TLDR

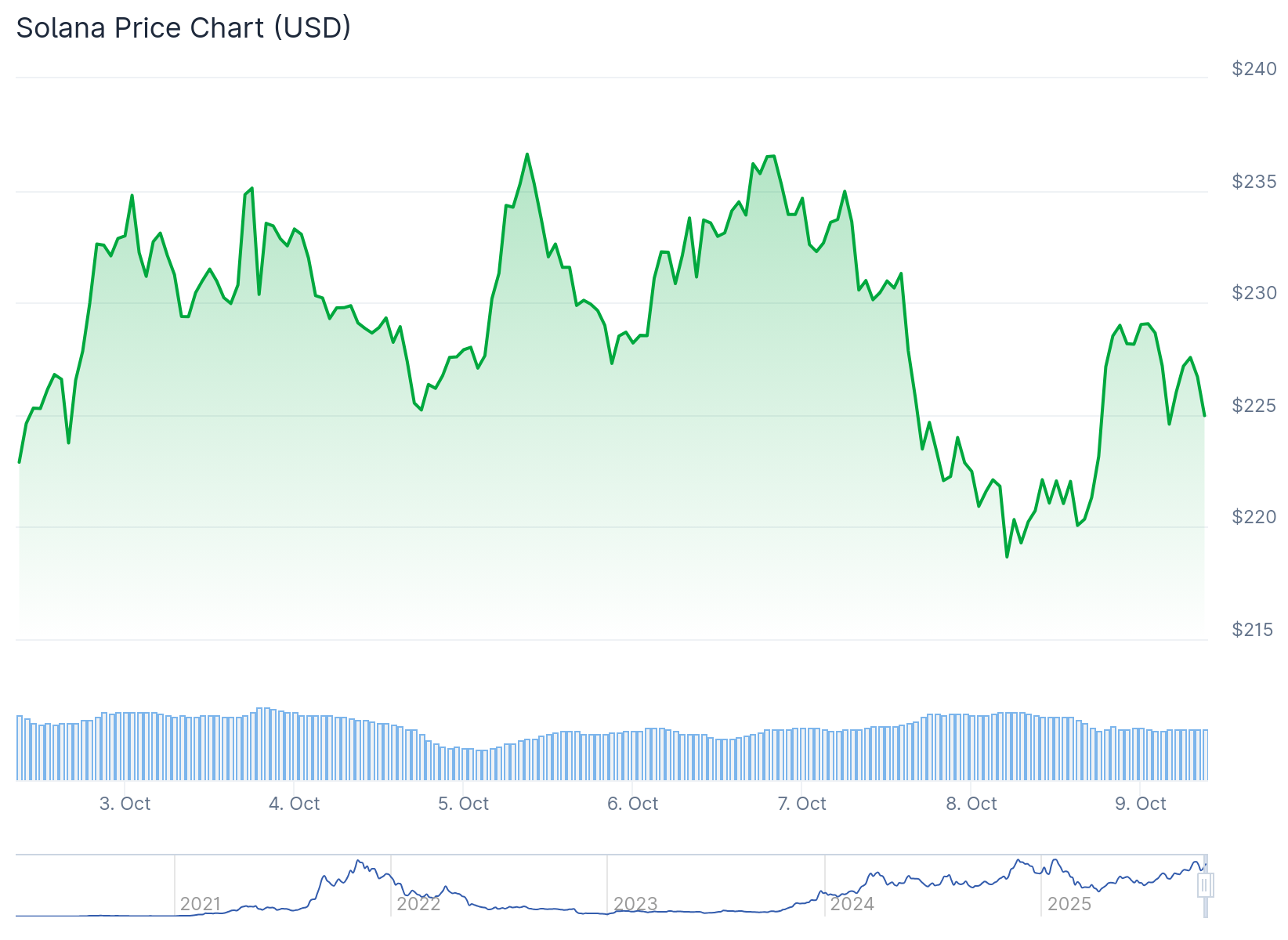

- Solana (SOL) climbed back to $229 after briefly dipping to $218, with traders targeting the $300 mark driven by positive Federal Reserve interest rate outlook.

