TLDR

- Q3 2025 EPS: $1.71 adjusted vs. $1.53 expected; revenue $15.2B vs. $15.06B forecast.

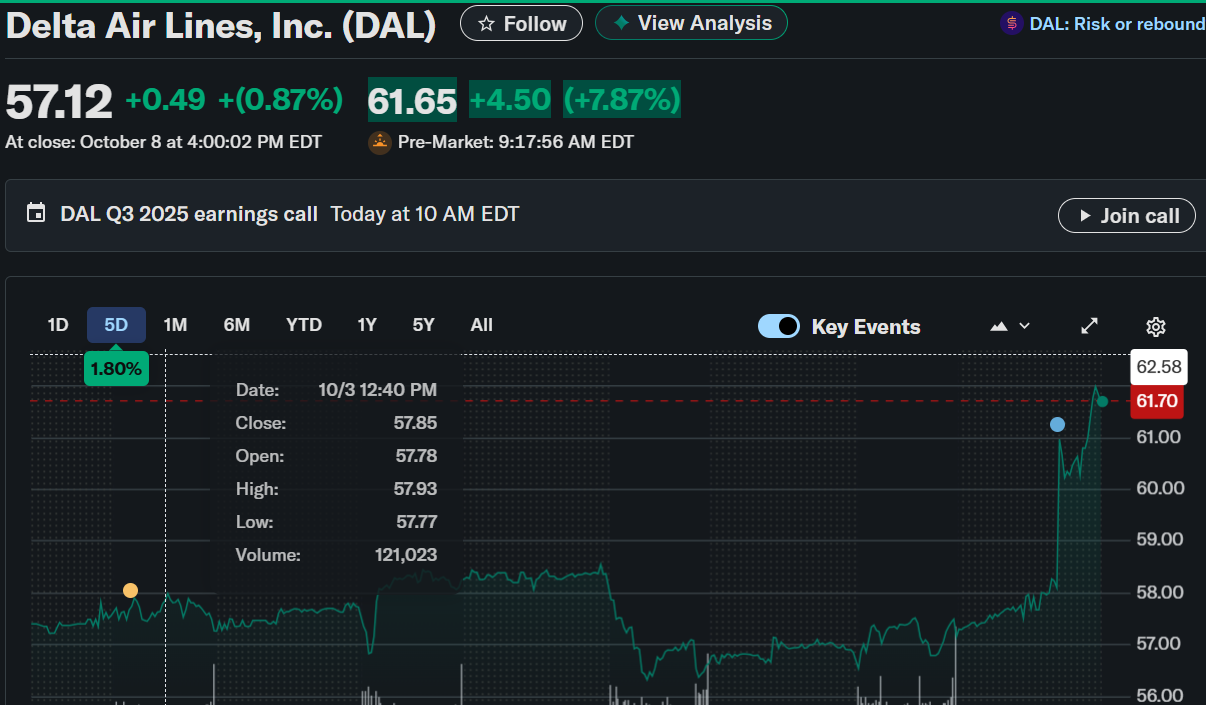

- Shares rose 5.9% pre-market to $60.53 after results.

- Premium travel revenue grew 9% YoY, offsetting a 4% decline in main cabin.

- Delta forecasts Q4 EPS of $1.60–$1.90 and full-year EPS of ~$6, topping guidance.

- CEO Bastian sees 2026 margin expansion and earnings improvement ahead.

Delta Air Lines Inc. (NYSE: DAL) stock rose 0.87% to $57.12 on October 8 and surged 5.91% in pre-market trading to $60.53 after releasing its September quarter 2025 results.

The Atlanta-based carrier outperformed Wall Street expectations, driven by solid revenue growth and resilient premium travel demand.

For the quarter ending September 30, 2025, Delta reported adjusted earnings per share (EPS) of $1.71, beating analysts’ estimates of $1.53, on revenue of $15.2 billion, which also topped the consensus forecast of $15.06 billion.

GAAP results showed operating revenue of $16.7 billion, operating income of $1.7 billion with a 10.1% margin, and pre-tax income of $1.8 billion. GAAP EPS came in at $2.17, up from $1.97 a year earlier, marking an 11% profit increase.

Strong Premium Travel Drives Growth

CEO Ed Bastian highlighted Delta’s strong positioning, citing its competitive advantage and consistent operational execution. Premium travel continued to be a key revenue driver, generating $5.8 billion, up 9% year-over-year, while main cabin revenue fell 4% to $6 billion.

Bastian said there are no signs of consumer pullback in premium products, with corporate travel showing renewed strength. Domestic unit revenue rose 2% on a 4% capacity increase, helping offset weaker midweek demand and rising costs.

Robust Outlook for Q4 and 2026

Delta expects adjusted Q4 2025 EPS between $1.60 and $1.90, compared with Wall Street’s $1.65 forecast, and anticipates revenue growth of up to 4%, exceeding expectations. The carrier reaffirmed its full-year EPS guidance at the high end of $6, signaling sustained profitability momentum.

Looking ahead, Bastian said Delta is well-positioned for 2026, targeting top-line growth, margin expansion, and earnings improvement consistent with its long-term strategy.

Financial Health and Cash Flow

Operating cash flow for Q3 stood at $1.8 billion, with $459 million in debt and lease repayments. The airline ended the quarter with total obligations of $14.9 billion, reflecting solid financial discipline as it continues to manage capacity efficiently and retire high-cost debt.

Market Performance Overview

Despite a YTD decline of 4.74%, Delta’s 1-year return of 14.18% and 3-year gain of 99.17% underscore its resilience. Over the past five years, DAL stock has climbed 79.12%, compared to the S&P 500’s 95.94%.

Delta’s strong Q3 results, premium segment growth, and confident 2026 outlook reinforce its leadership among U.S. carriers as it navigates evolving travel trends and global demand recovery.