TLDR

- The crypto market cap jumped $175 billion to reach $4.03 trillion, driven by the US government shutdown and weakening USD as investors hedge against dollar weakness.

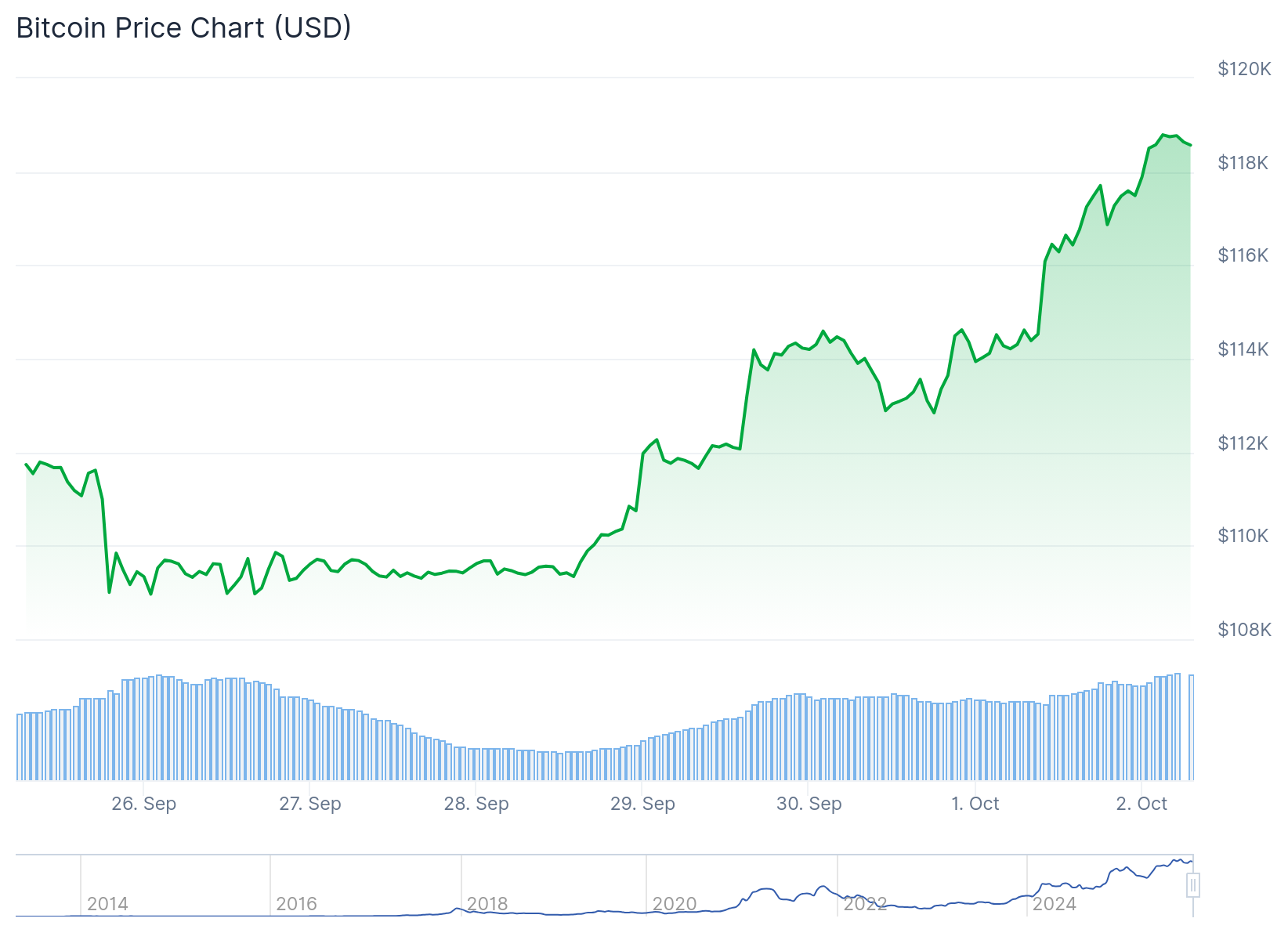

- Bitcoin is trading at $118,991, approaching its all-time high of $124,474, with key resistance at $120,000 and crucial support at $117,261.

- October’s historical bullish trend, known as “Uptober,” has boosted investor optimism and buying momentum across digital assets.

- Institutional inflows into Bitcoin spot ETFs are bringing hundreds of millions in new capital, supporting price gains and market stability.

- Altcoins including Ethereum, Solana, Dogecoin, Cardano, and Chainlink recorded strong 4-7% gains, increasing overall market participation.

The cryptocurrency market experienced a major rally on October 2, 2025, with total market capitalization increasing by $175 billion. The market now stands at $4.03 trillion, consolidating above the $4.00 trillion support level.

Bitcoin is currently trading at $118,991, positioning itself near the critical $120,000 resistance level. The leading cryptocurrency is inching closer to its all-time high of $124,474 set earlier this year.

The surge comes during a period of increased uncertainty in traditional markets. The ongoing US government shutdown has pushed investors toward alternative assets as a hedge against instability. A weakening US dollar has also contributed to the shift of capital into cryptocurrency markets.

October has historically been a strong month for crypto performance. Market participants often refer to this period as “Uptober” due to consistent gains during this timeframe. This seasonal pattern has contributed to renewed optimism and increased buying activity across digital assets.

Institutional investors continue to pour money into the crypto sector. Bitcoin spot ETFs are seeing net inflows totaling hundreds of millions of dollars. This institutional capital is providing support for price increases and creating a foundation for potential future rallies.

On September 30, spot Bitcoin ETFs saw a total net inflow of $430 million, while none of the twelve ETFs saw a net outflow. Spot Ethereum ETFs recorded a total net inflow of $127 million, while none of the nine ETFs saw a net outflow. https://t.co/BmieKfQjuL pic.twitter.com/8VdTa4wynM

— Wu Blockchain (@WuBlockchain) October 1, 2025

The current market rally also benefited from a short squeeze effect. As prices climbed, traders who had bet against the market were forced to close their positions. This created a cascading effect that pushed prices higher, particularly for Bitcoin and major altcoins.

Altcoin Performance Strengthens Market Rally

Altcoins participated strongly in the market upswing. Ethereum, Solana, Dogecoin, Cardano, and Chainlink all posted gains between 4-7% during the trading session. This broad-based rally increased overall market participation and reinforced positive sentiment among traders.

The total crypto market cap is now pressing against the $4.05 trillion resistance level. This barrier has capped previous rallies in recent trading sessions. A breakout above this level could trigger additional buying pressure across the market.

However, the rally faces potential risks if momentum weakens. If the market fails to hold above $4.00 trillion, prices could decline toward $3.94 trillion or lower. Such a drop would erase recent gains and shift market sentiment.

Bitcoin Tests Key Resistance Levels

Bitcoin must clear several resistance zones to maintain its upward trajectory. The cryptocurrency faces immediate resistance at $120,000, followed by another barrier at $122,000. Breaking through these levels is necessary for Bitcoin to reach its all-time high.

Support for Bitcoin currently sits at $117,261. A breakdown below this level would represent a setback for the bullish outlook. Such a move could trigger selling pressure and invalidate the current positive trend.

Circle announced a partnership with Deutsche Börse to bring USDC and EURC stablecoins into Europe’s financial system. The deal includes custody through Clearstream and Crypto Finance, expanding regulated stablecoin adoption in traditional markets. The collaboration will utilize the 3DX trading platform for distribution.