TLDR

- Dogecoin has broken through its third descending trendline in recent cycles, with previous breakouts leading to rallies of 230% and 350%

- 21Shares filed an amended SEC registration for a Dogecoin ETF under ticker TDOG, causing a 10% price jump

- A golden cross between the 100-day and 200-day moving averages is forming, which historically signals extended bullish phases

- Analysts identify $0.33 as a critical resistance level that could trigger broader altcoin market rallies

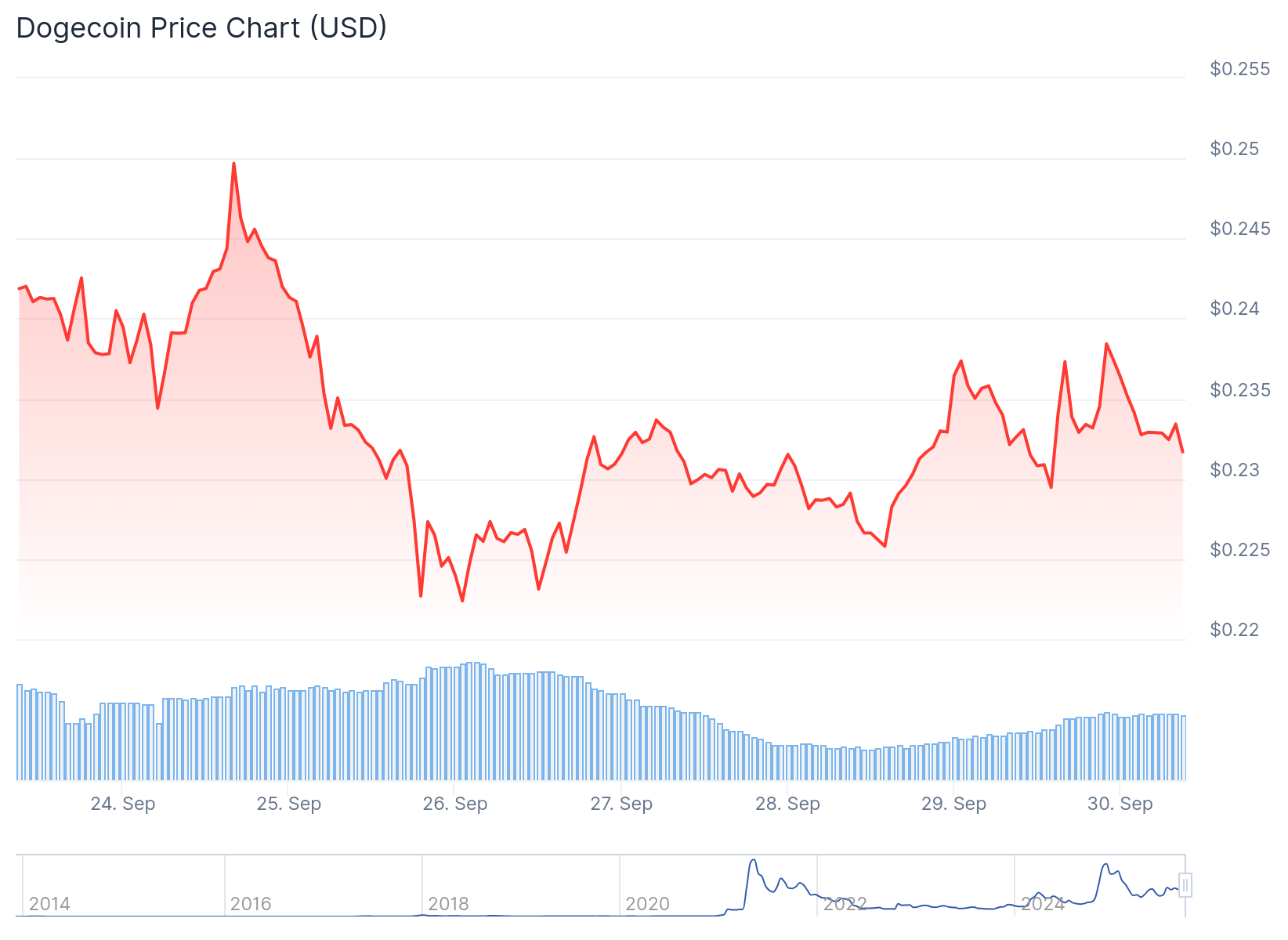

- Liquidity maps show strong support around $0.18 and resistance above $0.30, with DOGE currently trading near $0.229

Dogecoin is trading near $0.229 after breaking through a multi-month descending trendline for the third time in recent cycles. The breakout comes as European asset manager 21Shares filed an amended SEC registration for a Dogecoin ETF.

