TLDR

- Bitcoin price climbed to $114,000 after forming a double-bottom chart pattern with support at $108,650

- The technical pattern suggests a potential price target of $127,000 based on the measured move from the neckline at $117,875

- US government shutdown risks and upcoming non-farm payrolls data on Friday could impact Bitcoin’s direction

- Michael Saylor’s Strategy Inc. purchased 196 BTC worth $22.1 million at an average price of $113,048 during the recent dip

- Bitcoin is showing reduced selling pressure with more coins leaving exchanges than arriving, while funding rates have cooled

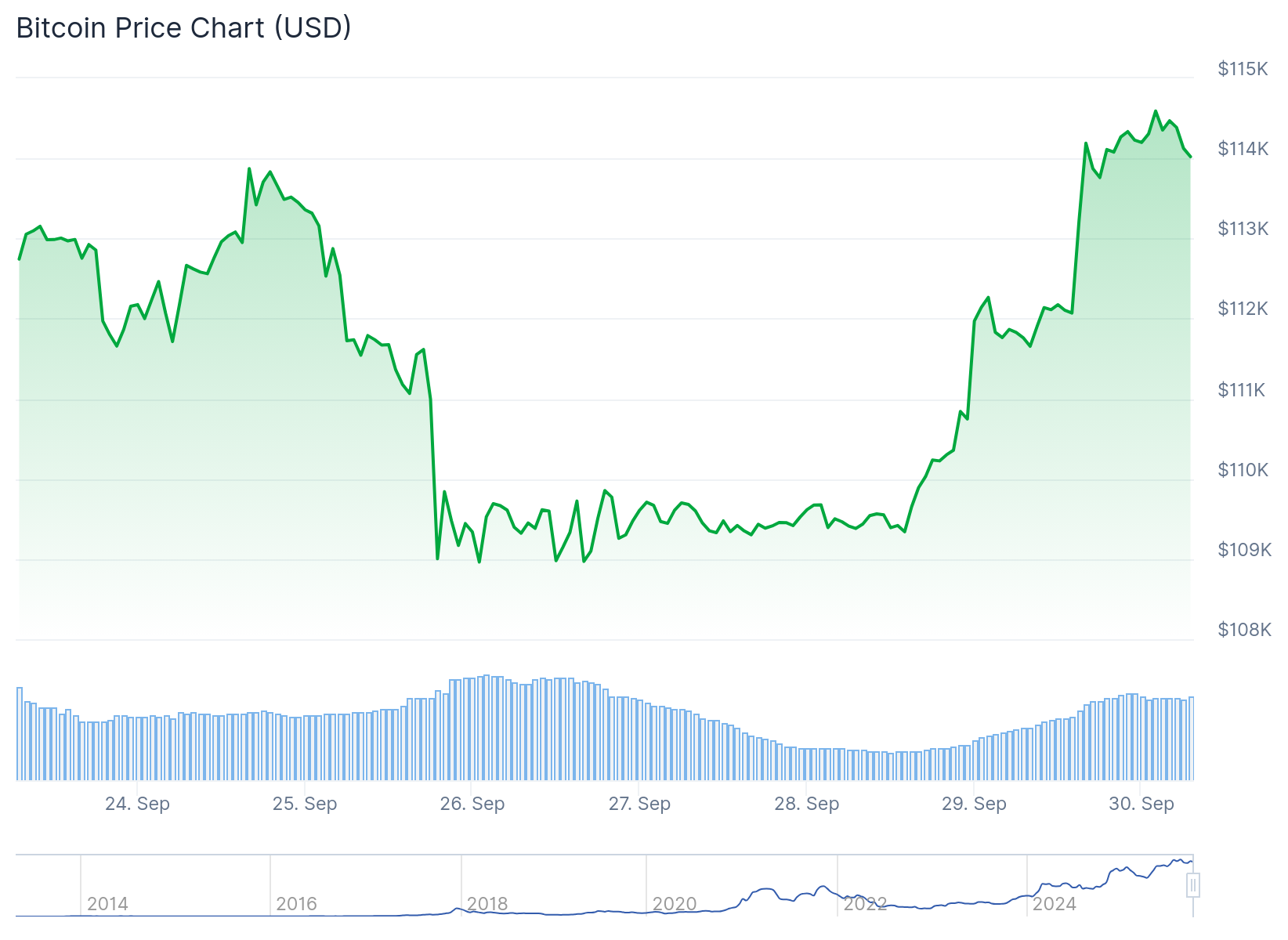

Bitcoin price rose for two straight days, moving from a low of $108,650 to nearly $114,000. The cryptocurrency trades at $114,423 with a daily volume of $62.2 billion, up 3.62% in the last 24 hours.

The daily chart shows Bitcoin has formed a double-bottom pattern. This pattern consists of two low swings at $108,650 and a neckline at $117,875.

The price target for this pattern is calculated by measuring the distance between the low and the neckline. That same distance is then projected upward from the neckline, pointing to a target of approximately $127,000.

Bitcoin has moved above both the 50-day and 100-day Exponential Moving Averages. The Relative Strength Index and MACD indicators have both turned upward, supporting the bullish case.

The cryptocurrency surged 4.5% over two days, reversing last week’s sell-off. Analysts say the earlier dip came from leveraged long positions being unwound, which often creates a stronger foundation for future rallies.

On-chain data shows more Bitcoin is leaving exchanges than arriving. This indicates accumulation and reduced selling pressure from holders.

Funding rates have also cooled down. This signals less speculative leverage in the market and a healthier environment for sustained growth.

Government Shutdown Risks

The US faces a potential government shutdown this week as Democrats and Republicans remain divided on spending. Republicans want a clean spending bill while Democrats seek to implement policies on health and Medicaid.

A shutdown could benefit Bitcoin price because it would impact the economy. The government is one of the largest spenders in the US, and a shutdown might increase the chance of more Federal Reserve interest rate cuts.

Mark Zandi noted that recession risks remain high despite recent improvements. He pointed out that current economic growth relies heavily on AI spending and wealthy consumers who have benefited from rising asset values.

NFP Data This Week

The Bureau of Labor Statistics will release non-farm payrolls data on Friday. This report will provide information about the health of the American labor market.

The data will help predict when the Federal Reserve might cut interest rates next. Some Fed officials like Beth Hammack have said the labor market remains strong and inflation is too high, urging caution on rate cuts.

Traders are watching a CME gap near $111,300 that could pull prices lower temporarily. However, these pullbacks have historically been short-lived.

A close above $115,000 would confirm bullish momentum heading into the fourth quarter. The next resistance levels sit at $116,150 and $117,850, with a potential push toward $120,000.

Strategy has acquired 196 BTC for ~$22.1 million at ~$113,048 per bitcoin. As of 9/28/2025, we hodl 640,031 $BTC acquired for ~$47.35 billion at ~$73,983 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/NnmLONBsRK

— Michael Saylor (@saylor) September 29, 2025

Michael Saylor’s Strategy Inc. bought another 196 BTC worth $22.1 million at an average of $113,048 during last week’s dip. The company now holds 640,031 BTC valued at over $47 billion.

Strategy’s stock fell to a six-month low of $300.7 but remains up 96% over the past year. The RSI has spiked to 83, showing overbought conditions but also underlining the strength of the current rally.