TLDR

- Senate lawmakers debated crypto tax policy including a proposed $300 de minimis exemption for small crypto transactions to encourage everyday use

- Senator Elizabeth Warren opposed special crypto tax exemptions, claiming crypto holders underpay taxes by $50 billion annually and that exemptions could aid money laundering

- The US government entered its first shutdown since 2018 following a partisan dispute over a continuing resolution funding bill

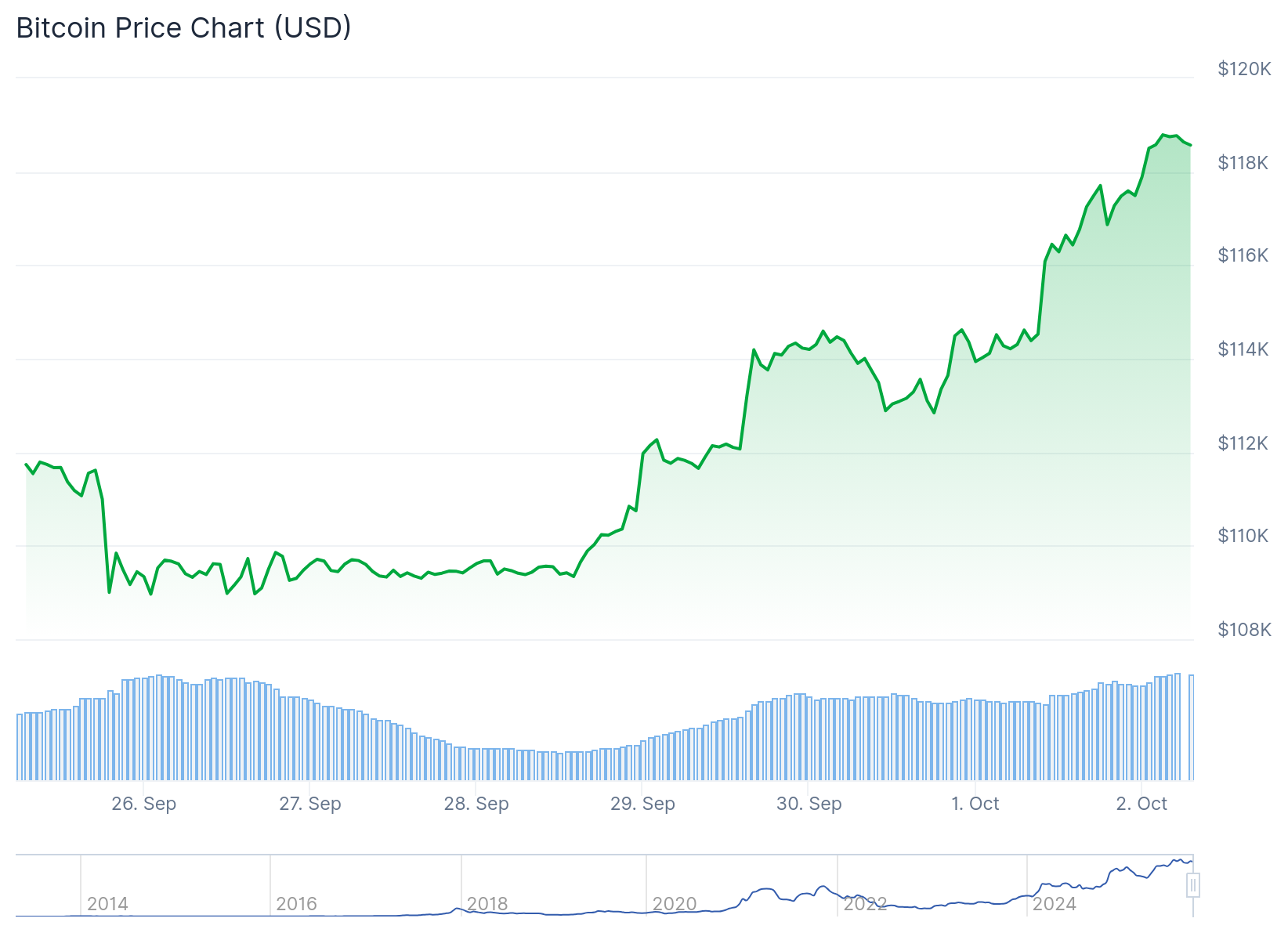

- Bitcoin rose 2.9% to $116,427 during the shutdown as investors moved into safe-haven assets alongside gold

