The crypto market has been on a strong rebound following one of the most volatile weeks of 2025. Bitcoin and Ethereum reclaimed crucial support areas, recording steady gains as risk sentiment improves. Meanwhile, XRP and Avalanche (AVAX) are experiencing upside momentum, with each up more than 15% since the fall amid renewed optimism on ETF approvals and institutional inflows.

With the confidence returning, analysts observe that new Ethereum-based projects such as MAGACOIN FINANCE are also attracting the attention of investors in need of diversification and increased growth potential.

Bitcoin Regains Bullish Momentum

The fact that Bitcoin recovered on the weekend, shows a fresh surge of confidence by institutional players following the sharp market correction experienced last week. This flagship crypto recovered to $125,000 after dropping to around $110,000, due to large inflows into the iShares Bitcoin Trust (IBIT) of BlackRock.

Moreover, the ETF is nearing over $100 billion assets under management, firmly establishing Bitcoin as a prominent institutional hedge in the face of macroeconomic uncertainty.

Market data indicates that the increase of whale accumulation has been up to 8% in the last 48 hours, which indicates that long-term holders are taking advantage of lowered prices. BTC futures open interest has also risen, indicating a return of speculative demand. Analysts reckon that should Bitcoin maintain its position above the $124,000–$126,000 zone, the subsequent rise to $135,000 will be realized in a short period.

As Bitcoin remains the top news in institutional circles, MAGACOIN FINANCE has become an alternative channel of investment. In contrast to established blue-chip cryptos, its community ecosystem has attracted traders interested in early-stage exposure and long-term upside potential.

Ethereum Price Path to Recovery

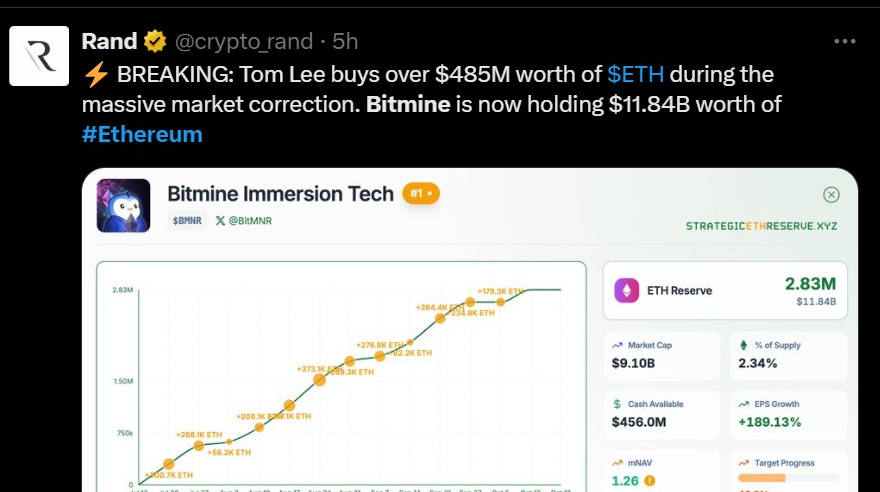

Ethereum, which suffered a steep drop to $3,686 during the market sell-off, has bounced back above the $4,000 threshold. The rebound follows BitMine’s $838 million purchase of 202,037 ETH, one of the largest public Ethereum acquisitions to date. This accumulation brought BitMine holdings to more than 3 million ETH, solidifying its position as the largest Ethereum treasury company in the world.

Source: X

Despite on-chain activity showing a 12% decline in daily active addresses, ETH remains a favorite among institutional buyers. ETF inflows totaling $547 million in the past week have provided strong backing, helping Ethereum stabilize around its crucial support. However, technical charts show that ETH remains below its Ichimoku cloud, suggesting resistance persists near $4,200–$4,250.

For investors looking beyond large caps, MAGACOIN FINANCE presents a promising Ethereum-based hedge. Built on audited smart contracts, the token offers exposure to the Ethereum ecosystem with reduced downside volatility. Its fast-growing presale participation underscores growing investor demand for innovative, security-verified altcoins.

XRP and AVAX Lead the Recovery

XRP and Avalanche have taken the lead in the current rebound, each gaining over 15% from Friday’s market crash. XRP currently trades near $3.00 as traders await the SEC’s decisions on multiple XRP spot ETF filings scheduled between October 18 and 25. JPMorgan and Bloomberg analysts estimate the potential inflows of between 4 billion and 8 billion in case the approvals are obtained.

Instead, Avalanche is enjoying good institutional backing due to its $675 million SPAC investment. The token is trading between $21-23 with a strong performance given the technical indicators, i.e. RSI and moving averages, depicting a bullish recovery regime. Whale data shows over 6 million in big transactions over the weekend, which is often a prelude to greater upward trends.

Combined, these assets reflect a reshaping market story, in which the existing ecosystems and newer ones are all attracting more liquidity. This rotation has also increased the enthusiasm behind pre-sale projects such as MAGACOIN FINANCE which investors consider an early-stage entry point due to the overall recovery.

Why MAGACOIN FINANCE Is Among the Best Crypto to Buy

The analysts include MAGACOIN FINANCE among the best altcoins to buy this October, due to its transparent presale model, verified audits and growing community. Being compatible with MetaMask, Trust Wallet and Coinbase Wallet, it offers secure access to retail and institutional investors.

The involvement of whales and more than 18,000 holders prior to its exchange listing is an indicator of increased trust and demand. The investors are also given a limited period 50% bonus using the code PATRIOT50X, which is an offer that shows a sense of urgency to secure early slots before listing.

Conclusion

The recovery of the market by Bitcoin, Ethereum, XRP, and Avalanche indicates renewed confidence among investors following a volatile week. With liquidity returning, focus is shifting to emerging Ethereum-based projects such as MAGACOIN FINANCE, which is experiencing presale gains that make it one of the best altcoins this season. MAGACOIN FINANCE is a verified and high-upside competitor to investors who want to be positioned early before the next wave of market growth.

For More Information

Website: https://magacoinfinance.com

X (Twitter): https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.