Gold and silver reached new heights on October 9, yet the rally may come to a close and usher in a rotation toward Bitcoin and other assets.

Yet, some experts are claiming the 4-year cycle is no longer relevant, in spite of solid ETF inflows and increased institutional investments.

Regardless of the future Bitcoin price prediction, many traders expect October rallies and anticipate a bullish Q4. As a result, the hunt for coins with explosive potential is in full swing, with presales attracting massive attention.DeepSnitch AI is one of the most notable examples. The project raised $340K in the first stage, with whales and retail investors lining up for a moonshot opportunity and the chance to gain early access to DeepSnitch AI’s trading analytics platform.

Is there a massive rotation into the crypto market in the books?

After gold reached $4K per ounce and silver shot up to a historic $50 per ounce in early October, many believe that the momentum may slow down and usher in rotation into digital assets.

Gold surged by 50% this year as the US dollar weakened, and could trade at $4.9K per ounce by the end of 2026. Both these factors indicate that the precious metal assets are close to overheating, according to Nic Pucrkrin.

Pucrkin believes that alternative stores of value, which are undervalued compared to gold, may start attracting more attention.

Furthermore, US spot ETFs reached $2.2B in net inflows. As spot volumes coincided with massive ETF purchases, the discretionary and institutional buying are converging, potentially fueling massive crypto rallies.

Amidst ETF appetite, political figures are also pushing for more regulatory clarity. Senator Cynthia Lummis started developing legislation to make small BTC transactions exempt from capital gains taxes.

Although it’s not clear if the legislation will pass, the move could erase the tax burden on smaller purchases, which could transform Bitcoin into a viable currency for everyday purchases.

However, some experts, such as Arthur Hayes, believe that institutional interest may not be a good indicator of bull markets. Hayes agrees that a four-year crypto cycle revolving around halving events is a thing of the past, suggesting that price cycles are primarily driven by quantity and supply of money.

Although Uptober fell below the mark of previous rallies, traders are still bullish and are actively looking beyond Bitcoin and Ethereum in Q4. In addition to meme coins and undervalued crypto coins, investors are also eyeing new presales, primarily for their potential for faster and more explosive gains.

Best crypto to buy now

DeepSnitch AI: Is DSNT the next big thing in crypto?

DeepSnitch AI is attracting massive attention from traders and whales, who invested over $340K in the first stage. Whales might be looking for a way to multiply their holding, yet the project’s growing community is rallying around the AI-powered utility.DeepSnitch AI blends AI with blockchain analytics in a single, easy-to-use dashboard. Five proposed AI agents will specialize in different types of crypto data, meaning that the suite is set to cover a wide array of information.

Not only can the AI agents detect market movements in real time, but traders will also have access to a live feed that warns of insider signals, shady activity, and tracks trends. This means that the solution can track whales, scan contract risks, and also find breakout crypto coins.Utility is one thing. However, DeepSnitch AI also operates in the AI category, which is a growing subset of the crypto market. Plus, since it’s offering tangible results to traders and not just vague architecture, the project could very well reach the top of its respective category.

At press time, the price of the DSNT token is set at $0.01805. Traders quickly added two and two together, believing that the utility and the affordability could provide an asymmetric upside. Since 100x is a realistic target, if DeepSnitch AI meets expectations, a reasonable investment of $1K may provide traders with $100K returns.

Although whales may have the extra funds to pour into Bitcoin or Ethereum for massive returns, retail traders might not have the luxury. Thus, DeepSnitch AI could present a solid bag for the regular investor.

Bitcoin price prediction: Is $130K a realistic short-term target?

