A leading industry figure has declared the end of the 4-year cycle, claiming that monetary forces are stronger than Bitcoin halving hype. If true, this could fundamentally alter how investors perceive digital assets, potentially paving the way for a bull market that extends deep into 2026.

The move comes as Bitcoin trades at record price levels, altcoins like Ethereum and Solana near breakouts, and new developments such as Bitcoin Hyper (HYPER) aim to elevate Bitcoin to the next level.

Bitcoin Hyper is developing the world’s first ZK-rollup-powered Bitcoin Layer 2 blockchain, designed not only to break Bitcoin’s speed limit but also to introduce new utilities like dApps and high-frequency payments.

With Bitcoin expected to reach new highs in the coming months, the Bitcoin Hyper presale is experiencing a frenzy of whale buys, having raised an impressive $23 million to date. And as momentum builds, the project is quickly establishing a reputation as the best crypto to buy now. One analyst even says HYPER holds potential for 10,000% returns – let’s explore whether it can truly live up to this claim.

Bitcoin supercycle incoming? How Bitcoin Hyper could fuel the rally

BitMEX co-founder Arthur Hayes has provided an optimistic outlook for the crypto market, stating that the four-year Bitcoin cycle has ended. In a blog post published on Thursday, Hayes argued that people mistakenly believe that the Bitcoin halving drives bull markets, when in fact it’s monetary policy and global liquidity that primarily influence prices.

While this has historically resulted in a pattern of booms and busts coinciding with the 4-year Bitcoin halving, Hayes suggests that this year is different due to the expectation of an expanding monetary supply in both the United States and China.

“In the US, newly elected President Trump wants to run the economy hot. He routinely speaks about America growing in order to reduce its debt load… His desire is generating action. The Fed resumed cutting interest rates in September, even though inflation is above its own target,” he observed.

Should crypto break free from the four-year cycle and extend its rally into 2026, it opens up new opportunities for altcoins to grow and have a more lasting impact on the market’s structure. In Bitcoin Hyper’s case, it will provide a longer development runway with expanding market liquidity, which could provide enough time to truly cement itself as a top Bitcoin infrastructure play.

But what exactly is Bitcoin Hyper trying to do? Simply put, it aims to solve Bitcoin’s two major issues: slow speeds and limited functionality.

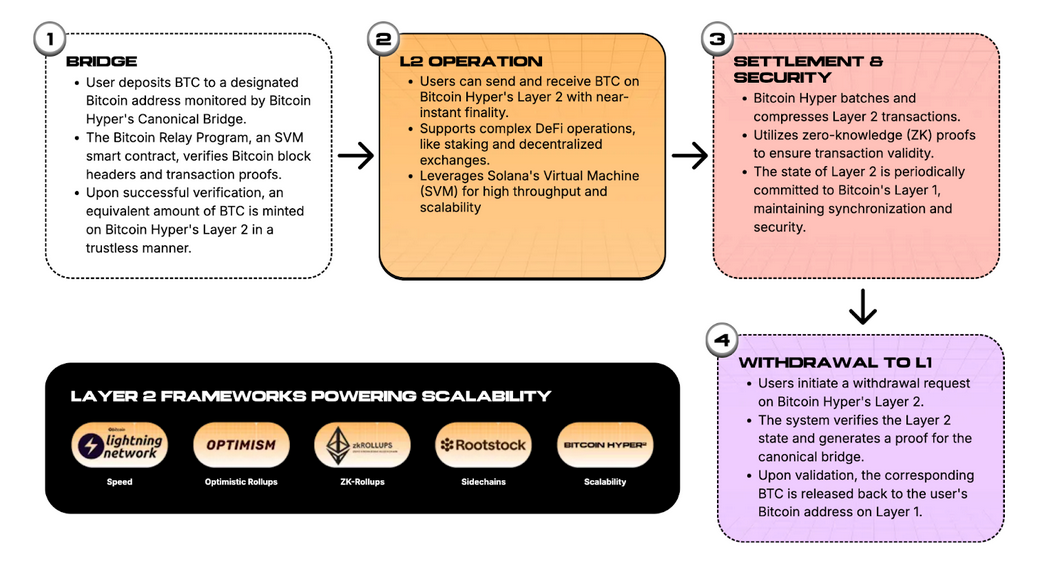

It operates as a separate blockchain, powered by the Solana Virtual Machine (SVM), which allows it to process thousands of transactions per second. It then employs ZK-rollups to bundle transactions and report them back to the Bitcoin base layer for final confirmation, thereby inheriting Bitcoin’s immutability and neutrality.

Additionally, by integrating SVM, Bitcoin Hyper supports smart contracts, opening up new possibilities, including DeFi, meme coins, AI, payments, and RWAs within the Bitcoin ecosystem. This expands the ways BTC can be used and could attract more investors.

Crypto whale eyes 10,00% HYPER gains

Popular trader Alessandro de Crypto recently shared his thoughts on Bitcoin Hyper’s use case and suggested it might be the best crypto to buy for 100x gains. The analyst emphasized that “Bitcoin Hyper is going to solve whatever problem Bitcoin has,” marking a setup that could be crucial in future-proofing the project.

Another point he highlights is the fast momentum of the HYPER presale. Things have only picked up recently, with one whale dropping $274,000 on a single purchase last week. Smart money traders don’t bet that much unless they’re confident that something big is happening – which tells us that Alessandro de Crypto’s bold prediction has real merit.

Why Bitcoin Hyper stands out from other L2s

The reason Bitcoin Hyper is gaining so much attention is simple: it’s creating a security guarantee that no other Bitcoin L2 provides. While other Bitcoin L2s operate as sidechains that don’t fully anchor their data to the Bitcoin mainnet, Bitcoin Hyper does things differently.

Its ZK-rollups use cryptographic verification to check every transaction and, once secured, report them back to the Bitcoin L1 for permanent and irreversible storage. It’s essentially like using the Bitcoin L1 itself, except with faster speeds, lower fees, and support for smart contracts.

With strong presale funding and an innovative scaling approach, Bitcoin Hyper has the potential to shake up the Bitcoin ecosystem – and that’s why top traders are going all in.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.