TLDR

- Solana has dropped 15% in a week, risking a further fall below $200 support.

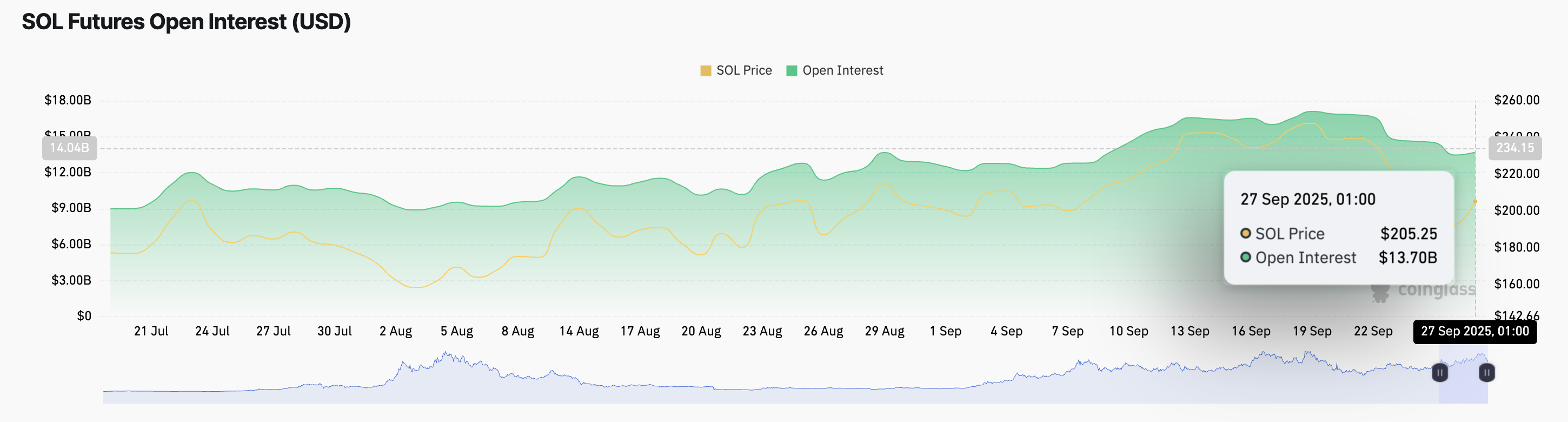

- Futures market open interest for Solana has decreased by 17% since September 19.

- Short-term holders of SOL are near break-even, increasing risk of sell-off.

- If demand doesn’t return, Solana could fall towards $195.55 in the near term.

Solana (SOL) has seen a significant drop of 15% in the past week, signaling a loss of trader confidence. On-chain data suggests that further price declines are possible, with the $200 support level under threat. Market participation in Solana has also decreased, as traders are closing positions, leaving SOL vulnerable to more selling pressure. If demand doesn’t pick up, SOL could test the $195.55 mark in the near future.

Falling Futures Market Interest

The futures market for Solana has experienced a sharp decline in open interest, a key indicator of market participation. As of September 19, the open interest has dropped by 17%, standing at $14 billion. Open interest measures the total number of unsettled contracts in futures and options markets. A decrease in open interest typically indicates that traders are closing positions rather than entering new ones, suggesting waning market interest.

This reduced participation reflects growing trader hesitation, further compounding concerns about Solana’s price stability. Traders closing their positions signals a bearish outlook, contributing to the downward pressure on SOL’s price.

