Institutional interest in Ethereum and Solana ETFs is pushing crypto back into the spotlight. Alongside these giants, MAGACOIN FINANCE is catching the eyes of smart investors looking for hedge and diversification opportunities.

Ethereum ETFs Gain Investor Confidence

Ethereum’s ETF ecosystem is expanding fast. Grayscale has activated staking for its U.S.-listed spot Ethereum ETFs — Grayscale Ethereum Trust ETF (ETHE) and Ethereum Mini Trust ETF (ETH). These are the first U.S. spot crypto ETFs to offer staking rewards, giving investors a way to earn yield while holding ETH.

ETHE now manages about $4.82 billion in assets, while ETH handles roughly $3.31 billion. By staking a portion of ETH through institutional custodians, these ETFs allow investors to benefit from network rewards without managing nodes or private keys.

The move shows growing institutional trust in Ethereum as a long-term blockchain asset. In just one day, Ethereum ETFs saw $420.9 million in inflows, signaling active participation from major funds. These products combine price exposure and staking yield in one structure, making them more appealing than non-staking ETFs or low-yield assets.

This new phase of Ethereum ETF innovation could strengthen ETH’s market position going into 2025, keeping it on top of lists for the best altcoins to buy as staking-enabled ETFs gain traction globally.

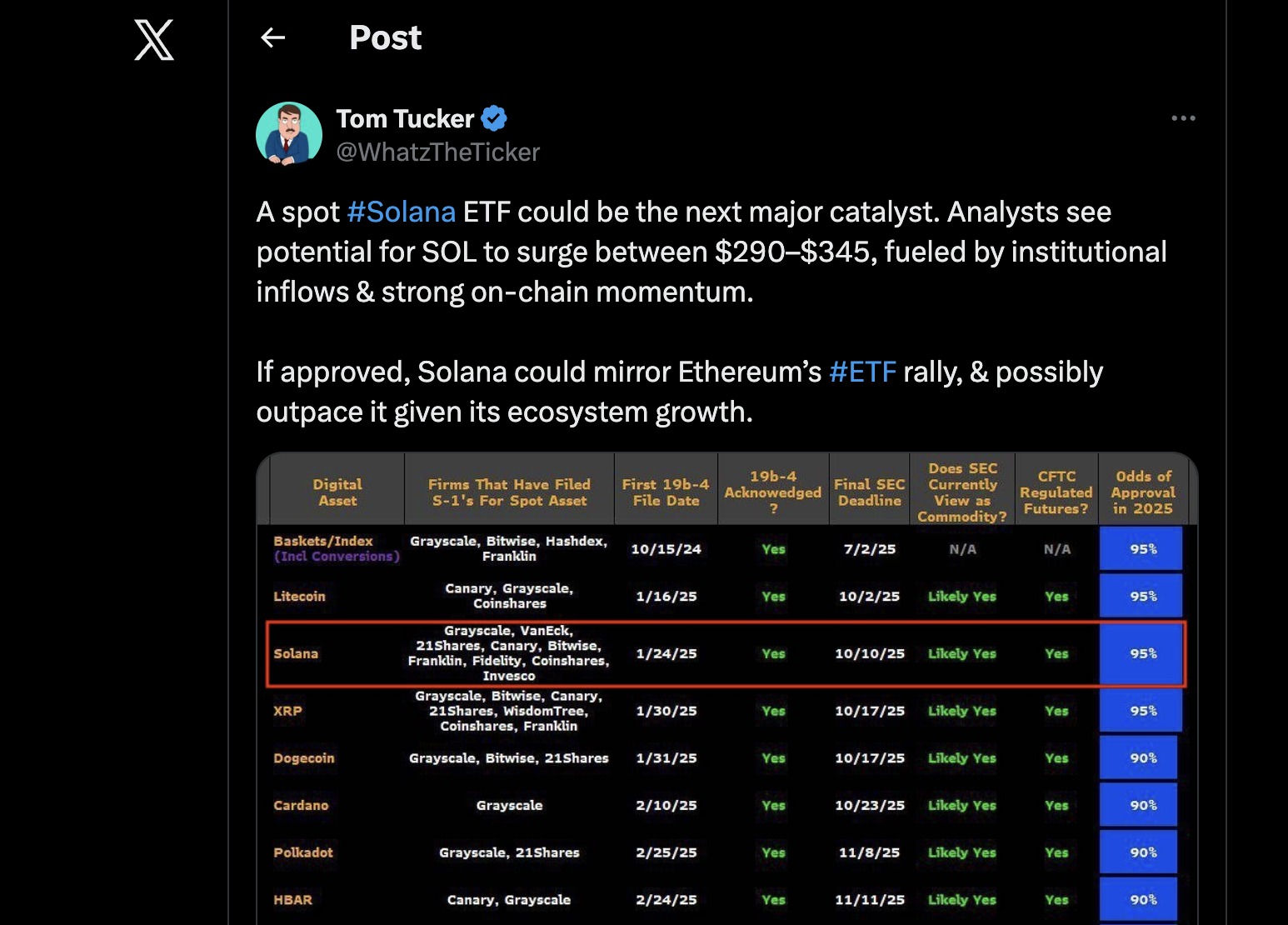

Solana’s Turn: ETF Approval Could Shift the Market

Solana is quickly catching up. The upcoming decision on a U.S. Solana ETF could change how investors view altcoins. Analysts estimate a 99% chance of approval, with Polymarket traders already betting on it.

The excitement comes after Solana ETPs hit a record $706.5 million in weekly inflows, showing huge global interest. The network has also become a major player in stablecoin transactions and user activity, reporting over $271 million in revenue in Q2 2025 alone.

If approved, a Solana ETF could make SOL accessible to pension funds and brokers, expanding its reach beyond crypto-native buyers. Bitwise CEO Hunter Horsley also pointed out Solana’s faster unstaking process as an edge over Ethereum’s longer queue times.

For those researching the best altcoins to buy, Solana stands out for speed, low fees, and rising institutional visibility — but investors are also watching a new player making waves.

MAGACOIN FINANCE: The Hidden Gem Investors Are Watching

Whale activity around MAGACOIN FINANCE is rising fast, with over 18,000 investors joining ahead of its listing. Many see it as a hedge and diversification play alongside major ETFs like Ethereum and Solana.

Analysts call it a hidden gem altcoin worth watching as attention shifts beyond traditional names.

Why MAGACOIN FINANCE:

- Whale interest and smart money signals ahead of launch

- Rapid investor growth and verified smart contract audit

- Built for security and fairness with zero insider allocations

MAGACOIN FINANCE Audit Verification Sets Benchmark

MAGACOIN FINANCE’s full verification on Hashex.org has set a new benchmark for crypto launches, confirming legitimacy before listing.

Final Thoughts — Positioning for 2025

As Ethereum and Solana ETFs continue to attract record inflows, traders are exploring new opportunities in upcoming altcoins. MAGACOIN FINANCE stands out as one to watch closely for those seeking early exposure to a verified project before major listings. Explore the project:

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.