TLDR

- XRP crashed 42% from $2.70 to $0.77 in minutes after Trump’s tariff announcement.

- XRP’s trading volume surged 164% during the flash crash, indicating high activity.

- XRP quickly recovered to $2.46, signaling strong resilience after the crash.

- Key support for XRP is at $2.30, with resistance around $2.75 and $3.00.

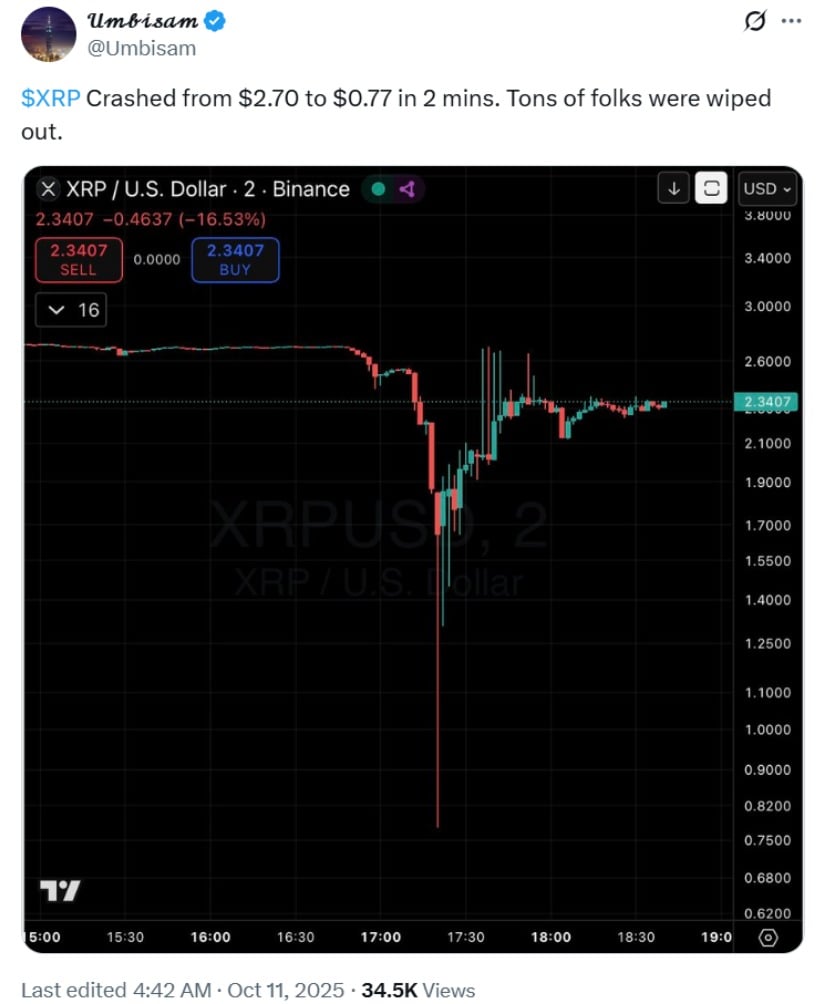

XRP experienced a sharp 42% drop in price on October 10, 2025, crashing from $2.70 to $0.77 within just two minutes. This sudden flash crash was triggered by President Donald Trump’s announcement of a 100% tariff on Chinese imports. The news sent shockwaves through the global markets, including the cryptocurrency sector, leading to massive sell-offs and liquidations. However, XRP managed to recover swiftly, regaining much of its losses to settle at $2.46 the following day.

Tariff Announcement Triggers Market Sell-Off

The rapid drop in XRP’s price coincided with a broader market sell-off driven by Trump’s tariff announcement. The announcement sparked a risk-off sentiment, pushing investors to sell off riskier assets like cryptocurrencies.

