TLDR

- Uganda’s CBDC is backed by treasury bonds and accessible via smartphones.

- Kenya’s VASP bill now awaits the president’s approval after parliament’s passage.

- Sub-Saharan Africa saw $205 billion in crypto value from July 2024 to June 2025.

- Africa’s crypto user base is projected to exceed 75 million by 2026.

Uganda has launched a central bank digital currency (CBDC) pilot, marking a significant step in the country’s digital finance efforts. This move comes amid growing interest in cryptocurrencies across Sub-Saharan Africa. Meanwhile, Kenya is about to pass a crucial bill that will regulate the crypto industry. Both developments represent important milestones in the region’s evolving digital economy, reflecting a broader trend of embracing blockchain technology.

Uganda’s CBDC Pilot and Digital Tokenization

Uganda has introduced a CBDC pilot as part of a broader plan to digitize its financial infrastructure. The digital Ugandan shilling, backed by the country’s treasury bonds, is deployed on a permissioned blockchain.

This effort aims to boost economic transparency and financial inclusion. The CBDC is available for use via smartphones, which could potentially increase access to financial services in remote areas.

The pilot complies with both local and international standards, including Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. GSN, a blockchain financial infrastructure company, partnered with Uganda’s Diacente Group to tokenize $5.5 billion in real-world assets. This initiative is focused on various sectors such as agro-processing, mining, and renewable energy.

Kenya’s Crypto Bill Nears Final Approval

In neighboring Kenya, the virtual asset service providers (VASP) bill has passed its final parliamentary reading and is awaiting President William Ruto’s signature to become law. The bill seeks to create a regulated framework for crypto exchanges, brokers, and wallet operators. The law also includes consumer protection measures and establishes the Central Bank of Kenya as the overseeing authority for payment and custody functions.

The proposed legislation is in line with global standards, including KYC and AML measures. It also includes provisions to prevent deceptive advertising practices and enforce penalties for non-compliance. Once signed into law, this bill will set a clear regulatory path for Kenya’s growing crypto industry.

Growing Crypto Adoption in Sub-Saharan Africa

Both Uganda and Kenya are part of the rapidly expanding crypto ecosystem in Sub-Saharan Africa. According to blockchain data platform Chainalysis, the region saw a surge of $205 billion in on-chain value between July 2024 and June 2025. Countries like Nigeria, South Africa, and Ghana are also leading the charge in crypto adoption, with Uganda ranking seventh in the region for total transaction volume.

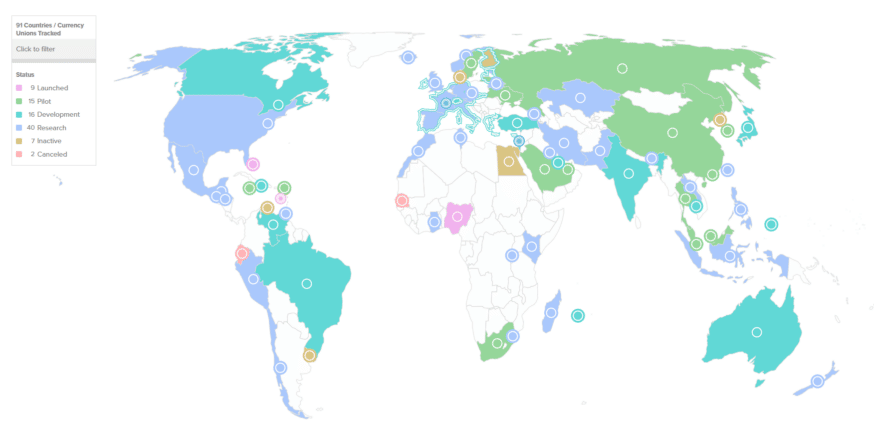

As blockchain technology and digital currencies gain traction, many African nations are exploring the potential of CBDCs. While Nigeria was the first African country to launch a CBDC in 2021, other countries such as Ghana and South Africa have also conducted CBDC trials. In contrast, Kenya and Rwanda are still in the research phase but are expected to launch in the coming years.

The Future of Digital Finance in Africa

The initiatives in Uganda and Kenya underscore a wider shift toward digital finance across Africa. As blockchain technology becomes more integrated into the financial system, countries are positioning themselves to attract new investment and stimulate economic growth. Tokenization of assets, along with CBDCs, can enhance transparency and help industries access new funding opportunities.

With a growing user base in the crypto space, Africa’s digital asset market is expected to reach significant heights. Statista estimates that over 75 million users in Africa will be engaged in crypto by 2026, with a revenue of $5.1 billion expected. This growth could further reinforce the region’s position as a key player in the global blockchain and cryptocurrency landscape.