TLDR

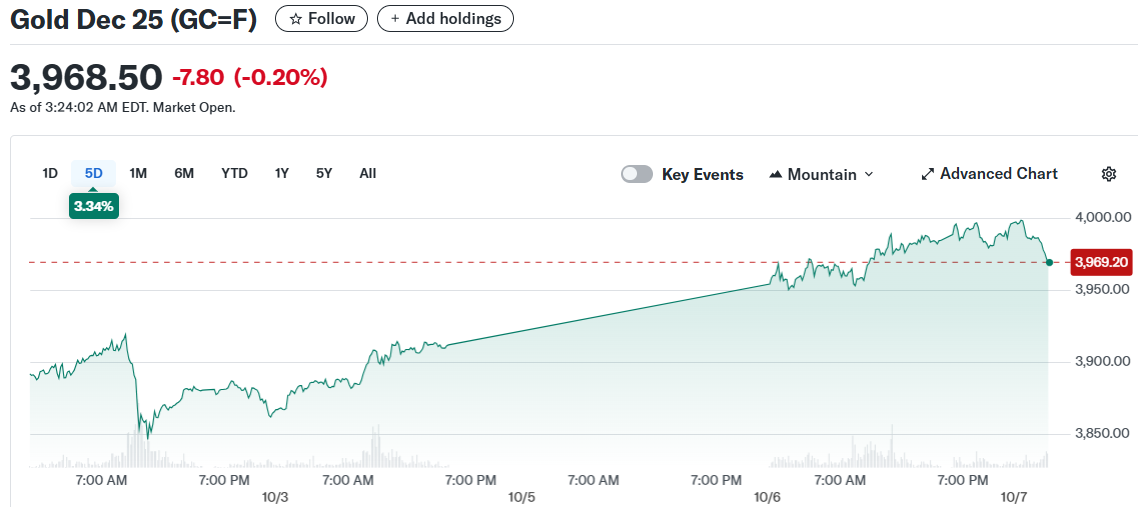

- Gold futures hit $4,000 per ounce for the first time on Tuesday, with spot prices reaching an all-time high of $3,976

- Gold has surged over 50% since January 1, outperforming Bitcoin’s 33.5% gain during the same period

- Analysts predict Bitcoin will follow gold’s rally with a lag, potentially leading to a strong end-of-year performance

- The US government shutdown and political crises in France and Japan are driving investors toward safe-haven assets

- Goldman Sachs raised its gold price forecast for December 2026 to $4,900 per ounce, up from $4,300

Gold futures reached $4,000 per ounce for the first time on Tuesday morning. Spot prices climbed to an all-time high of $3,976, according to TradingView data.

The precious metal has gained more than 50% since January 1. This performance has outpaced Bitcoin, which rose 33.5% over the same timeframe.

Gold critic Peter Schiff called the new record a warning about current Federal Reserve policy. He urged the US central bank to raise interest rates immediately.

The rally comes as investors seek safe-haven assets during uncertain times. A US government shutdown has stretched into its second week, depriving markets of key economic data.

Political turmoil is also affecting markets. In France, Sebastien Lecornu resigned as prime minister after failing to reach consensus on budget spending.

France faces the largest fiscal deficit in the euro area. In Japan, Sanae Takaichi’s expected elevation as prime minister has also rattled financial markets.

Bitcoin Expected to Follow Gold’s Path

Justin d’Anethan from Arctic Digital called gold hitting $4,000 confirmation of the same forces supporting Bitcoin. He noted both assets are reacting to US deficit concerns and weakening dollar credibility.

Bitcoin operates 24/7 and is scarcer than gold, which could lead to bigger price moves. The digital asset hit an all-time high above $126,000 late Monday.

Analyst James Bull said Bitcoin is lagging behind gold and global M2 money supply. He expects Bitcoin to adjust higher.

Trader Ted Pillows noted Bitcoin shows high correlation with gold with an eight-week lag. He predicted the fourth quarter will be strong for Bitcoin despite possible short-term corrections.

$BTC has been highly correlated to Gold with an 8-week lag.

Right now, Gold is hitting new highs, which means Bitcoin will do this next.

Maybe we could see another correction, but overall Q4 will be big for Bitcoin. pic.twitter.com/RkOTTgsfG3

— Ted (@TedPillows) September 30, 2025

Central Banks and ETFs Drive Gold Demand

Goldman Sachs raised its gold price forecast for December 2026 to $4,900 per ounce. The investment bank cited ETF inflows and central bank buying as key factors.

The People’s Bank of China bought gold for an 11th straight month in September. Central banks and gold-backed exchange-traded funds have been major buyers this year.

Federal Reserve interest rate cuts have also supported gold prices. Traders are pricing in a quarter-point cut this month, which benefits gold since it doesn’t pay interest.

David Chao of Invesco Asset Management recommended overweight positions in gold as a hedge against the US dollar. He suggested investors hold around 5% of their portfolios in gold.

David Marcus, CEO of Litespark and former PayPal executive, compared the two assets on Monday. He said if Bitcoin were valued like gold, it would be worth $1.3 million per coin.

President Donald Trump’s trade and geopolitical policies have contributed to gold’s 50% surge this year. His aggressive moves sparked a flight to safety and shift away from the dollar.

Spot gold traded at $3,965.90 per ounce as of 1:17 PM Singapore time on Tuesday. The gain puts gold on track for its biggest annual increase since 1979.