TLDR

- TRX holds steady above $0.30 support with targets at $0.36 and $0.42 resistance levels

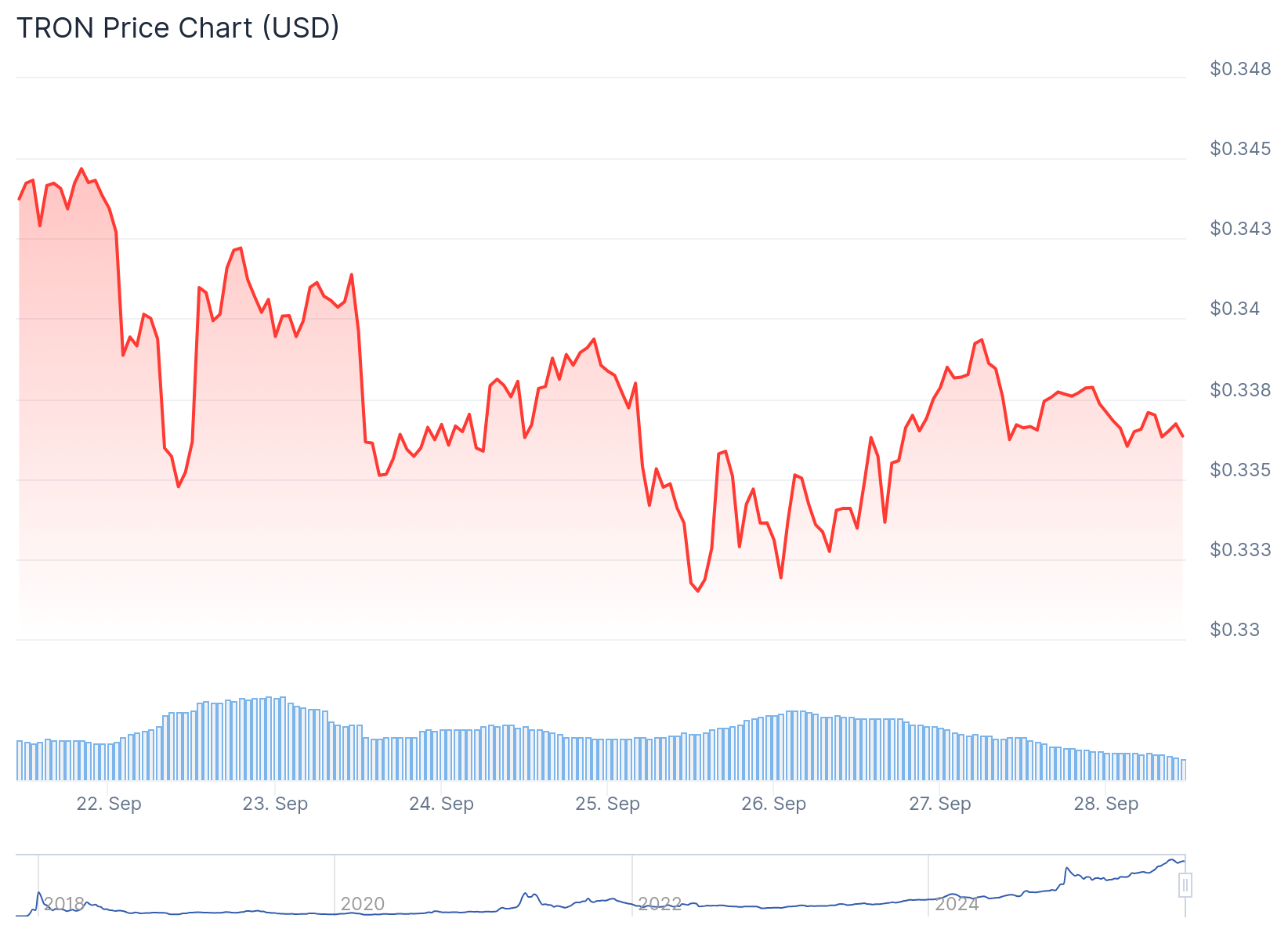

- Trading volume surged past $1.49 billion as price remained around $0.334 with modest daily gains

- Reports suggest Justin Sun controls up to 64% of TRON’s circulating supply, raising market concerns

- TRON processes over 2.3 million daily USDT transfers worth $22.5 billion, supporting network strength

- Weekly 3% decline countered by defensive action at key support zones

TRON has maintained its position above the critical $0.30 support level as traders monitor for signs of a potential breakout move. The cryptocurrency is currently trading near $0.334, showing resilience during recent market turbulence.

The token posted modest gains of 0.8% to 1.1% in daily trading sessions. This stability comes despite broader market pressures affecting other cryptocurrencies.

TRX defended the $0.30 to $0.32 range multiple times over recent trading periods. This defensive action has created a foundation for potential upward movement.

Trading volume experienced a surge, climbing past $1.49 billion on major exchanges. The volume spike indicates renewed market participation even as price movements remained relatively contained.

Market participants are closely watching the $0.36 level as the next key resistance point. A break above this level could open the path toward $0.42, according to technical analysis.

The weekly timeframe shows TRX building a higher-low structure. This pattern suggests underlying accumulation by market participants.

TRON’s market capitalization holds around $31 billion, maintaining its position in the top 10 cryptocurrencies. This ranking reflects continued investor interest despite recent price consolidation.

Network Activity Provides Fundamental Support

TRON’s blockchain infrastructure continues to process substantial transaction volumes. The network handles over 2.3 million daily USDT transfers valued at approximately $22.5 billion.

The network now supports more than 334 million total accounts. This user base provides a foundation for sustained network activity and token utility.

Daily stablecoin settlement on TRON has remained consistent throughout market volatility. This stability reinforces the blockchain’s role as a key settlement layer for cryptocurrency transactions.

On-chain data from Lookonchain shows adoption-driven flows have maintained steady levels. These metrics help explain TRX’s ability to defend support levels during market downturns.

Since its founding in 2017, #Tron has surpassed 334.59M accounts in just eight years.

It currently processes an average of 2.36M $USDT transfers daily, with a daily $USDT transfer volume of $22.55B.https://t.co/m802HEOMBm pic.twitter.com/MU5i22TFoF

— Lookonchain (@lookonchain) September 27, 2025

Governance Concerns Create Market Caution

Recent reports from AssembleAI cite Bloomberg data suggesting Justin Sun controls up to 64% of TRON’s circulating supply. This concentration level has drawn attention from market observers.

The concentration gives one individual substantial influence over TRX liquidity and price movements. Some market participants view this as a risk factor for the token’s long-term prospects.

Critics argue that high concentration could limit TRON’s decentralization and transparency. However, supporters suggest it reduces the risk of large-scale selling pressure.

Market reaction to these reports has been relatively muted so far. Price action suggests traders are focusing more on technical levels than governance concerns.

Technical Outlook Points to Key Resistance Tests

The $0.38 to $0.40 zone continues to act as strong resistance for TRX. Multiple attempts to break above this level have resulted in profit-taking and price retreats.

Failure to maintain current support could expose the $0.28 level. A deeper correction might target $0.24 according to technical analysis.

Momentum indicators suggest room for upside movement before conditions become stretched. This provides optimism for bulls defending current levels.

The all-time high near $0.45 remains a longer-term target if TRX can clear intermediate resistance levels. Heavy supply previously capped attempts at this level.

TRX closed the weekly period with a 3% decline but maintained its position above key support. The price action suggests consolidation rather than a breakdown from current levels.