TLDR

- Dogecoin whales accumulated 122 million DOGE tokens, moving them to cold storage

- New Dogecoin ETFs launched, attracting $26 million in liquidity within the first week

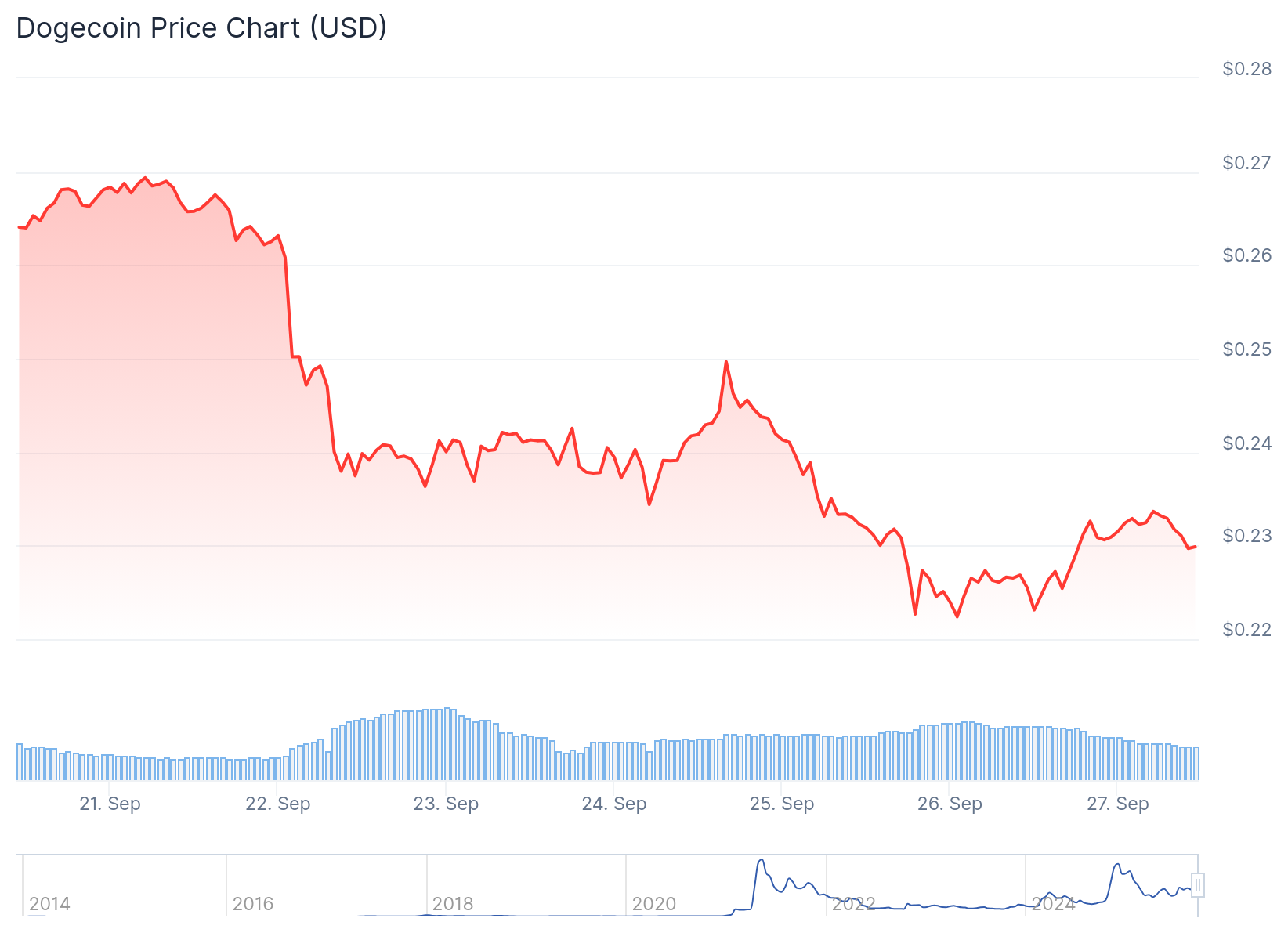

- DOGE price trading above $0.23 within a rising channel pattern with support at $0.22

- Large holders executed over $13 million in spot purchases on Binance and $16 million in net longs

- Technical analysis shows potential for price movement toward $0.25-$0.30 range

Dogecoin has experienced increased market activity following the launch of new exchange-traded funds and large-scale accumulation by major holders. The cryptocurrency currently trades above $0.23 within an established rising channel pattern.

Recent on-chain data shows 122 million DOGE tokens moved from exchanges into cold storage. This movement typically reduces immediate selling pressure while indicating long-term confidence from large holders.

The newly launched Dogecoin ETFs have attracted institutional attention. Within one week of launch, these funds received approximately $26 million in liquidity inflows.

For a cryptocurrency originally built on retail enthusiasm, institutional access through regulated ETFs represents a structural change. These funds provide traditional investors their first regulated pathway to Dogecoin exposure.

Whale Activity Increases

Large order book data reveals increased whale activity across multiple exchanges. On Binance spot markets, whales acquired over $13 million worth of DOGE tokens.

Dogecoin $DOGE!

122M DOGE moved off exchange → signs of whale accumulation

ETFs now live → institutional doors opening

RSI sitting neutral-bullish → many indicators flash Buy

Price consolidating $0.21–$0.22, rising channel intact

DOGE to $1 is coming soon stay focused and… pic.twitter.com/GJ4ptOD5G9

— MosesMee (@MeeMoses83411) September 26, 2025

OKX data shows whales executed more than $9 million in net spot purchases. Binance perpetual markets saw approximately $16 million worth of net long positions from large holders.

Despite this bullish activity, OKX still maintains over $48 million in short positions. The mixed signals suggest the market remains divided on short-term direction.

Spot flow data indicates cooling outflow pressure. Dogecoin spot outflows dominated since mid-September but have decreased substantially this week.

The reduction in selling pressure coincides with the whale accumulation data. However, immediate demand recovery has not yet materialized as market participants remain cautious.

Technical Analysis Shows Consolidation

Dogecoin has been trading within a $0.21-$0.22 range inside a rising channel pattern. The cryptocurrency has found consistent support at the $0.22 level during recent pullbacks.

The Relative Strength Index remains neutral-to-bullish without showing overextension signals. Trading volume has gradually increased, suggesting growing market interest.

Current price action above $0.23 positions DOGE for potential movement toward $0.25 if buying momentum continues. A break above this level could open the path to $0.30.

The cryptocurrency recently retested a resistance line active since March before beginning its current pullback. This retracement also tested short-term support that has been active since June.

One analyst has predicted DOGE could achieve an 800% rally and potentially reach above $1.30 in its next major price movement. Such a move would surpass the cryptocurrency’s previous all-time high.

The prediction assumes healthy liquidity conditions and strong sustained demand. Recent Federal Reserve rate cuts and ETF approvals may provide supportive market conditions.

Current trading remains above the key $0.22 support level, with whale accumulation and institutional flows providing fundamental support for potential upward movement.