- Solana ETFs and ETPs recorded $706 million in weekly inflows through September 5, outpacing XRP’s $219 million and showing strong institutional demand.

- Multiple spot Solana ETF decisions from major firms like Grayscale, Fidelity, Franklin Templeton, and VanEck are expected by October 10, with approval odds near 100%.

- Solana’s network activity surged with a 22% increase in seven-day fees and DEX volumes rising 78% on Pump, 73% on Meteora, and 46% on Raydium, pushing 30-day volume to $129 billion.

- Solana’s total value locked (TVL) rose 8% in 30 days to $14.2 billion, securing its position as the second-largest network with an 8% market share.

Solana’s native token SOL climbed back to $229 on Tuesday after briefly falling to $218. The recovery came as investors reacted positively to Federal Reserve minutes from the September 17 meeting. The minutes confirmed expectations of more interest rate cuts in 2025.

Traders are now watching the $300 price level. This target appears realistic based on current derivatives data and onchain metrics showing strong network growth.

The crypto market is focused on multiple Solana ETF decisions expected by October 10. Major financial firms including Grayscale, Fidelity, Franklin Templeton, and VanEck are awaiting approval for their Solana ETF products. Market observers estimate approval odds at close to 100%.

Solana ETFs and ETPs attracted $706 million in inflows during the seven days ending September 5. This figure far exceeded the $219 million recorded by XRP instruments during the same period. The strong inflows demonstrate growing institutional interest in Solana exposure.

The first Solana spot ETF launched by REX-Osprey in July became the first SEC-approved product with built-in staking rewards. This product has earned over $400 million since its launch.

Network Activity Shows Strong Growth

Solana recorded a 22% increase in seven-day network fees. This growth was driven by rising activity across decentralized exchanges. Ethereum saw the opposite trend with network revenue falling 21% during the same period.

DEX volumes on Pump rose 78% over the past seven days. Meteora saw a 73% increase while Raydium posted a 46% rise. Solana regained its leading position in decentralized exchange activity with $129 billion in 30-day volume. This surpassed Ethereum’s $114 billion.

Solana continues to dominate in transaction count. The network processes more transactions than Ethereum and its layer-2 ecosystem combined.

Network fees remain important for any blockchain focused on decentralized applications. The revenue helps offset inflationary pressures. Maintaining validators incurs costs and staking participants expect reasonable returns. Weak network activity can trigger sell pressure on the native token.

Solana’s total value locked rose 8% in 30 days to $14.2 billion. This represents an 8% market share across all blockchains. The network has solidified its position as the second-largest by TVL.

Kamino deposits increased 20% while Drift and Orca each grew 12%. By comparison, Ethereum’s TVL increased 3% over the same period. Tron deposits grew 6%.

Technical Signals Point to Potential Breakout

The daily chart shows Solana found strong resistance at around $250 last month. The token appears headed to retest that area as positive momentum has returned.

The Relative Strength Index climbed above its 14-day moving average. This move is often viewed as a buy signal by traders. The $200 level will serve as key support if the price pulls back.

The funding rate on Solana perpetual futures has remained below the 6% neutral threshold. This signals weak demand for bullish leveraged positions. The cautious stance among traders may stem from growing competition from other blockchains.

BNB Chain attracted attention after a wave of memecoins surged 150% or more within seven days. BNB rallied 28% during this period while SOL’s price rose 3%. This performance weighed on sentiment among some Solana ecosystem investors.

Some rival tokens recently reached new all-time highs. BNB hit $1,357 on Tuesday while Mantle reached $2.81 on Wednesday. Many SOL holders grew frustrated after the failed attempt to break above $250 on September 18.

The upcoming ETF decisions on October 10 could trigger fresh institutional capital flows into SOL. If approved, these products would provide new channels for investors to gain Solana exposure.