TLDR

- Thumzup taps blockchain with DogeHash merger and crypto-savvy board pick

- TZUP eyes crypto future with DogeHash deal and new tech board appointment

- Chris Ensey joins Thumzup board, signaling crypto-focused expansion

- Thumzup stock dips, then rebounds on big moves in crypto and AdTech

- New board member and merger drive Thumzup’s pivot into crypto finance

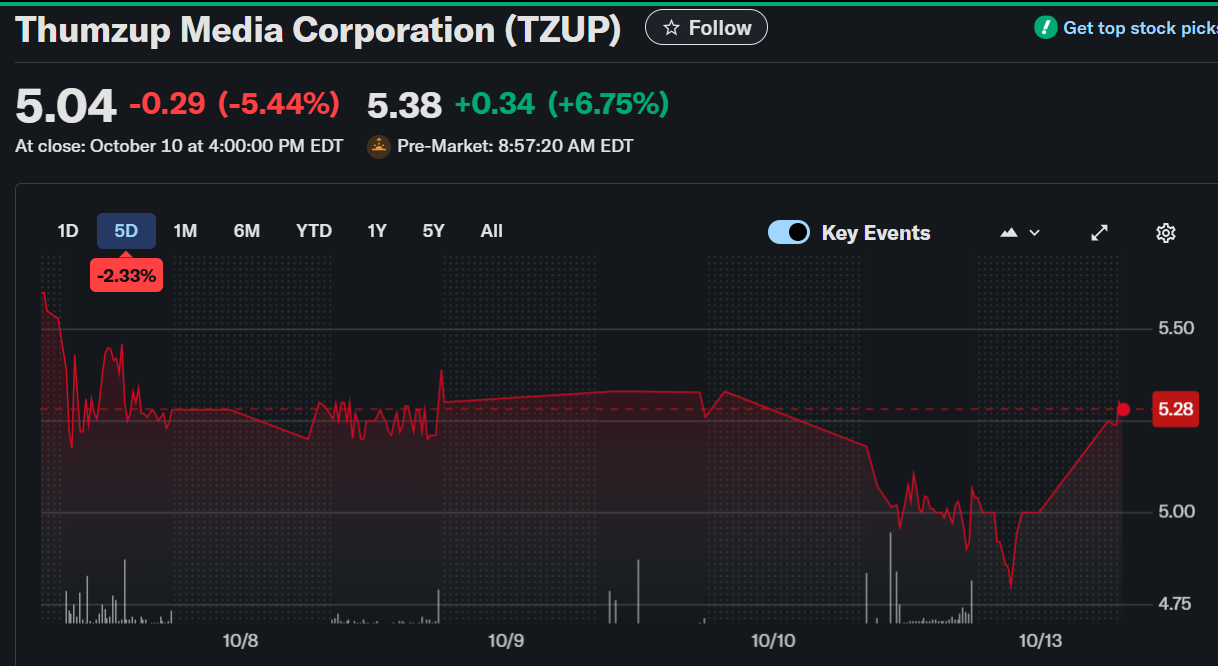

Thumzup Media Corporation (NASDAQ: TZUP) closed October 10 at $5.04, posting a 5.44% decline during the session. However, pre-market trading on October 11 indicated a 3.96% rebound to $5.24.

Board Appointment Signals Strategic Shift Toward Crypto-Driven Growth

Thumzup confirmed the appointment of Chris Ensey to its Board of Directors, effective October 14, 2025. Ensey currently serves as CEO of Aligned, a firm specializing in GPU cloud services for AI and computing. His addition supports Thumzup’s ongoing transition toward a broader digital asset and AdTech enterprise.

Ensey previously held senior roles in major blockchain companies, including Riot Blockchain and Gryphon Digital Mining. His leadership during critical growth phases brought significant operational and strategic expertise to those organizations. His background also includes roles at IBM, BlueVoyant, and SafeNet, where he managed cybersecurity and infrastructure programs.

Thumzup aims to benefit from Ensey’s vast experience in technology, risk mitigation, and decentralized architectures. The company views this appointment as a critical step in executing its post-merger strategy. Ensey brings the capacity to scale innovation as Thumzup evolves beyond its core marketing platform.

DogeHash Merger to Reinforce Expansion into Digital Assets

The upcoming merger with Dogehash Technologies, Inc. reflects Thumzup’s commitment to diversifying its business into the blockchain space. Thumzup is actively building a foundation to become a leading digital innovation platform across marketing and digital finance. The DogeHash merger will likely enhance its infrastructure for handling digital asset operations.

The company has laid the groundwork by forming a Board with capabilities across finance, technology, and digital assets. Ensey’s appointment strengthens this initiative, supporting the technical demands of the upcoming merger. This corporate action also suggests a strategic pivot aimed at maximizing long-term value.

Through this merger, Thumzup plans to integrate advanced mining and computing resources into its operational model. The acquisition signals a clear effort to combine advertising technology with crypto-based asset models. This integration aligns with Thumzup’s broader goal of redefining how digital assets and engagement platforms operate together.

Expanded Crypto Treasury Shows Financial Agility

Thumzup recently broadened its treasury policy to include multiple cryptocurrencies beyond Bitcoin. The company now holds assets such as Dogecoin, Litecoin, Solana, Ripple, Ether, and USD Coin. This shift highlights a strategy aimed at capital flexibility and crypto alignment.

The expanded crypto strategy reflects Thumzup’s intent to remain agile in financial operations amid shifting market conditions. It also complements the company’s broader push toward decentralized technologies and alternative value systems. These treasury adjustments support Thumzup’s innovation-first financial positioning.

By combining AdTech innovation with digital asset backing, Thumzup positions itself as a dual-force player in marketing and crypto finance. Ensey’s addition and the DogeHash merger provide structural support for these goals. With these developments, Thumzup signals readiness to capitalize on future growth.