As the final quarter of 2025 begins, the crypto market is entering a crucial phase characterised by ETF speculation, whale accumulation, and institutional re-entry. The spotlight this week shines on XRP, as expectations build for its potential ETF approval later in October, while Solana and Ethereum continue to be highlighted by analysts as two of the best altcoins for Q4 portfolio rotation.

At the same time, investors seeking early exposure to smaller-cap opportunities are turning to MAGACOIN FINANCE, a fast-rising project gaining traction among traders positioning for 2025’s next growth phase.

XRP — ETF Approval Could Trigger Billions in Institutional Inflows

The SEC will likely decide on multiple spot XRP ETF applications between Oct 18 and Oct 25, 2025. The application has a long waitlist sorted out by major issuers like Grayscale, Fidelity, VanEck and many more. It is expected that the necessary approval will be granted since the October filings of the 11 XRP ETF meet the September 2025 digital-asset ETF listing standards of the SEC.

XRP ETF approval could bring in anywhere from $3 billion to $15 billion in inflows from institutions, according to analysts. This has the potential to cause big price rallies and demand increases. Whales have been accumulating over $1 billion worth of XRP, showing a strong sign of confidence ahead.

Solana (SOL) — Institutional Interest and DeFi Growth Boost Confidence

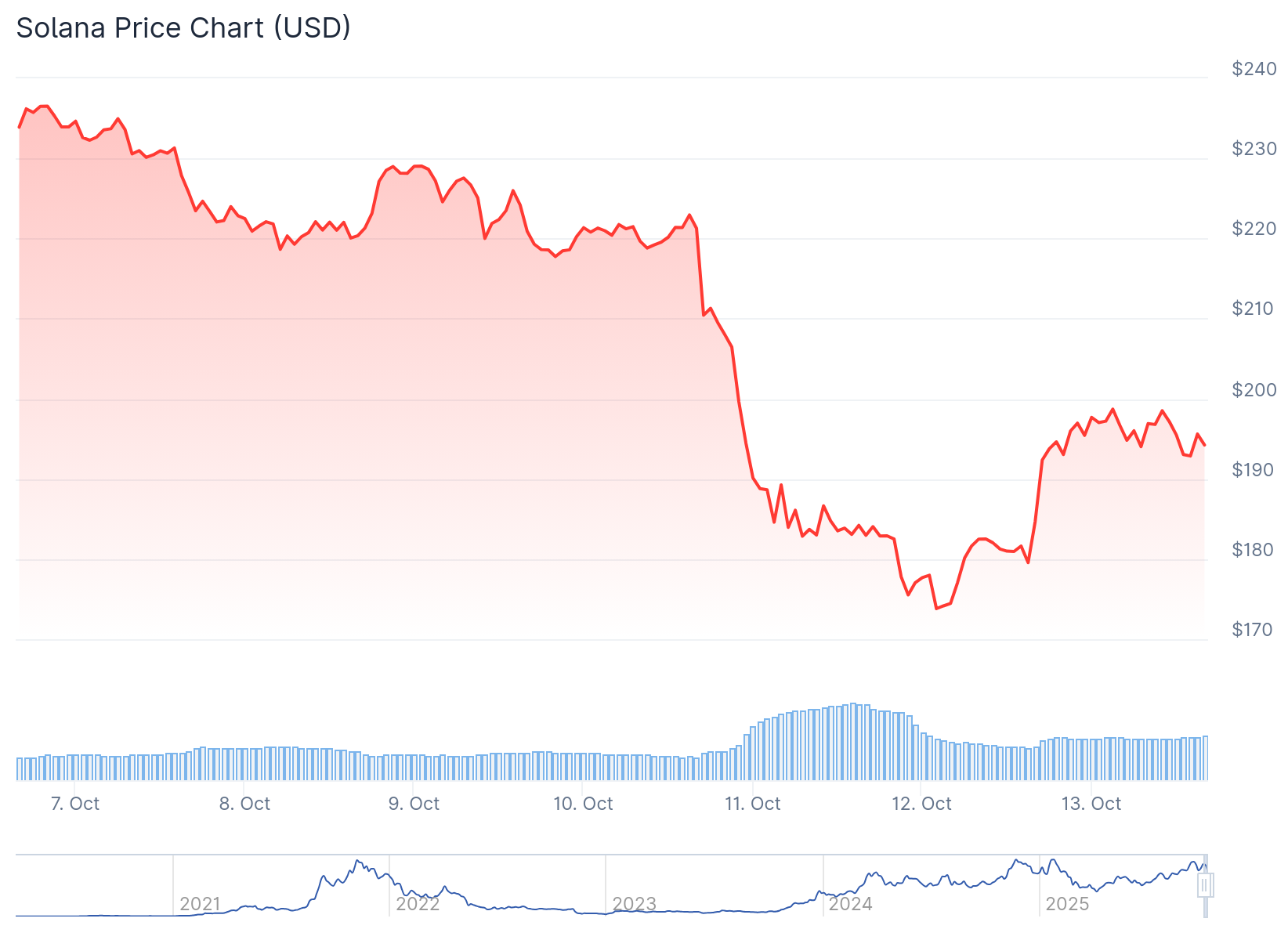

The price of Solana (SOL) has slowed in recent days, thanks to a bounce-off at the upper boundary of around $192-$195 after it dropped to the low $174 over the last week. A major diminishing of volume has been observed. Solana (SOL) gave a bearish break under an important support level of $195.

Solana Price Chart: CoinGecko

A recovery above this level could see the price test higher levels at $220 and $250. Positive interest is emerging despite the volatility seen in Solana’s ecosystem including increased DeFi liquidity and NFT market revival. According to recent reports, some analysts are expecting Solana to work its way to $300 in the near term, especially with the institutional bets and growing open interest on DEXs.

Ethereum (ETH) — Institutional Accumulation Hits Multi-Year Highs

