TLDR

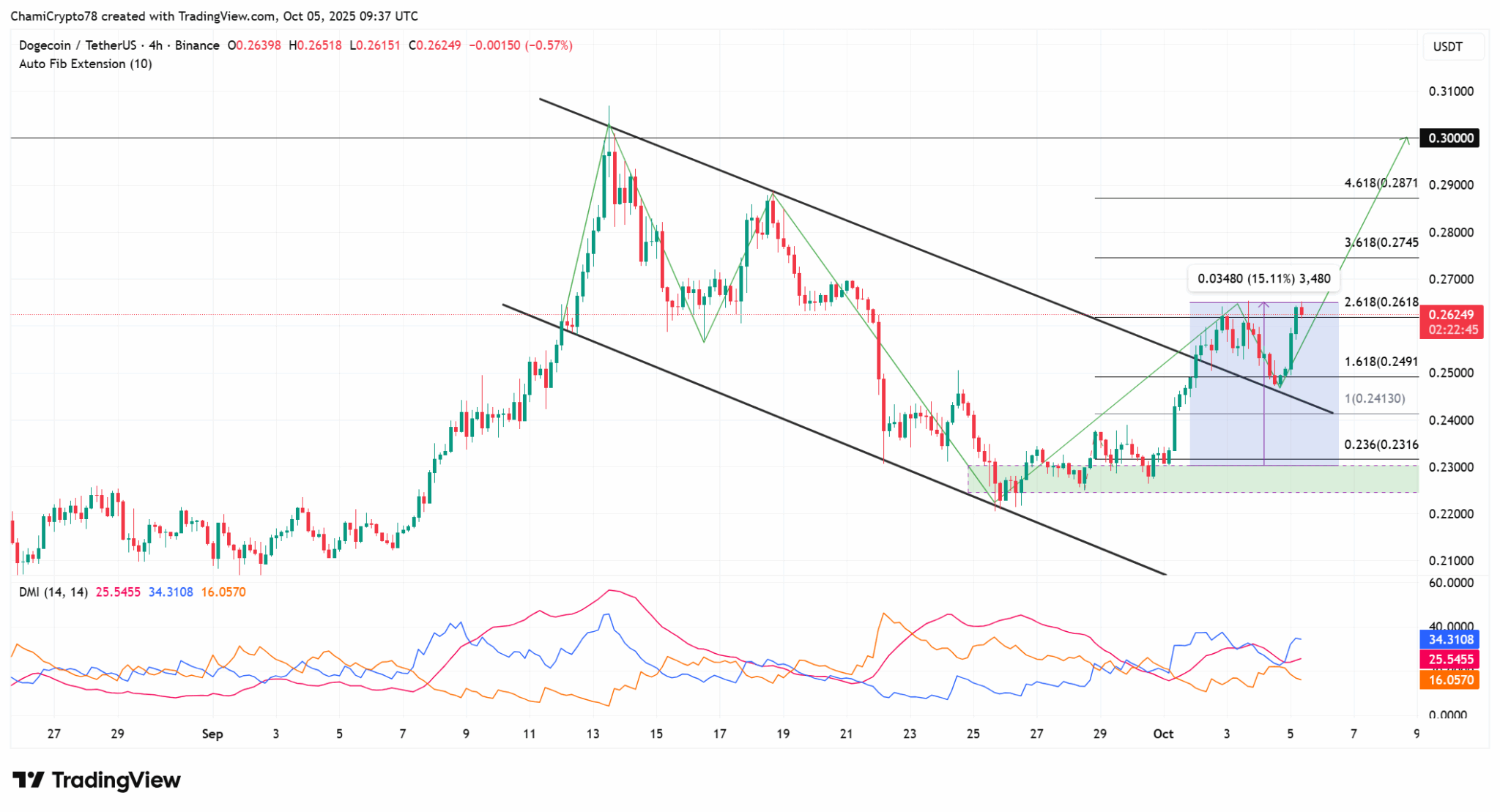

- Dogecoin broke out of a descending channel pattern and successfully retested the upper boundary at $0.26

- Large holders accumulated over 30 million DOGE tokens in 24 hours while exchange outflows exceeded $25 million

- Technical indicators including DMI and ADX confirm strong buyer control and bullish momentum

- Analysts identify repeating chart patterns from 2022-2023 that previously led to price rallies

- Rising megaphone formation on three-day chart suggests potential move toward $0.70 if resistance breaks

Dogecoin traded near $0.26 at press time after gaining 3.3% in 24 hours and 14.6% over the past week. The token delivered a 15% rebound from a previously identified buying zone around the $0.25 support level.

The price action showed a breakout from a descending channel pattern. After breaking through the upper boundary, DOGE successfully retested this level as support. This technical move validated a bullish reversal pattern according to chart analysis.

The $0.25 support zone now serves as a critical threshold for the current uptrend. Maintaining this level could enable an extension toward $0.30, where the next major resistance awaits. Price movement above this area would mark the first test of that level in recent weeks.

Technical indicators reinforced the bullish structure. The Directional Movement Index showed the +DI line trending above the -DI line. The Average Directional Index rose as well, confirming strengthening trend momentum.

Whale Activity Signals Institutional Interest

On-chain data revealed that large holders added more than 30 million DOGE tokens within a 24-hour period. This accumulation by whales often precedes price advances as these investors position for expected appreciation.

Exchange data from CoinGlass showed net outflows exceeding $25 million. These outflows indicated tokens moving from exchanges to private wallets. Reduced exchange balances typically signal decreasing selling pressure as holders move assets into storage.

Lower exchange reserves combined with active demand create tighter supply conditions. When supply decreases while buying interest remains steady, upward price pressure often follows.

The whale accumulation aligned with the technical breakout pattern. Both on-chain metrics and chart structures pointed toward continued buyer participation across different investor segments.

Chart Patterns Echo Previous Bull Cycles

Analyst Tardigrade identified a fractal pattern on the two-week chart similar to formations seen in 2022 and 2023. During those periods, DOGE moved within descending triangles before breaking higher.

$Doge/2-week#Dogecoin Massive Surge is coming 🚀 pic.twitter.com/OgNDtUWM8I

— Trader Tardigrade (@TATrader_Alan) October 4, 2025

The current structure showed the same characteristics. The token pushed through a falling trendline and formed higher lows. This pattern of rising support levels typically indicates accumulation as buyers increase positions while selling weakens.

Another analyst, EtherNasyonaL, pointed to a rising megaphone formation on the three-day chart. This pattern features widening price swings that often precede breakouts. The upper boundary of this megaphone represents the next resistance level.

A confirmed close above the megaphone resistance could trigger acceleration toward $0.70 according to technical projections. Sustained momentum beyond that level might carry prices closer to $1, a psychological threshold for the community.

The Relative Strength Index approached neutral levels after a prolonged decline. The MACD indicator turned positive for the first time since mid-summer. Both momentum indicators showed early signs of recovery.

Historical data suggested that when Bitcoin volatility cooled, traders shifted capital toward alternative tokens. This rotation pattern helped lift Dogecoin volumes through early October as market participants sought higher short-term returns.

Network use and payment integrations provided baseline demand beyond speculative trading. DOGE continued appearing in small-payment systems and tipping applications. These use cases maintained transaction volumes even during periods of weak market sentiment.

Developers and businesses exploring low-fee transfers increasingly added DOGE support. Community engagement through social platforms maintained liquidity and awareness across the user base.

The combination of technical breakout, whale accumulation, and declining exchange balances created favorable conditions for continued upward movement. If the $0.25 support level holds and volume remains elevated, DOGE appears positioned to test the $0.30 resistance zone in the near term.