Short-Term Holder Sentiment Weakens

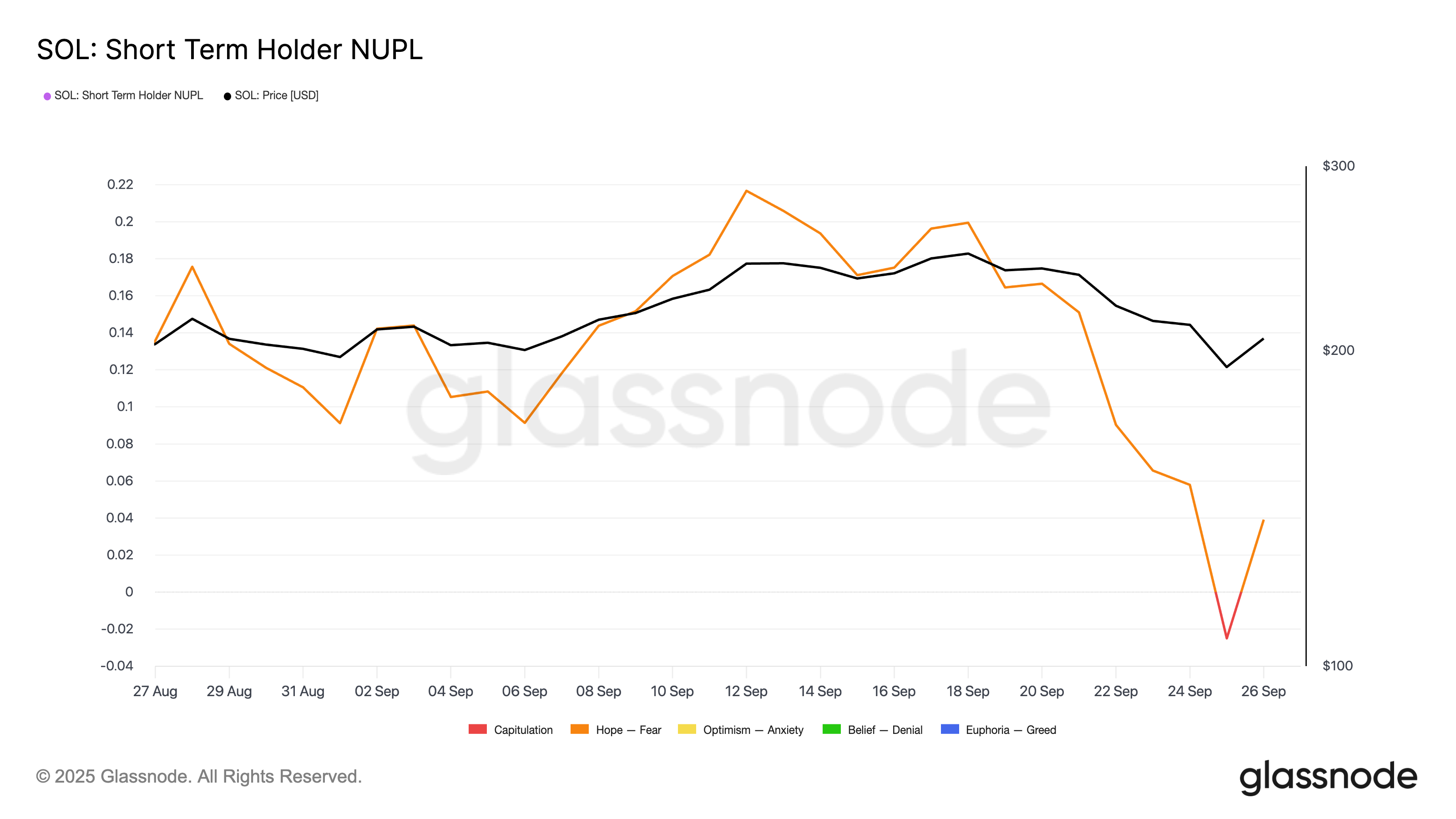

Data from Glassnode reveals that Solana’s short-term holders are currently in a precarious position, with the Net Unrealized Profit/Loss (NUPL) at 0.039. This metric measures the profitability of holders and reflects market sentiment. At this level, short-term holders are close to break-even, meaning they have little to no profit from their investments.

As a result, these holders are particularly vulnerable to selling pressure. When NUPL is low, even small price movements can trigger a sell-off, increasing the likelihood of further declines. This makes Solana more susceptible to price drops if sentiment doesn’t improve.

Potential to Fall Below $200

If the current trend of declining participation and weak sentiment continues, Solana may breach its critical $200 support level. This could open the door for further downside, with a potential target of $195.55. Without renewed buying interest, SOL risks prolonged weakness, potentially dragging the price lower.

However, if buying demand returns and traders begin to re-enter the market, there is a possibility of stabilization. A shift in market sentiment could help SOL recover, pushing the price towards the $219.29 level.

Outlook for Solana’s Price Movement

The coming days will be crucial for Solana, as the price continues to face downward pressure. Whether SOL can avoid further losses will largely depend on whether traders regain confidence and buying interest picks up. The risk of further declines remains if current market conditions persist.

Given the reduced futures market activity and the fragile position of short-term holders, traders will be closely monitoring any signs of a reversal. If the price continues to slide below the $200 mark, Solana could face additional challenges in the weeks ahead.