TLDRs;

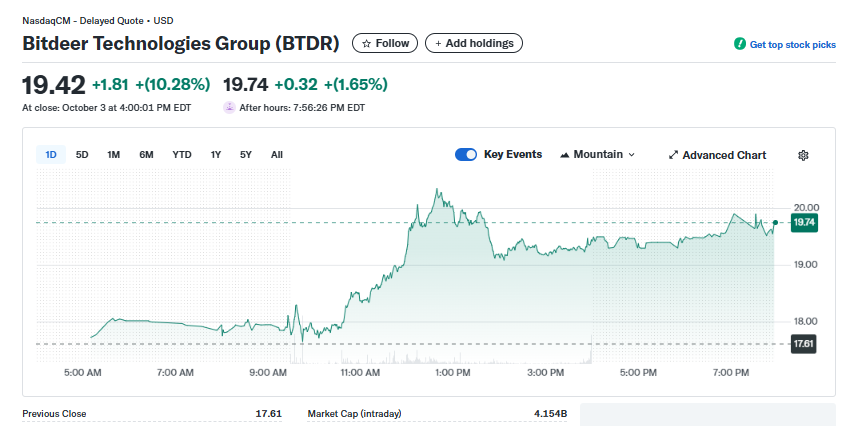

- Bitdeer stock soared 10.28% to $19.42 on October 3, 2025, following Bitcoin’s push toward $124K.

- Q2 revenue rose 56.8% YoY, fueled by stronger mining output and new SEALMINER rig sales.

- Analysts project up to $40/share, citing strong fundamentals and Bitcoin correlation.

- Diversification into AI and HPC data centers could boost long-term valuation beyond crypto mining.

Bitdeer Technologies Group (NASDAQ: BTDR) surged 10.28% on Friday, closing at $19.42, as Bitcoin’s relentless rally brought it within reach of its $124,000 all-time high.

The cryptocurrency market’s “Uptober” momentum, coupled with strong company updates, sent investor enthusiasm soaring. After-hours trading showed Bitdeer continuing to climb, up another 1.65% to $19.74, signaling strong market confidence.

The stock’s upward trend aligns closely with Bitcoin’s explosive 12–15% weekly gain. As the world’s largest cryptocurrency inches toward record territory, mining firms like Bitdeer are seeing substantial tailwinds.

Strong Fundamentals and Expansion Drive Optimism

Bitdeer’s recent success is not solely tied to Bitcoin’s resurgence. The company has been expanding aggressively, ramping up mining capacity and unveiling new hardware innovations.

In Q2 2025, Bitdeer reported $155.6 million in revenue, marking a 56.8% year-over-year increase. Despite posting a net loss of $147.5 million due to high capital expenditure, the firm maintained a healthy $299.8 million cash balance, underscoring strong liquidity for further growth.

Chief Business Officer Matt Kong reaffirmed Bitdeer’s target to reach 40 EH/s of self-mining hash rate by October, potentially surpassing that milestone by year-end. The company’s newest mining rigs, including the SEALMINER A3 and upcoming A4 models, are expected to improve efficiency and cost-effectiveness, putting Bitdeer in direct competition with leading manufacturers like Bitmain.

Beyond mining, Bitdeer has signaled plans to diversify into high-performance computing (HPC) and AI data centers, leveraging its existing 1.3 GW power infrastructure. A recent agreement with AEP Ohio for 570 MW expansion at its Clarington facility could position Bitdeer as a dual crypto and AI infrastructure player.

Crypto Stocks Rise in Tandem

Bitdeer’s rally comes amid a broader resurgence in crypto-linked equities. Peers such as Marathon Digital (MARA), Riot Platforms (RIOT), and Hut 8 (HUT) have also seen sharp price increases in recent sessions. Marathon jumped nearly 17% on Friday as it reported strong Bitcoin production and balance sheet growth.

Hut 8 soared 18% in late September, mirroring Bitcoin’s strength, while Riot Platforms also trended higher despite slight mining output declines.

Market analysts note that Bitcoin’s performance directly drives miner valuations. As Bitcoin’s price surges, mining profitability and investor appetite for exposure to the sector increase.

Analysts Remain Bullish on Bitdeer

Wall Street remains broadly optimistic about Bitdeer’s trajectory. Roth Capital recently raised its 12-month price target to $40, suggesting over 100% potential upside from current levels. Other analysts place targets between $22 and $25, with consensus calling Bitdeer a “Strong Buy.”

Technical analysis mirrors the optimism, momentum indicators and moving averages on Investing.com also rate BTDR as a “Strong Buy.” Trading volume has exceeded its 5 million-share daily average, further signaling heightened investor interest.

Bitdeer’s leadership continues to reinforce bullish sentiment. CEO Jihan Wu, co-founder of Bitmain, reiterated his long-term conviction in Bitcoin’s value, projecting it could reach $1,000,000 within decades. Chief Strategy Officer Harris Nasse added that the company’s integrated growth strategy positions it well for sustainable expansion, particularly as it bridges mining, data centers, and AI computation.

Future Outlook

With Bitcoin hovering around its all-time highs, Bitdeer is riding a powerful wave of investor optimism. The company’s ongoing hardware rollout, expanding data center footprint, and strong analyst backing make it one of the most closely watched crypto mining stocks heading into Q4.

If Bitcoin’s momentum continues, Bitdeer could not only sustain its recent surge but potentially break into the $20–$25 range forecast by analysts in the coming months.