TLDRs:

- China blacklists Canadian chip research firm TechInsights citing national security risks.

- Chinese individuals and organizations barred from sharing data with TechInsights.

- Huawei AI chip findings reportedly triggered TechInsights’ “unreliable entity” designation.

- Semiconductor analysis firms outside China may fill void left by TechInsights.

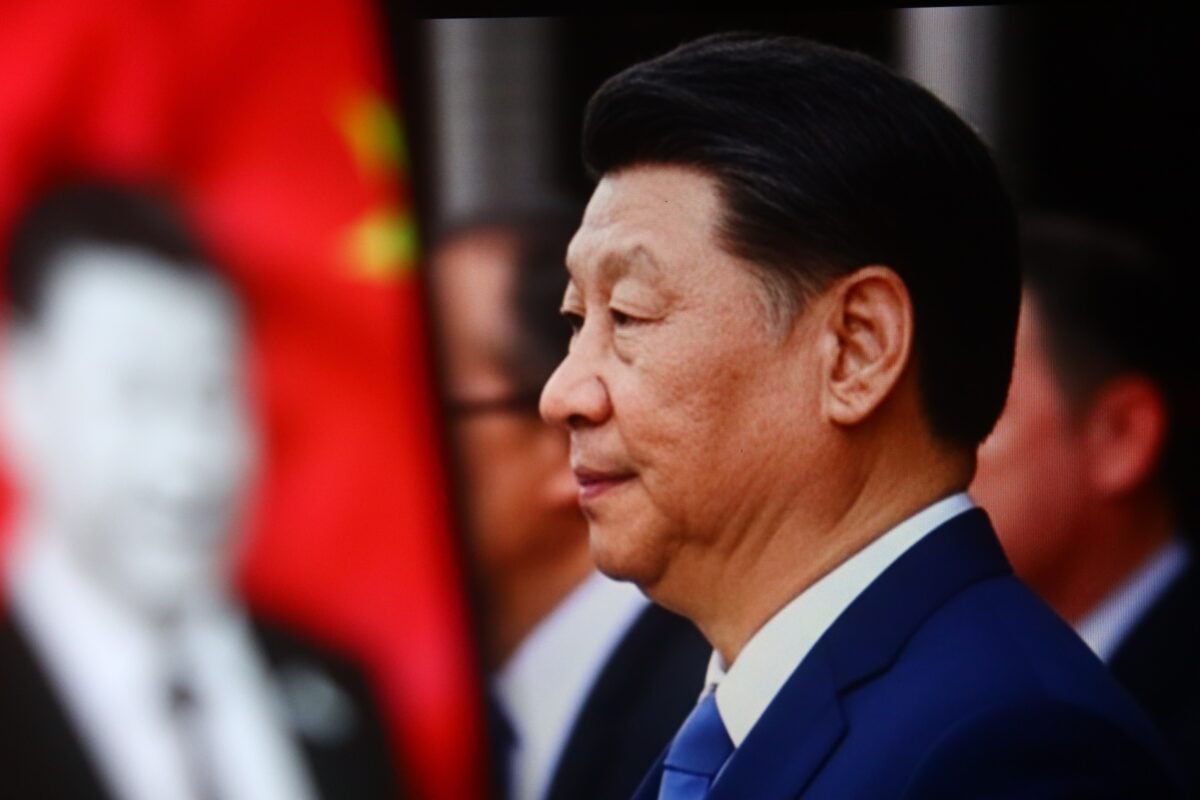

China’s Ministry of Commerce has officially placed Canadian semiconductor research company TechInsights on its “Unreliable Entity List,” citing national security concerns.

The move effectively prohibits any Chinese individual or organization from sharing information or collaborating with the firm. TechInsights is recognized for its detailed analysis of Chinese semiconductor technology, including AI chip components used by major tech companies like Huawei.

The listing comes less than a week after TechInsights reported that Huawei’s newest AI chips include components sourced from outside mainland China, raising scrutiny from Chinese authorities.

Unreliable Entity List Powers

The Unreliable Entity List (UEL) allows Chinese regulators to impose sweeping restrictions, ranging from import and export limitations to investment bans and entry restrictions for personnel.

Authorities may also levy fines based on the severity of perceived infractions, with no formal upper limit. While the rules theoretically extend to actions taken outside of China, enforcement mechanisms remain unclear. Prior to the TechInsights designation, China had included two U.S. defense companies on the UEL in 2023, highlighting a selective approach that balances national security with the potential impact on global business.

Impact on Semiconductor Research

TechInsights’ exclusion from Chinese sources creates a vacuum in semiconductor intelligence, particularly for independent analysis of chip supply chains and component sourcing.

Other research firms such as Yole Group and SemiAnalysis are likely to fill this gap. These firms specialize in teardown analysis, disassembling and studying chips to determine architecture, materials, and manufacturing costs.

Investors, chipmakers, and electronics manufacturers rely on such analysis to verify whether Chinese companies like Huawei maintain self-sufficiency or depend on restricted foreign components.

Shifts in Global Chip Monitoring

The move signals growing international interest in alternative semiconductor intelligence outside China’s jurisdiction. Advanced packaging techniques, which combine multiple chips into a single efficient unit, are receiving more attention, as are automotive semiconductor analyses.

With TechInsights sidelined, demand is expected to increase for independent insights into global chip supply chains. Analysts note that firms offering reverse engineering and teardown services may now play a more prominent role in monitoring Chinese semiconductor progress, particularly in AI and high-performance computing sectors.

Looking Ahead

The TechInsights case underscores the tensions between China’s national security concerns and the global semiconductor ecosystem’s need for transparency.

Companies and investors are likely to increase reliance on independent analysis outside China, while U.S. and Canadian firms navigate the uncertainties of doing business with Chinese entities. Experts predict that as Chinese authorities continue to scrutinize foreign research firms, the role of extraterritorial compliance, risk management, and supply chain verification will become increasingly critical.

China’s decision to blacklist TechInsights represents a significant escalation in its enforcement of the Unreliable Entity List. The designation not only restricts TechInsights’ operations but also reshapes global semiconductor research dynamics, potentially boosting independent analysis and supply chain verification services outside Chinese jurisdiction.