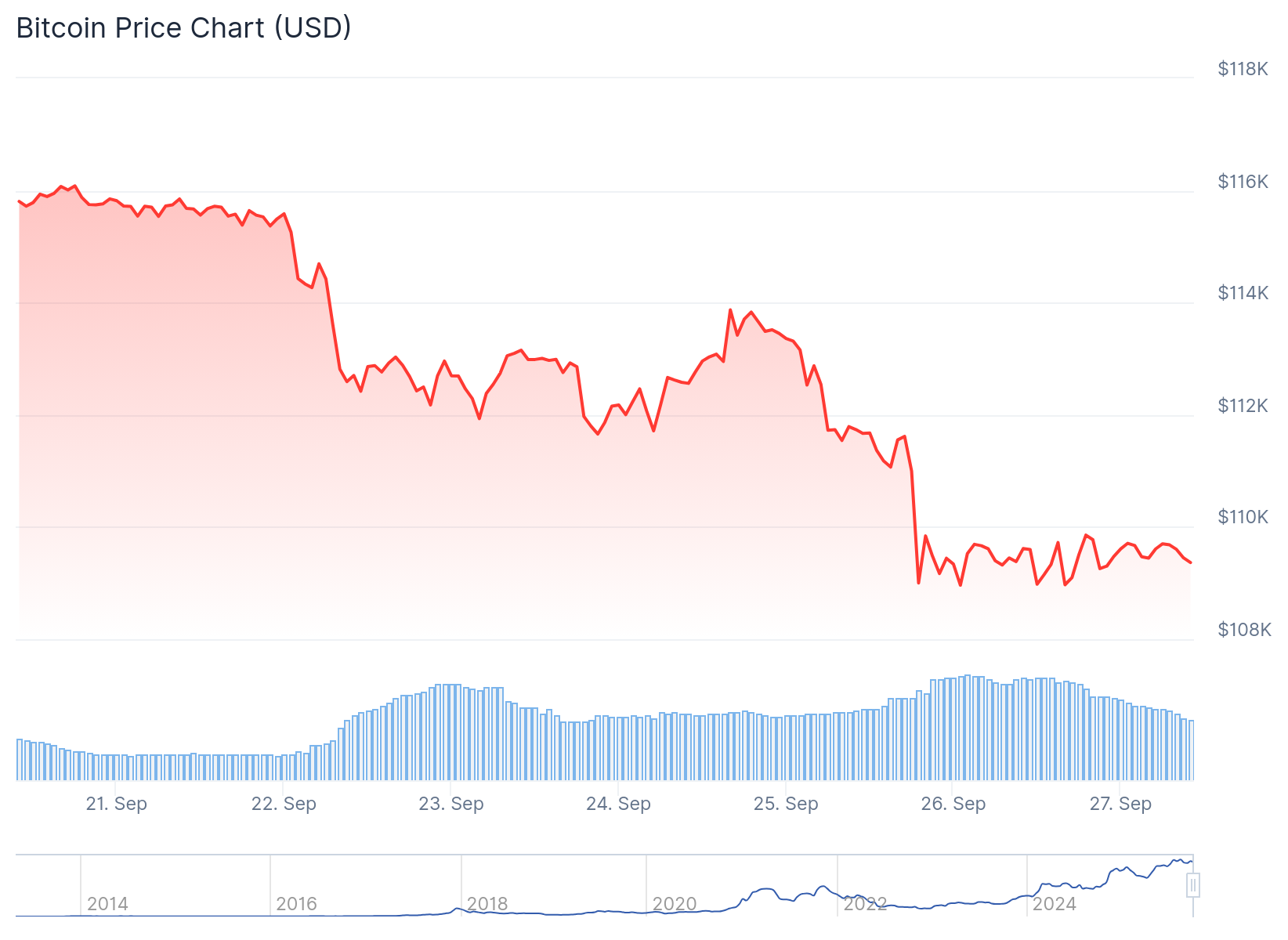

- Bitcoin currently trades near $109,000 after a 6% weekly drop

- Crypto market saw $1.1 billion in liquidations this week

- Trump has narrowed Fed Chair candidates to three: Kevin Hassett, Chris Waller, and Kevin Warsh

Galaxy Digital CEO Mike Novogratz has identified the upcoming Federal Reserve Chair appointment as a potential game-changer for Bitcoin. He believes this decision could trigger the cryptocurrency’s next major rally.

Speaking in a recent interview with Kyle Chasse, Novogratz called the Fed Chair selection “the biggest bull catalyst for Bitcoin and the rest of crypto.” His bold prediction centers on the possibility of President Trump appointing a dovish candidate to replace Jerome Powell.

The Galaxy Digital chief projects Bitcoin could surge to $200,000 in this bull cycle under the right conditions. “Can Bitcoin get to $200K? Of course it could,” Novogratz stated during the interview.

His optimistic scenario depends on the incoming Fed Chair adopting an aggressively dovish monetary policy stance. Such a position would likely involve continued or accelerated interest rate cuts, which historically benefits risk assets like Bitcoin.

Bitcoin currently trades near $109,000, down 6% from the previous week. This decline came after Powell tempered expectations for additional rate cuts this year at a recent economic outlook event.

Market Pressure and Liquidations

The broader cryptocurrency market has faced pressure recently, with total liquidations exceeding $1.1 billion this week. Ethereum led altcoin losses with $409 million in liquidations, while Bitcoin accounted for $272 million.

Traders are preparing for a massive Bitcoin options expiry worth $17 billion on Deribit. The put-call ratio of 0.75 suggests a slightly bearish sentiment among derivatives traders.

Despite current market conditions, Novogratz maintains his bullish outlook contingent on Fed leadership changes. He emphasized that markets won’t fully price in Trump’s dovish appointment until it becomes official.

Trump has reportedly narrowed his Fed Chair shortlist to three candidates: Kevin Hassett, Chris Waller, and Kevin Warsh. Treasury Secretary Scott Bessent was also mentioned but has shown no interest in the role.

Fed Independence Concerns

While bullish for crypto, Novogratz expressed concerns about the broader implications of an overly dovish Fed Chair. He warned such an appointment could compromise the Federal Reserve’s independence.

“It would be really shitty for America,” Novogratz said, describing the potential trade-offs involved. He noted that aggressive monetary easing could trigger what he calls an “oh shit moment” in markets.

A dovish Fed stance typically weakens the US dollar while boosting alternative assets. Gold and Bitcoin tend to benefit as investors seek alternatives to traditional fixed-income investments.

Novogratz believes both gold and Bitcoin would “skyrocket” under such conditions. However, he cautioned that this scenario, while beneficial for crypto holders, could have negative consequences for the broader economy.

The Galaxy CEO noted that while markets may anticipate a dovish pick, confirmation will only come once the appointment is made. “I don’t think the market will buy that Trump’s going to do the crazy, until he does the crazy,” he explained.

Daleep Singh from PGIM Fixed Income echoed similar views about potential Fed changes. He suggested there’s “a very decent chance” the Federal Open Market Committee could look different after Powell’s term expires in May 2026.

Powell’s current term as Fed Chair runs until May 2026, giving Trump time to evaluate candidates. The selection process remains ongoing, with no official timeline for the announcement.

Jerome Powell recently delivered the Fed’s first rate cut of 25 basis points in September, meeting market expectations after months of speculation about monetary policy direction.