The price of Ethereum (ETH) recently bounced off the $4,100 mark, with strong signals. Analysts and traders believe ETH is poised for a more substantial rally, expecting the coin to reach around 5k or possibly even 7k by year’s end, with a long-term target of up to 15k. Institutional accumulation remains noteworthy as exchange supply hits lows not seen since 2016, meaning more ETH is being removed from exchanges into cold storage.

The month of October typically sees a price gain of nearly 4.7%, allowing for a short-term spike of the ETH price above $4,300. Standard Chartered Bank raised its 2025 price target to $7500 as institutional confidence grows.

Emerging Altcoin Gains Momentum as Traders Diversify

As assets like XRP, Solana and Ethereum draw headlines around the world, MAGACOIN FINANCE is quietly consolidating a strong position among new-generation digital assets. The project’s transparent structure, ongoing community involvement, and rapid presale momentum have made it one of the best new altcoins for investors to put on their watchlists this quarter.

Analysts are referring to MAGACOIN FINANCE as an emerging opportunity for diversification, and this has caught the eye of early adopters looking to get in on the action before it receives mainstream listing. The growing social presence and continuous updates of development have likewise instilled confidence in retail and early-stage participants.

As capital rotations begin this quarter across top-performing assets, MAGACOIN FINANCE emerges as a new conversation that connects early to the stability often seen long after initial price surges at the start of the next wave of altcoin growth.

Conclusion

The coming weeks could define the crypto market’s direction heading into 2026. XRP’s ETF approval window has the potential to reshape institutional positioning, while Solana and Ethereum remain at the core of network-driven growth and investor confidence.

At the same time, projects like MAGACOIN FINANCE offer new pathways for diversification as traders prepare for a market phase defined by innovation and inflow-driven growth. Experts highlight MAGACOIN FINANCE’s successful Hashex audit and ongoing verification on Certik as major proof of reliability, reinforcing investor trust in its presale model.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.