This led to a cascading effect in the markets, causing a $19 billion liquidation event across various digital assets. The broader market saw Bitcoin drop to around $113,000, and Ethereum fell below $4,000. XRP’s sudden fall was part of this trend, with its price tumbling from $2.70 to as low as $0.77 on Binance.

The sudden movement also led to massive liquidations in leveraged positions. According to data, open interest in XRP futures contracts dropped by $150 million, signaling the extent of the deleveraging process. XRP’s sharp fall was accompanied by a dramatic surge in trading volume, which increased by 164% compared to the 30-day average. This suggested significant institutional or whale activity during the sell-off, contributing to the sharp price action.

Market Recovery and XRP’s Resilience

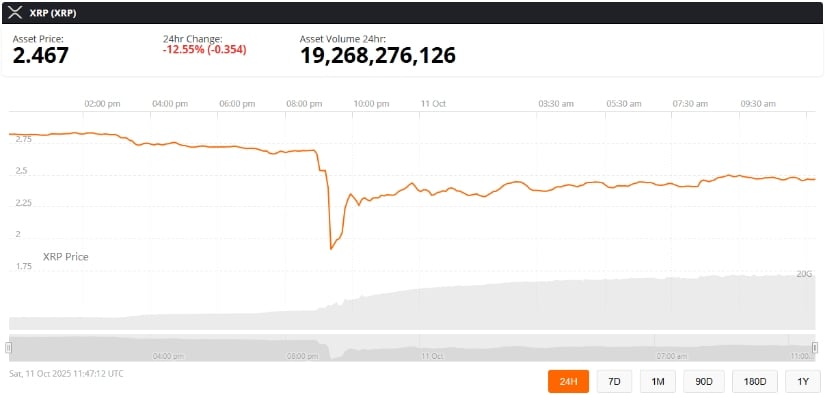

Despite the severe drop, XRP demonstrated strong resilience. Within hours of hitting its low of $0.77, XRP rebounded to $2.46, recovering nearly 50% of its losses. This quick recovery signaled that some investors saw the crash as a buying opportunity.

On-chain data revealed that long-term holders increased their positions during the dip, indicating growing confidence in the asset despite short-term market volatility.

XRP’s recovery came amid a broader market stabilization after the tariff announcement and the initial sell-off. As the dust settled, many market participants began to assess the situation more calmly, leading to a rebound across several assets. XRP’s bounce back to $2.46 suggested that the cryptocurrency might not face a prolonged downturn, though the support and resistance levels will be key in determining the next direction.

Key Support and Resistance Levels for XRP

The key question now is whether XRP can maintain its position above $2.30. The support level at $2.30 is critical in determining whether the price will continue to stabilize or face further downside risk.

A fall below this level could potentially push XRP toward $2.00 or $1.80, levels that have previously provided some support during market corrections. On the other hand, a successful reclaiming of the $2.75 level would indicate a strong recovery and could lead to further gains, possibly reaching the $3.00 mark.

Market analysts are closely monitoring these levels, as XRP faces both technical challenges and macroeconomic factors. Despite recent volatility, Ripple’s fundamentals remain strong. Ongoing legal developments and growing institutional interest provide a foundation for long-term growth. While the broader market is still adjusting to global economic shifts, XRP’s swift recovery could be a positive sign for investors looking for stability amidst ongoing geopolitical uncertainty.

Looking Ahead for XRP

XRP’s recent volatility highlights the sensitivity of the cryptocurrency market to global macroeconomic news. As geopolitical tensions continue, including the trade dispute between the U.S. and China, XRP and other digital assets may face further fluctuations. However, the coin’s ability to recover quickly suggests that it remains a strong asset for many investors.

In the short term, XRP’s price movements will largely depend on the broader market conditions and whether it can hold key support levels. Longer-term, Ripple’s continued legal progress and institutional adoption will likely be central to XRP’s growth trajectory. Investors and traders will remain vigilant as they await further developments that could influence the cryptocurrency market’s direction in the coming weeks.