After last week’s flash crash, many investors hoped for a ‘V-shaped’ reversal, in which the market would shrug off the losses and fresh capital would flood in. The outcome was slightly different; despite a small pump, Bitcoin has been unable to maintain meaningful bullish momentum and is now testing support levels around $109,000, showing a clear lack of strength from the bulls.

However, price action and fundamentals send two different signals. Check the charts and you’ll see a depressed market – but look closely at the fundamentals and you’ll find a ‘sleeping giant’ opportunity.

Not only does institutional demand continue to flow into cryptocurrencies, but gold is also climbing higher, reflecting investor interest in hard assets outside government control. Meanwhile, interest rate cuts are on the horizon, and the crypto market is gaining credibility; tokenization is becoming a favored use case for banks and institutions.

While Bitcoin and top altcoins may bounce in the coming weeks as prices start to reflect these fundamentals, the real opportunity lies in newer tokens with solid use cases and more room for growth. One such opportunity could be Bitcoin Hyper (HYPER), the world’s first ZK-rollup-powered Bitcoin Layer 2 blockchain.

Currently, HYPER is in a presale, having raised $24 million, which is a significant milestone that showcases its market appeal and potential to attract demand once it enters the open market.

How does Bitcoin Hyper work?

Bitcoin Hyper is designed to address Bitcoin’s three primary issues: a lack of speed, limited functionality, and high transaction fees. To achieve maximum performance, the L2 integrates three core components. Let’s explore each one and understand how they interoperate to lift Bitcoin to new heights.

