Bitcoin (BTC) is attracting investor attention as it continues to perform strongly in 2025. Traders expect the price to break above $130,000 in the last quarter of the year, driven by historical trends, institutional inflows, and technical momentum. As BTC faces selling pressure, analysts believe that recent gains in XRP and Cardano (ADA) could lead to price increases in Q4. The attention on the two digital assets could provide a strong alternative for traders.

In addition, analysts note that past altcoin rallies could provide clues on how further gains could accumulate in Q4. Moreover, MAGACOIN FINANCE is also quietly becoming a project which can lead to a reasonable return, making it one of the altcoins to watch in the coming months.

Bitcoin: BTC Eyes $130K as Institutional Inflows Drive Momentum

Bitcoin could rise past $130,000 in the coming days, according to some analysts and on-chain data. Nonetheless, various signals and forecasts from experts indicate that this target can be achieved. Institutional demand, positive ETF flows, STH-MVRV, and on-chain whale accumulation collectively indicate that a significant amount of upside could be ahead for Bitcoin in the final quarter of 2025.

It’s worth noting that Bitcoin is currently trading between $121,300 and $124,000, with new all-time highs around $126,200. The cryptocurrency has risen by more than 6% over the last week and has almost doubled year-over-year. October is a month traditionally known for being bullish and is thus dubbed as ‘Uptober’.

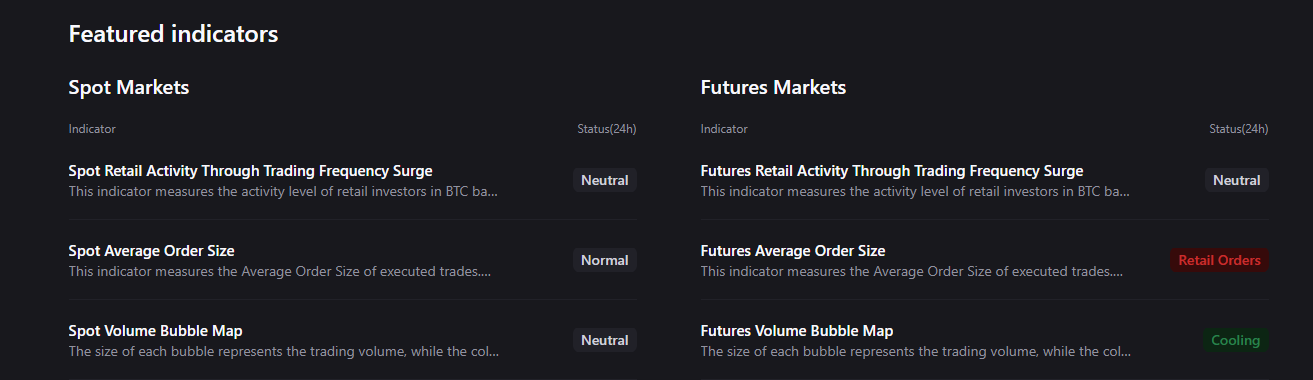

Bitcoin Institution Trend: Source: Cryptoquant

Analysts from CryptoQuant point out the STH-MVRV indicator suggesting short-term holders take profit at $130K. This price level may act as a strong resistance level. However, it is a level that the market can achieve. The RSI, MACD crossovers, volume changes, and on-chain whale accumulation give a second bullish signal, this time with stronger momentum towards $130K.

XRP: Bulls and Bears Clash Near Key Downtrend Line

Attention is currently shifting to XRP, the native digital asset of Ripple’s payments network. However, on the surface, XRP appears to be an unlikely candidate for ETF approval. It has spent years fighting the US Securities and Exchange Commission in court and doesn’t carry the cultural weight of Bitcoin or Ether. Still, major asset managers are filing ETF applications (and analysts are split on whether investors would bite).

Nate Geraci, who heads The ETF Store and closely tracks ETF markets, thinks skeptics are underestimating demand. He compares today’s doubts to the early pushback against Bitcoin and Ether ETFs, which faded quickly once billions of dollars started flowing in. This has sparked a sense of uncertainty among some investors. What is certain is, XRP has always found its way to surprise its believers, and its preparation for the Q4 of the year could attract several investors.

Cardano: ADA Shows Strength While Eyes Key Resistance

Cardano recently closed above the 50-day SMA ($0.85), but the bulls could not clear the hurdle at the resistance line. A positive sign in favor of the bulls is that they have not allowed the price to sustain below the 20-day EMA ($0.84). That suggests strong demand at lower levels. The bulls are again attempting to push the price above the resistance line. If they succeed, the ADA/USDT pair could rally toward $1.02.

On the other hand, if the price turns down and closes below the 20-day EMA, it indicates strong selling near the resistance line. The Cardano price may then continue to remain within the descending triangle pattern for some time.

Emerging Altcoin Positioned as a Top Q4 Opportunity

MAGACOIN FINANCE is emerging as a potential top altcoin with the capacity to generate more upside this quarter. According to analysts, its structured roadmap and early community engagement, as well as limited token supply, may make it one of the best altcoins to watch after BTC, XRP and ADA. As momentum builds through Q4, confidence in its fundamentals was reported from early adopters.

The project is interesting enough in nature to attract fresh investors while having features that promote long-term participation. It certainly stands out in the current market. Despite being a new alternative coin, MAGACOIN FINANCE is viewed as one with high growth potential and is considered by investors alongside leading coins such as BTC, XRP and ADA.

Conclusion: Q4 2025 Rotation Opportunities

Bitcoin continues to show strength and may challenge $130K as Q4 unfolds, supported by institutional ETF inflows and favorable market momentum. XRP and Cardano remain key altcoins to watch for rotation opportunities, drawing lessons from their historical rallies.

Meanwhile, MAGACOIN FINANCE has been fully audited and verified by Hashex, confirming its smart-contract integrity and investor protection. Analysts note that few presales offer this level of transparent, certified security backed by Certik review.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.