The current technical setup mirrors two previous patterns that led to substantial price increases. The first trendline break in September 2023 resulted in a 230% rally. The second break in October 2024 produced a 350% advance.

Price action since the November-December 2024 high near $0.48 formed the third descending trendline. DOGE pushed through that line in recent weeks before pulling back to retest it. The token now sits at a level that technical analysts describe as a classic return move.

Crypto analyst Cantonese Cat documented these three cycles on the weekly chart. Each sequence followed the same pattern: months of consolidation under a descending trendline followed by a breakout and expansion phase.

The current retest is happening on reduced momentum compared to previous rallies. DOGE trades around $0.2369 on the weekly timeframe, positioned in the middle of the retest zone.

Golden Cross Formation Draws Attention

A golden cross between the 100-day SMA at $0.2192 and the 200-day EMA at $0.2199 is forming on the daily chart. These crossovers have historically marked the beginning of extended bullish periods for Dogecoin.

Crypto analyst Cas Abbé is monitoring this development closely. He noted that Dogecoin rallies often precede broader altcoin market movements. His analysis focuses on the $0.33 level as a critical threshold.

$DOGE golden cross is approaching soon 👀

This is one of the alts I'm paying very close attention to.

The reason is very simple: When DOGE pumps, Altseason starts.

If DOGE manages to pump above $0.33, alts will go bonkers. pic.twitter.com/AcO8nN9oVF

— Cas Abbé (@cas_abbe) September 29, 2025

That resistance point has capped multiple rallies in recent months. A break above $0.33 could accelerate capital rotation into other altcoins. Abbé stated that such a move would likely trigger widespread gains across the altcoin market.

Liquidity data adds another layer to the technical picture. A heatmap shared by Cryptoinsightuk shows dense buy orders around $0.18. Supply concentrations above $0.30 form resistance zones.

This market structure suggests traders are positioning for potential downside moves before any sustained rally. Some analysts have closed long positions and placed new orders near the $0.18 support level.

ETF Filing Sparks Price Movement

21Shares filed Amendment No. 1 to its SEC registration for a Dogecoin trust under ticker TDOG. The filing represents the firm’s first Dogecoin product planned for the U.S. market.

BREAKING: 21Shares' Spot $DOGE ETF has been listed on the DTCC under ticker $TDOG

It’s happening 🚀 pic.twitter.com/ZqT2uOD0fz

— Bark (@barkmeta) September 22, 2025

The SEC documentation labels Dogecoin as a meme coin but explicitly states it is not considered a security. This classification aligns DOGE with other tokens like SHIB in regulatory treatment.

News of the filing triggered a 10% intraday price jump. The rally represents the first confirmed market reaction to institutional ETF interest in Dogecoin.

21Shares already offers several crypto exchange-traded products in Europe. The TDOG fund would expand that lineup to include Dogecoin for U.S. investors.

The updated prospectus mentions Dogecoin’s uncapped supply structure. This differs from Bitcoin’s fixed maximum supply and represents a key characteristic cited in the filing.

The ETF remains in registration and has not received SEC approval. Past crypto ETF approvals for Bitcoin and Ethereum saw rapid inflows and price gains for those assets in 2024.

Some analysts compare the potential DOGE ETF approval to the 2021 rally when Dogecoin rose over 600% on social media momentum. That advance proved short-lived as prices retreated in subsequent months.

A cup and handle pattern is forming on the weekly chart according to analyst CobraVanguard. The cup portion formed between May 2021 and December 2024, with a peak at $0.760.

The handle developed through April 2025 when DOGE fell to $0.13 before rebounding. The pattern would be validated by a break above resistance near $0.4846, representing a 102% gain from current levels.