Cardano (ADA) is trading around $0.82 as investors await a potential breakout before the end of the year. Analysts point out ADA’s stability amid recent market fluctuations, setting the stage for a possible march towards $1.

Solana (SOL) and Chainlink (LINK) are surging, showing major positive momentum among major altcoins. Both networks have seen a notable increase in institutional activity and user engagement. Joining them, MAGACOIN FINANCE has also drawn a lot of attention as some analysts have put it on their lists of the top altcoins to watch in the fourth quarter.

Cardano Price Analysis

Cardano’s chart presents a symmetrical triangle formation that echoes accelerating price action while trading between $0.75 and $0.93. A decisive breakout follows when either trendline breaks.

Source:X

The 50-day and 200-day moving averages hover near $0.80, providing solid support. The RSI is still neutral at 45, indicating a possibility of upward continuation. A breakout over $0.93 could lead ADA to $0.99 and $1.01. A strong continuation may drive gains toward target levels of $1.13 or $1.23.

However, a break below $0.75 would expose ADA to $0.68, where more aggressive buyers are expected to support. Cardano’s structure remains inclined towards a bullish breakout if the current base holds.

What Is Driving ADA Toward $1?

Cardano’s fundamentals are growing strong as its ecosystem grows. Developer activity continues to increase, and staking participation remains steady, indicating long-term network confidence.

DeFi projects on Cardano are increasing in adoption, and transaction numbers are increasing on new dApps. Analysts note that ADA’s consistent upward trajectory and undervaluation present a substantial opportunity for a robust catch-up rally against peers such as Solana and LINK.

With a number of protocol upgrades planned for Q4, Cardano could experience greater liquidity and more network utility. This combination makes the $1 target more achievable as traders hunt for technically supported plays.

Solana Price Outlook — Institutional Inflows Boost Confidence

Solana has regained its market attention through an impressive development in multiple performance metrics. Network fees increased by 22% to $5 million, reflecting the increasing number of Solana-enabled apps.

