TLDR

- SharpLink’s unrealized profits exceed $900 million, thanks to its Ethereum strategy.

- The company now holds 839,000 ETH and has no debt on its balance sheet.

- SharpLink plans to tokenize its stock and stake ETH on Ethereum’s Layer 2 network.

- SharpLink aims to continue accumulating Ethereum through its treasury strategy.

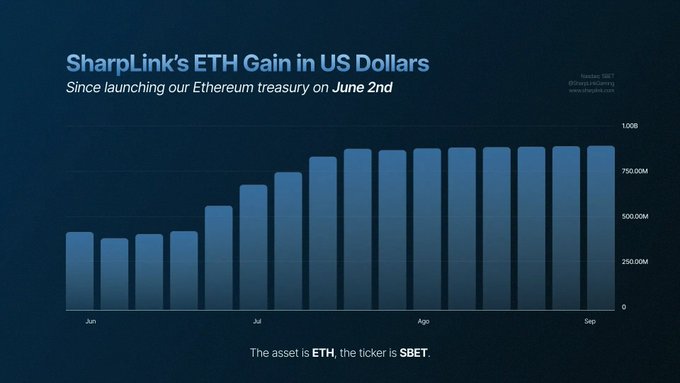

SharpLink Gaming has reported a surge in unrealized profits, surpassing $900 million since launching its Ethereum treasury strategy in early June 2025. The company currently holds 839,000 ETH on its balance sheet, a significant increase in Ethereum concentration that has boosted the value of its stock. With no debt on its balance sheet, SharpLink is in a strong financial position, thanks to its investment in Ethereum, a productive and yield-bearing asset.

SharpLink’s ongoing strategy of accumulating Ethereum has proven highly effective, with the company’s ETH holdings now representing a major part of its overall portfolio. The firm’s success underscores the growing trend of publicly traded companies incorporating cryptocurrencies into their treasury management strategies.

SharpLink Gaming Growing Ethereum Holdings and Strategy

SharpLink’s ETH treasury strategy has involved steadily increasing its holdings of Ethereum over the past few months. The company has doubled its ETH concentration during this period, allowing every share of the company to become more valuable. According to SharpLink, this accumulation strategy is a key part of its business model and its overall growth strategy.

SharpLink has committed to continuing its ETH accumulation strategy and is also exploring other ways to leverage its Ethereum holdings.

The company has already announced plans to tokenize its common stock, SBET, on the Ethereum blockchain, providing greater integration with the cryptocurrency ecosystem. This move reflects SharpLink’s ambition to stay at the forefront of the evolving digital asset landscape.

Other Firms With Major ETH Treasuries and Market Dynamics

SharpLink Gaming is not the only firm leveraging Ethereum in its treasury strategy. Bitmine, for instance, has just bought 179,251 ETH, bringing its total ETH holdings to an impressive 2.83 million ETH, worth around $13 billion. This places Bitmine in the lead among firms with the largest Ethereum holdings.

In second place is SharpLink with 839,000 ETH, while the Ethereum Foundation holds approximately 222,000 ETH, securing the fourth spot. These companies are part of a growing trend of institutional investors recognizing the value of Ethereum as a long-term asset.

Bitmine just bought another 179,251 ETH

They now hold 2.83 MILLION ETH, worth $13 billion dollars

SharpLink is in 2nd place with 838K ETH

The Ethereum foundation is in 4th with 222K ETH

SEND ETH TO $10,000!! pic.twitter.com/4I6W5qWUDr

— borovik (@3orovik) October 6, 2025

In addition to company holdings, Ethereum ETFs have seen massive inflows. In just six days, $1.6 billion flowed into Ethereum ETFs, with around 346,000 ETH being snapped up. The major ETF firms involved in these purchases include Bitwise ($110 million), Grayscale ($208.3 million), Fidelity ($328.8 million), and BlackRock ($784.3 million). The surge in ETF purchases reflects strong retail and institutional demand for Ethereum and Bitcoin, which continues to grow.

Partnerships and Future Plans for SharpLink

SharpLink is not only focusing on accumulating Ethereum but also on exploring new opportunities within the Ethereum ecosystem.

The company has announced that it will collaborate with ConsenSys, the Ethereum-focused software company, to work on the Ethereum Layer 2 network, Linea. This partnership is expected to enhance SharpLink’s ability to generate yield from its Ethereum holdings.

Joseph Lubin, chairman of SharpLink and founder of ConsenSys, has stated that the collaboration will allow SharpLink to leverage Linea for risk-adjusted yields, providing further opportunities for growth. SharpLink plans to stake a portion of its ETH on Linea, enabling the company to take advantage of Layer 2 solutions for more efficient and scalable Ethereum transactions.

Market Sentiment and SharpLink’s Position in the Crypto Landscape

The success of SharpLink Gaming Ethereum treasury strategy reflects broader market trends as companies increasingly embrace cryptocurrencies as part of their business operations. With major institutional investors showing increased interest in Ethereum, SharpLink is well-positioned to continue benefiting from its early adoption of this strategy.

The company’s strong financial position, characterized by its debt-free balance sheet and large ETH holdings, provides a solid foundation for future growth.

Concurrently, SharpLink Gaming plans to tokenize its stock and stake its ETH on Ethereum’s Layer 2 network further illustrate its commitment to integrating with the broader cryptocurrency ecosystem. This forward-thinking approach has the potential to generate substantial value for shareholders in the coming years.