- Analysts suggest the government shutdown may signal a market bottom for cryptocurrencies, with historically positive outcomes for Bitcoin following past shutdowns

The US Senate Committee on Finance held hearings on Wednesday to discuss cryptocurrency tax policy while the federal government entered its first shutdown in six years. The timing of these two events has created uncertainty for crypto investors and industry participants.

The 🇺🇸 US government shutdown has started.

If history repeats, the $DXY will dump and Bitcoin will pump! pic.twitter.com/1apGdqa51v

— Mister Crypto (@misterrcrypto) October 1, 2025

Lawrence Zlatkin, vice president of tax at Coinbase, testified before the Senate committee. He proposed a de minimis tax exemption for crypto transactions under $300. The exemption would treat small crypto purchases similar to how foreign currency transactions are handled.

Zlatkin argued that current tax rules create barriers to using cryptocurrency for everyday payments. He emphasized that the same tax rules should apply to similar economic activities whether they involve traditional assets or blockchain tokens. The lack of tailored rules creates consequences for US-based innovation in the crypto sector.

The Senate hearing also addressed the annual tax gap of approximately $700 billion. Lawmakers discussed enforcing tighter reporting requirements for crypto transactions. They considered classifying revenue from staking services as earned income subject to the tiered income tax system.

Tax Policy Concerns

Senator Elizabeth Warren from Massachusetts opposed special tax exemptions for cryptocurrencies during the hearing. She claimed that crypto holders fail to pay at least $50 billion per year in owed taxes. Warren argued that carving out exemptions would cause investors to abandon other asset classes to take advantage of crypto tax savings.

The Joint Committee on Taxation estimated that the proposed $300 exemption would provide a $5.8 billion tax benefit for crypto investors. Warren connected special tax exemptions to potential money laundering activities. She stated that exemptions could provide cover to evade US sanctions and Financial Crimes Enforcement Network surveillance.

Warren concluded that no special tax exemptions should be granted for digital assets. She believes all crypto transaction profits should be taxed under existing securities and commodities frameworks.

The government shutdown began Wednesday due to a partisan dispute over a continuing resolution funding bill. Republicans advanced the resolution without additional policy changes requested by Democratic Party members. Senator Chuck Schumer and Democrats demanded a permanent extension of Affordable Care Act tax credits.

Market Response to Shutdown

Bitcoin rose 2.9% in the past 24 hours, trading at $116,427. Gold prices increased 0.7% during the same period. The price movements suggest investors are seeking safe-haven assets during the political uncertainty.

Ryan Lee, chief analyst at Bitget, told Cointelegraph that both Bitcoin and the S&P 500 may benefit from the shutdown. Government shutdowns typically result in lower US interest rates. Lee said Bitcoin’s immunity to government and political uncertainties makes it attractive to mainstream traditional investors.

— ninjobi (@verminsol) October 1, 2025

Lee believes most promising altcoins in the market appear to have bottomed out. Bitcoin reclaiming the $116,000 level is a positive sign heading into October, historically a strong month for crypto markets.

Historical data shows mixed market reactions to government shutdowns. During the 2013 shutdown, stocks fell while Bitcoin rallied. The 2019 shutdown saw both equities and Bitcoin valuations decline.

Following previous shutdowns, the Federal Reserve has typically adopted a more dovish interest rate policy. The S&P 500 has risen an average of 13% per year following past shutdowns according to trading resource Kobeissi Letter.

Prediction market platform Polymarket shows traders see a 38% chance the shutdown will end by October 15. The duration of the shutdown remains uncertain as partisan divisions continue in Congress over the funding bill and related policy demands.