TLDR

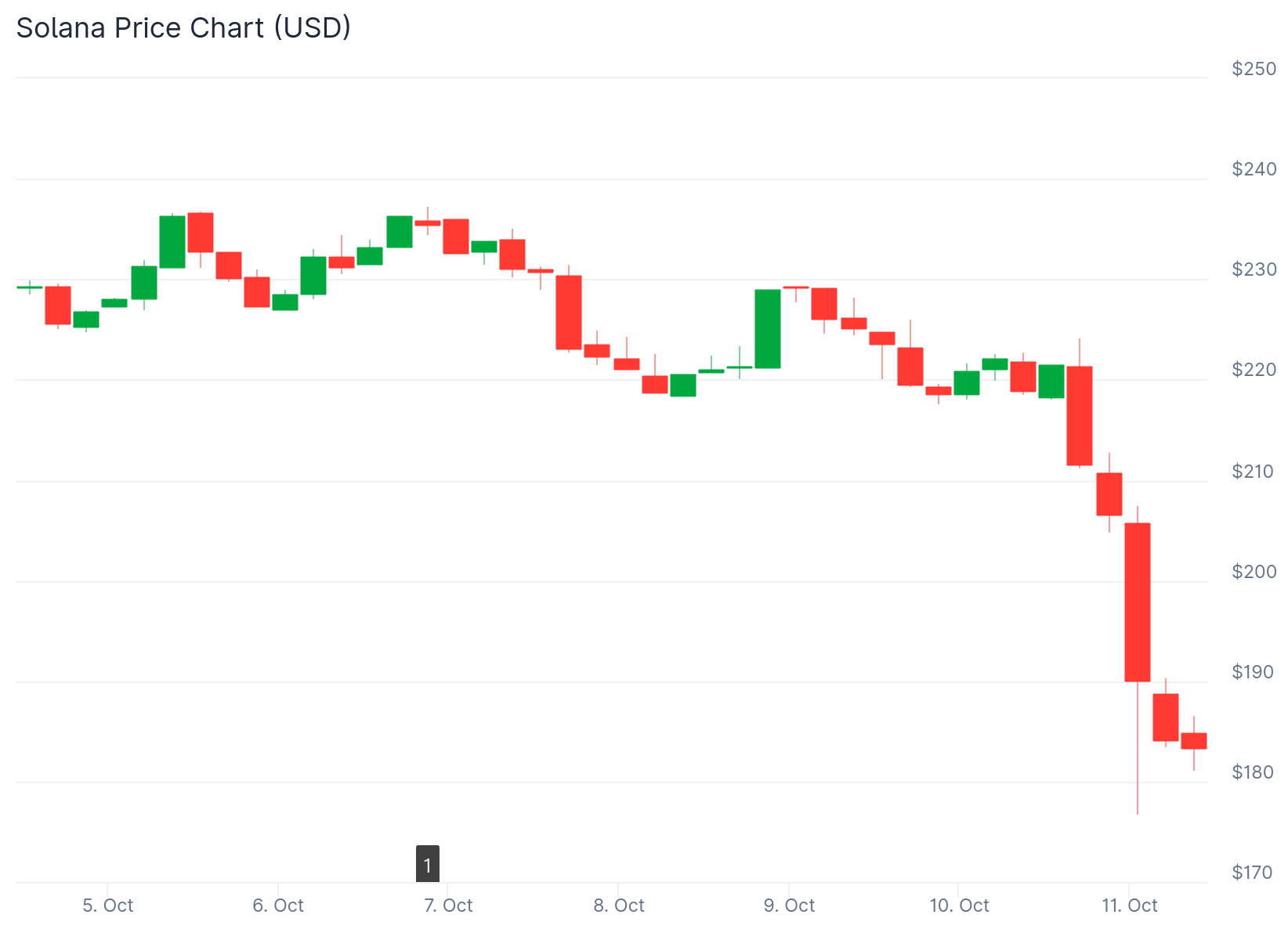

- Solana (SOL) dropped 16.2% in 24 hours and fell from $222 to $183 between October 10-11

- The crash followed President Trump announcing a 100% tariff on China starting November, escalating US-China trade tensions

- Bitcoin fell below $110,000 and the crypto market experienced over $7 billion in liquidations

- CoinCodex analysts predict Solana could reach $213.87 by December 31, representing a 16% recovery

- An expected Federal Reserve interest rate cut later this month could help SOL recover faster

Solana experienced a sharp price drop on October 11 as cryptocurrency markets faced heavy selling pressure. The asset fell from $222 on October 10 to $183 on October 11.

The broader crypto market declined 9.5% in 24 hours, bringing the global market cap down to $3.82 trillion. Bitcoin dropped to $102,000 on Binance, falling 12% in the same period.

Solana’s price charts show the damage across multiple timeframes. The asset lost 16.2% in 24 hours, 20.2% over the past week, and 17.5% over the previous month.

President Trump announced plans to impose a 100% tariff on China starting November 1. The announcement came late Friday afternoon through a Truth Social post.

BREAKING: 🇺🇸🇨🇳 President Trump to impose 100% tariff on China starting November 1st. pic.twitter.com/eBCzqjqIhh

— Watcher.Guru (@WatcherGuru) October 10, 2025

The tariff decision followed China limiting exports of rare earth materials. These materials are essential to the tech industry.

Trump also stated the US would impose export controls on critical software starting November 1. Bitcoin fell $3,000 immediately after the tariff announcement went live.

Trade War Triggers Market Liquidations

The market crash resulted in over $7 billion in liquidations from traders betting on higher prices. Ethereum dropped 16% below $3,700, while other major cryptocurrencies crashed between 20% and 40%.

Traders compared the price action to the March 2020 market crash during COVID-19 pandemic lockdowns. Trader Bob Loukas called it “Covid level nukes” in a social media post.

Ram Ahluwalia from Lumida Wealth said the Trump news combined with overbought market conditions caused the sharp decline. Zaheer Ebtikar from Split Capital noted markets reached levels not seen in more than a year.

Recovery Predictions

CoinCodex analysts predict Solana could reach $213.87 by December 31. This would represent a 16% rally from current price levels.

Solana has shown resilience in the past. The asset fell below $9 after the FTX collapse in 2022 but has since reached multiple all-time highs.

The Federal Reserve is expected to announce another interest rate cut later this month. Rate cuts typically increase investment in riskier assets like cryptocurrencies.

Positive ETF developments could also support price recovery. However, the ongoing trade uncertainty between the US and China may delay any sustained rally.