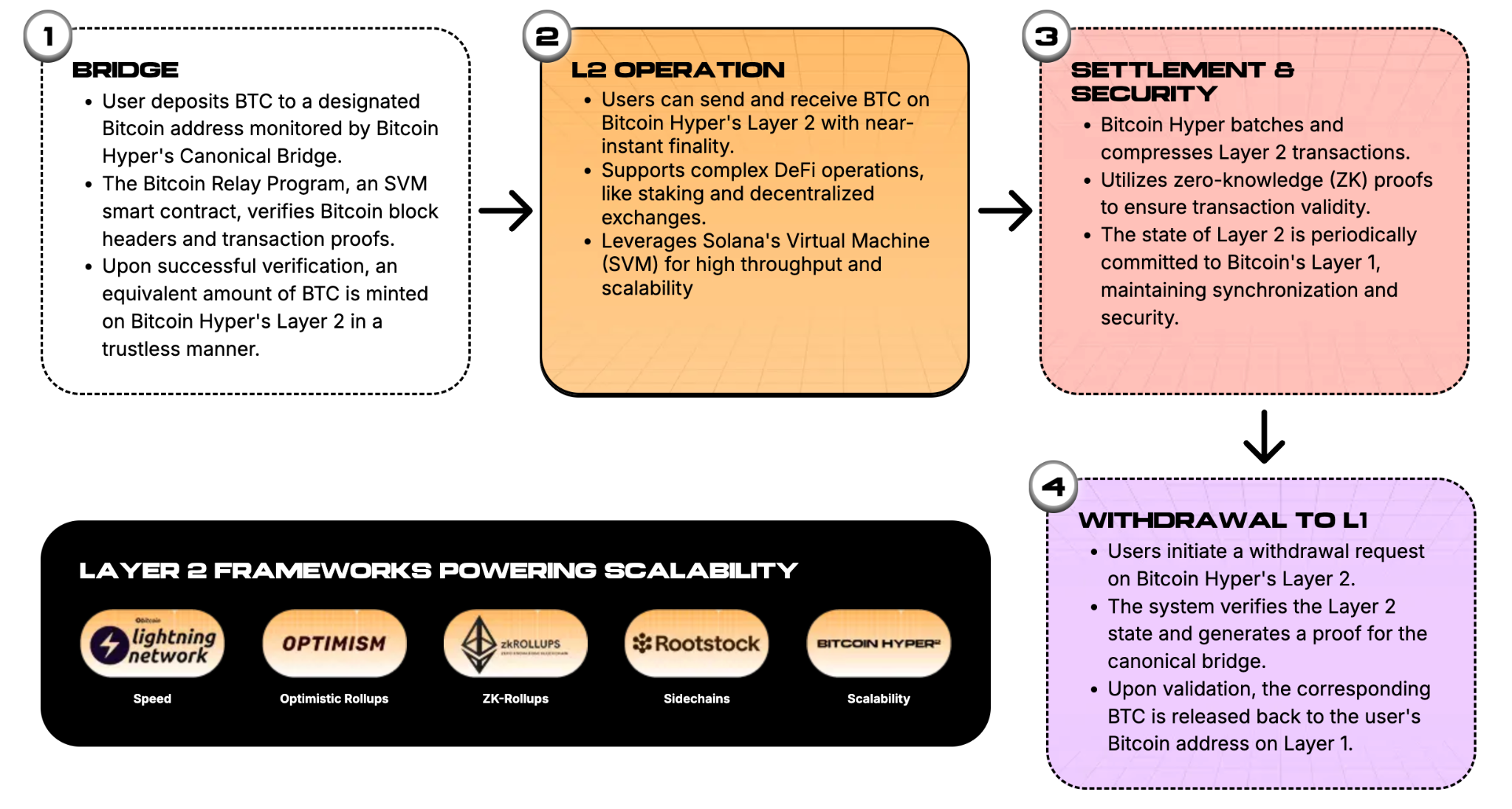

Trustless canonical bridge – At the core of Bitcoin Hyper is its trustless canonical bridge. Users send native BTC to the bridge’s wallet address, which is verified before being locked, and then an equivalent amount of wrapped BTC is minted on the L2 network. Users can also transfer their bitcoins back to the L1 at any time.

Solana Virtual Machine (SVM) – The L2 is built using SVM tooling, giving it the same speeds and smart contract support as the Solana network. This also allows Solana developers to port their apps and tokens to Hyper without wrappers or learning a new programming language.

ZK-rollups – Bitcoin Hyper will periodically report its state back to the L1 with ZK proofs. This ensures that transactions on L2 inherit the same neutrality and immutability as those on L1.

This creates a seamless pathway for onboarding BTC to the network, while also offering Bitcoin-level security with Solana-level speed and functionality. It might be the closest anyone has come to a perfectly balanced blockchain architecture.

Bitcoin Hyper could be Bitcoin’s portal to asset tokenization

Bitcoin Hyper could be Bitcoin’s portal to asset tokenization

What sets Bitcoin Hyper apart from older Bitcoin L2s like Stacks and Rootstock is its integration of ZK-rollups, which provide security guarantees similar to transacting on Bitcoin itself. This is why Hyper could become the go-to chain for experimental and mission-critical operations on Bitcoin, such as asset tokenization.

A recent Cointelegraph report found that Millennials and Gen Z will inherit approximately $83 trillion over the next 20 years, with up to $4 trillion of that potentially being tokenized. The fact that Bitcoin doesn’t support smart contracts means it has been largely excluded from tokenization discussions; however, Bitcoin Hyper could position it as a focal point in future talks.

Meanwhile, a report by Boston Consulting Group estimates that up to $18.9 trillion could be tokenized by 2033, highlighting that pilots involving money market funds, such as BlackRock’s BUIDL fund, have already been launched. It says that the next step involves tokenizing more complex assets, such as private credit, structured finance, and corporate bonds.

It’s also worth noting that Solana is quickly becoming a leader in real-world assets, with projects like Backpack launching on the chain and offering users access to tokenized stocks directly from their crypto wallets. The Solana blockchain also recently reached a record high of $697 million in tokenized real-world assets, marking a 34% increase in the last 30 days, per RWA.xyz data.

Since Bitcoin Hyper serves is at the intersection of Bitcoin and Solana, it’s clear how these two networks could converge into one of the most active and vibrant ecosystems for RWAs once the L2 goes live. It’s this potential for market-defining use cases that sets Bitcoin Hyper apart and has analysts buzzing. For instance, Alessandro de Crypto recently stated HYPER will be the “next big launch” to hit exchanges, in a video published on YouTube.

Since Bitcoin Hyper serves is at the intersection of Bitcoin and Solana, it’s clear how these two networks could converge into one of the most active and vibrant ecosystems for RWAs once the L2 goes live. It’s this potential for market-defining use cases that sets Bitcoin Hyper apart and has analysts buzzing. For instance, Alessandro de Crypto recently stated HYPER will be the “next big launch” to hit exchanges, in a video published on YouTube.

Bitcoin Hyper presale soars $200,000 in 24 hours despite the dip

Given its promising use case and current early stage, it is not surprising that the Bitcoin Hyper presale is soaring ahead even while the broader market struggles. Investors know that the chance to buy HYPER at $0.013125 probably won’t come around again, so they’re making sure to grab the opportunity with both hands.

In the past 24 hours, the presale has raised over $200,000, underlining investors’ unwavering conviction and signaling that HYPER could be the best crypto to buy now ahead of the broader market’s recovery.

Visit Bitcoin Hyper Presale

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.