TLDR

- XRP price has dropped below the $3 support level and is currently trading around $2.97

- Analysts identify $3.15 as the next major resistance level that needs to be cleared for upward movement

- Experts suggest XRP could reach $4 if it holds support at $2.97, but may drop to $2.80 if this level fails

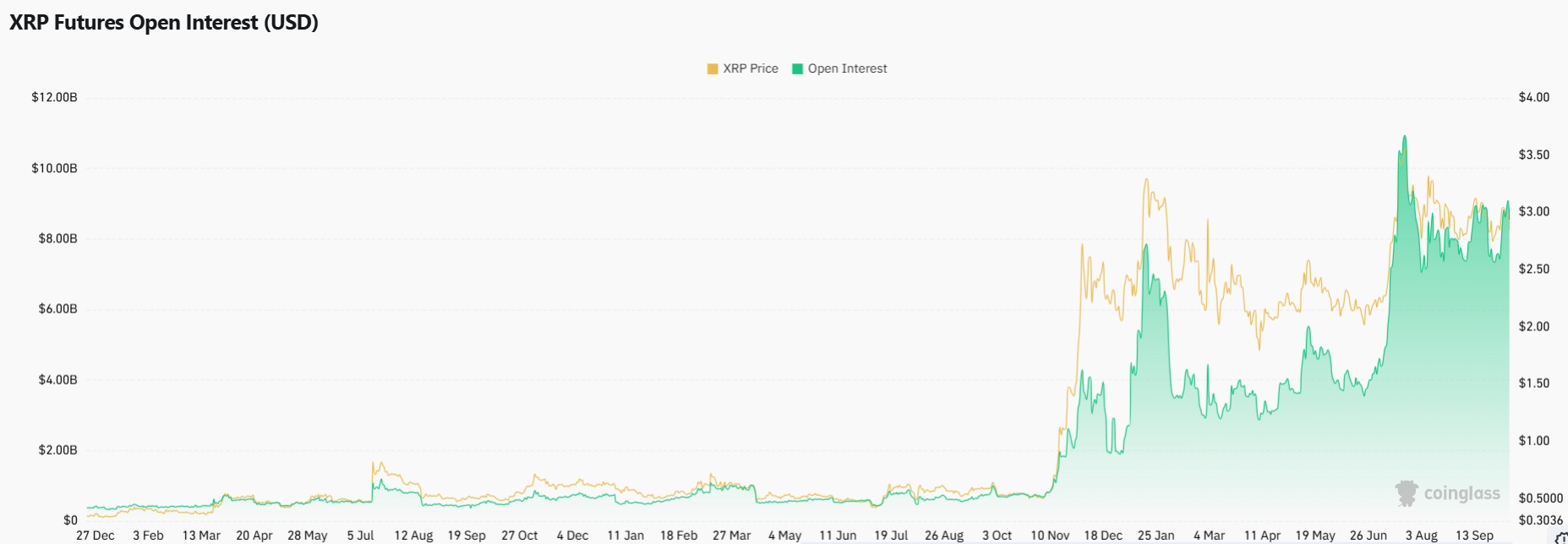

- Futures Open Interest increased by 3.5% to $9.25 billion despite the recent price decline

- Market sentiment data shows the highest retail fear in six months, which some analysts view as a positive buy signal

XRP price has slipped below the $3 mark, trading at $2.97 after a period of consolidation. The cryptocurrency touched a 24-hour high of $3.05 before pulling back to current levels.

The decline represents approximately a 1% drop in the daily chart. However, XRP has still gained 4.5% over the past week and 5% over the last 30 days.

The recent price action has prompted analysts to identify critical levels for traders to watch. Analyst Ali Martinez highlighted that $3.15 represents the next major resistance level for XRP after $3.

$XRP faces a major test at $3.15. A breakout here could trigger a rally to $3.60! pic.twitter.com/BOW6qVi0nv

— Ali (@ali_charts) October 7, 2025

Martinez stated that clearing $3.15 could open the path to $3.40 and then $3.60. These resistance levels will be important for determining the next phase of price movement.

Market analyst Lark Davis provided a different perspective on potential price targets. Davis suggested that if XRP maintains support at $2.97, the cryptocurrency could target $4.

Key Support Zones Under Watch

Davis also warned that failure to hold $2.97 could lead to a test of $2.94 support. Other technical analysis points to $2.85 as another critical support level.

A break below $2.80 could trigger further declines toward $2.72 and potentially $2.65. The $2.80 level represents a key zone that could determine whether XRP continues its downward movement.

The cryptocurrency is currently trading below the 100-hourly Simple Moving Average. It also broke below a declining channel with support at $2.90.

Technical indicators show mixed signals for XRP price movement. The hourly MACD is gaining pace in bearish territory.

The Relative Strength Index has fallen below the 50 level. These indicators suggest caution for traders watching the short-term price action.

Market Data Points to Continued Interest

Despite the price decline, derivatives data shows continued interest in XRP. Futures Open Interest rose by more than 3.5% to $9.25 billion.

This increase in Open Interest occurred even as the price pulled back. The metric suggests traders remain active in XRP markets.

On-chain analytics firm Santiment reported that XRP is experiencing its highest retail fear in six months. The platform noted more bearish comments than bullish ones for the asset.

Santiment characterized this as a potential buy signal. The firm suggested this sentiment pattern often precedes price recoveries.

XRP has gained approximately 5% over the past month. The cryptocurrency reached its 24-hour high of $3.05 before the current consolidation.

The $3 to $3.15 range will be critical for determining XRP’s next move. Traders are watching whether the cryptocurrency can reclaim $3 and push toward higher resistance levels or if further support tests are ahead.

XRP price currently stands at $2.97 with futures Open Interest at $9.25 billion.