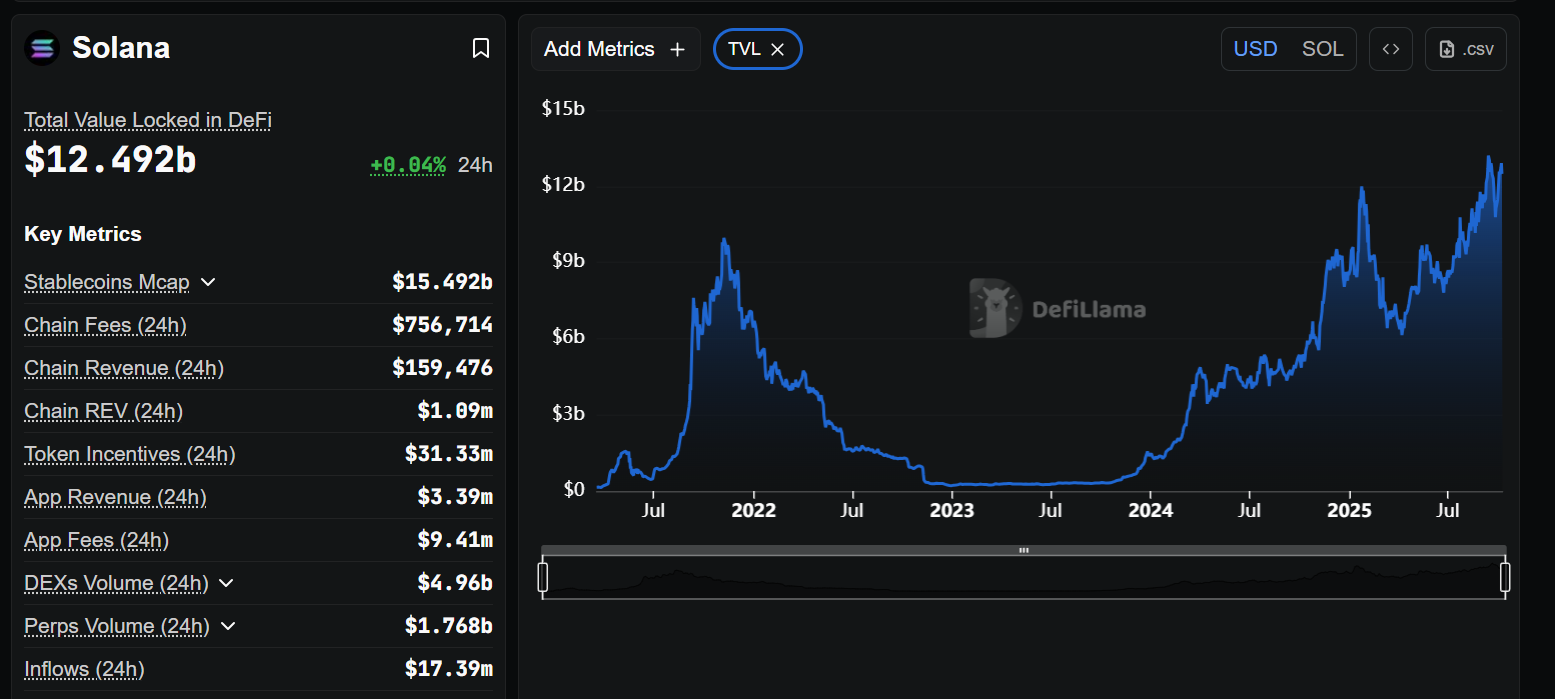

DEX trading volume soared to $129 billion last week, above Ethereum’s $114 billion. Solana’s total value locked (TVL) increased by 8% to $14.2 billion, posting one of its strongest performances in months. Meanwhile, institutional interest is skyrocketing with Solana-oriented ETFs drawing in $706 million weekly inflows.

Source: DefiLlama

SOL is up 3% this week to trade around $225. Analysts say if flows continue, Solana could hit $300 before mid-November.

Chainlink Forecast — CCIP and RWA Adoption Strengthen LINK’s Narrative

Chainlink remains a crucial application as Web3’s virtual infrastructure. Its Cross-Chain Interoperability Protocol (CCIP) has emerged as a vital interoperability solution and is adopted by projects like JovayNetwork and OpenEden.

An additional growth vector is the integration with Plume Network for tokenizing real-world assets using Chainlink oracles. Furthermore, Chainlink’s collaboration with SWIFT solidifies its institutional relevance, connecting traditional finance with blockchain infrastructure.

According to on-chain data, Chainlink currently protects $25.8 trillion in transactions across multiple blockchains. This milestone signals deep trust and growing real-world adoption.

MAGACOIN FINANCE Highlighted as a Top Buy for Q4

Alongside established leaders like Cardano, Solana, and Chainlink, MAGACOIN FINANCE is emerging as a notable pick for Q4 investors. To celebrate its strong performance in recent funding rounds, MAGACOIN FINANCE has launched a promo bonus through the code PATRIOT100X. The campaign has ignited a wave of new buying as traders seek to maximize profits ahead of the broader recovery.

Analysts say the growing demand reflects confidence in MAGACOIN FINANCE’s strong community and dual appeal for short-term and long-term investors. Its unique momentum and consistent visibility have made it one of the best-performing altcoins highlighted by analysts for this quarter.

ADA Leads Q4 Altcoin Strength

Cardano’s technical setup and strong fundamentals place it on track to test the $1 mark soon. Solana’s institutional momentum and Chainlink’s expanding integrations reinforce positive sentiment across major altcoins.

Meanwhile, MAGACOIN FINANCE’s growing recognition as a Q4 top pick underscores a shifting focus toward projects with strong communities and innovative models. Together, these assets highlight the confidence returning to the market as the year closes on a bullish note.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.