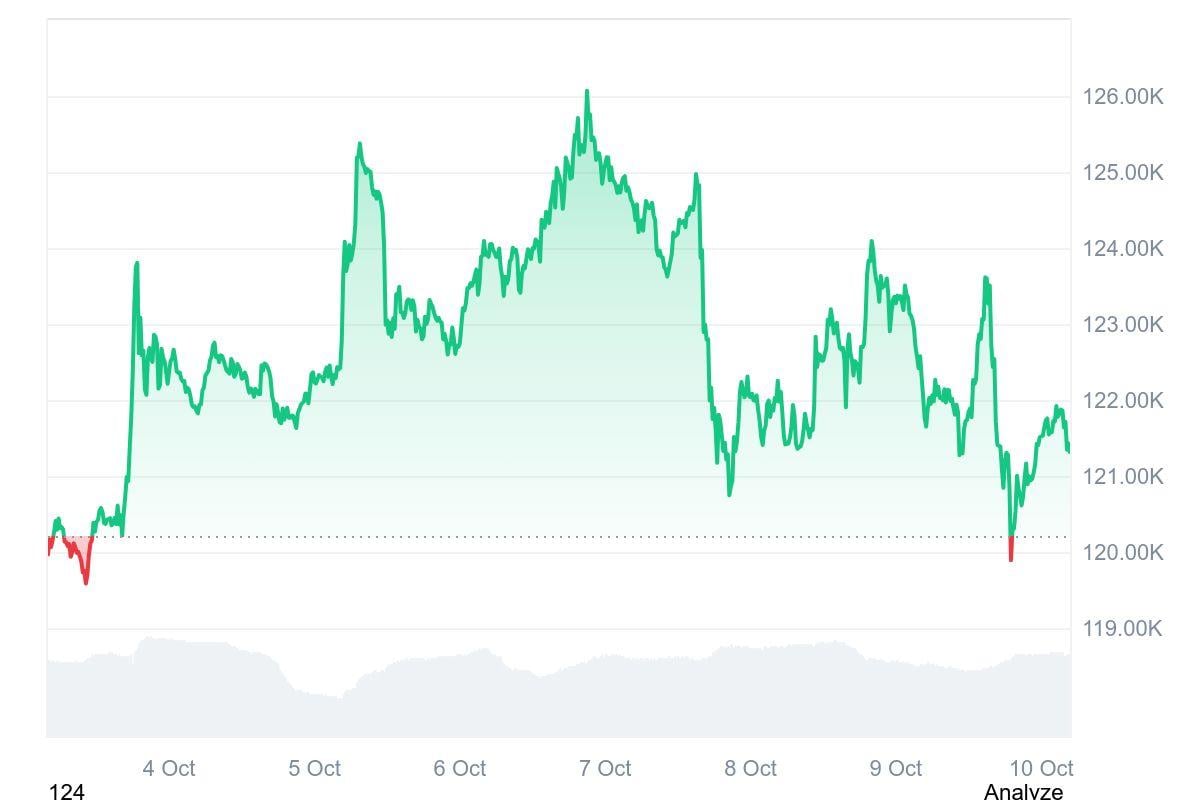

On October 9, Bitcoin dipped below $120K and climbed back into the $121K area, according to CoinMarketCap.

As long-term wallets remain inactive, traders expect the price action to stay slow as Bitcoin enters a small accumulation period.

However, analysts are confident that a strong push is in sight as Bitcoin is sitting in an ascending channel with key levels at $122K and $116.7K. If Bitcoin breaks out above $126K, the momentum could lead to a rally toward $130K.

Alternatively, if Bitcoin closes below $122K, there’s a possibility of a major pullback toward $118K.

Plasma price prediction: Is there hope for XPL at $1?

XPL continued a downward trend towards the $0.7400 area on October 9, according to CoinMarketCap. While the transaction volume on Plasma spiked in a 30-day period, many investors are wondering if the XPL can change course and pump above $1.

Analysts believe this is a realistic target for XPL, as XPL already broke out of a noticeable descending triangle platform, which indicated a slight reversal. Put differently, XPL simply pulled back and is retesting its former resistance, which could indicate an imminent breakout.

Bouncing off this level would propel XPL toward $1, and if bulls maintain momentum, the price may confidently shoot towards $1.700.

Although XPL might not possess the explosive potential of DeepSnitch AI, it’s more than a solid long-term bag for patient traders.

Conclusion: Say yes to asymmetric gains

As the trajectory of gold indicates a rotation toward crypto, the long-term Bitcoin price prediction could go either way, with analysts leaning bullish.

Yet, retail traders are hungry for gains and are itching for a presale that could deliver an asymmetric upside. This is exactly why DeepSnitch AI presale is close to going supersonic.

The price of $0.01805 sure is a steal.

Visit the DeepSnitch AI presale today.

FAQs

What is the current Bitcoin price prediction for 2025?

Analysts expect Bitcoin to break above $126K and test the $130K level in the short term, while the longer projections will depend on market movements.

Why is DeepSnitch AI gaining attention among crypto traders?

DeepSnitch AI raised over $341K in its first presale stage. The main selling point is the AI-powered analytics platform that tracks whale activity, insider trades, and emerging crypto trends.

How could gold’s rally impact Bitcoin’s price movement?

As gold and silver approach new heights, many investors anticipate a rotation into Bitcoin and digital assets, which could trigger massive demand.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.