Read our Advertising Guidelines Here

BlackRock just restructured its flagship money market fund into a compliant reserve vehicle for stablecoin issuers, aligning with the newly passed GENIUS Act in the U.S.

This makes BlackRock a key infrastructure player in a market expected to reach $4 trillion by 2030. But while giants battle for stablecoin dominance, DeepSnitch AI is taking over crypto’s trading sector.

With a smart AI toolkit designed for over 100 million active crypto traders, it’s no wonder whales have loaded over $430K into its ongoing presale. Here are more reasons why DeepSnitch AI could be the best presale bet for 2026.

BlackRock makes a major stablecoin play

BlackRock is officially entering the stablecoin arena, redesigning a flagship money market fund to serve as a secure reserve vehicle for stablecoin issuers. The move positions the $13.5 trillion asset manager at the center of a rapidly growing sector projected to hit $4 trillion by 2030.

The newly structured BlackRock Select Treasury-Based Liquidity Fund (BSTBL) is built to comply with the GENIUS Act. Under the act, issuers must hold reserves in ultra-safe, highly liquid assets, exactly what BSTBL offers through its exclusive investment in short-term U.S. Treasuries and overnight repos.

According to filings, the fund replaces the older BlackRock Liquid Federal Trust Fund and introduces expanded trading hours, later valuation windows, and a 0.27% total expense ratio after waivers. These refinements signal a clear pitch to institutional clients who need regulated, yield-bearing reserve options.

The move also aligns with BlackRock’s broader digital asset strategy, which now spans a Bitcoin ETF, an Ethereum product, and the tokenized BUIDL fund. But BSTBL represents something different: a regulated, real-world integration with the stablecoin back-end, one of crypto’s biggest liquidity drivers.

Top 3 breakout tokens to hold in 2026: DeepSnitch AI could outperform Solana and Cardano

DeepSnitch AI empowers retail traders with the same insights whales trade with

DeepSnitch AI is one of the most successful crypto presales of Q4 2025, raising over $430K in record-breaking time and delivering a 26% rally for early investors. This rapid growth is driven by the protocol’s utility-first approach that resonates with real traders.

At its core, DeepSnitch AI is solving a major problem in crypto: access to information. For years, big whales have dominated the market, not because they’re better, but because they have better tools and better data.

Retail traders are often left chasing pumps or panic-selling at the worst times. DeepSnitch AI uses AI to cut through noise, reduce emotional trading, and help regular traders act with confidence.

What truly sets DeepSnitch apart from other early-stage projects is trust. The platform is fully audited by Coinsult and SolidProof, with all contracts verified and publicly accessible. That level of transparency and security is rare in presales, giving investors real peace of mind.

And for those holding DSNT, there’s more: a powerful, dynamic staking program that rewards users from a growing pool, with no lockups and flexible withdrawal. Early stakers benefit the most, earning passive rewards while supporting long-term growth.

With this utility, DeepSnitch AI could repeat Solana’s 2021 run, the one that turned so many early investors into crypto millionaires. And still priced at just $0.01915, now is the perfect time to take advantage of that potential.

Solana price prediction: Can the altcoin keep above $200?

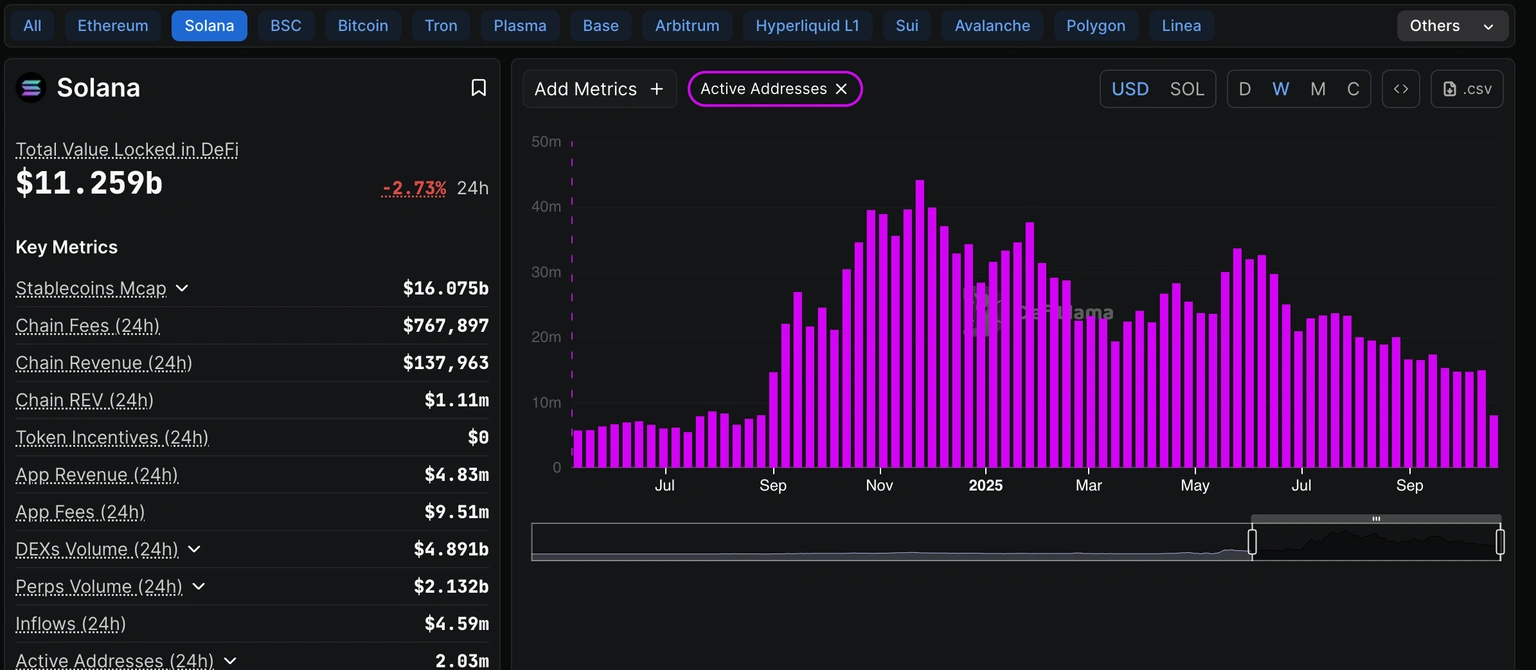

Solana was trading just above $195 on October 16 after bouncing from an early dip to $186. The move follows a slight recovery across crypto, with Bitcoin and Ethereum also pushing higher. Short-term sentiment looks better, but Solana still faces hurdles.

The path to $200 isn’t clear. A rejection at $197 shows how fragile momentum is. The SOL price sits between the 200-day EMA at $186 and the 100-day EMA at $199, a tight range with no clear breakout. RSI remains weak, and MACD is still bearish.

More worrying is the drop in user activity. DefiLlama reports Solana’s active addresses fell from 33 million in May to just 8 million now. That steep decline questions the strength behind any bounce.

Without a strong push above $200, Solana risks slipping back toward lower support. Bullish Solana price predictions say traders need volume to turn this into a proper recovery.

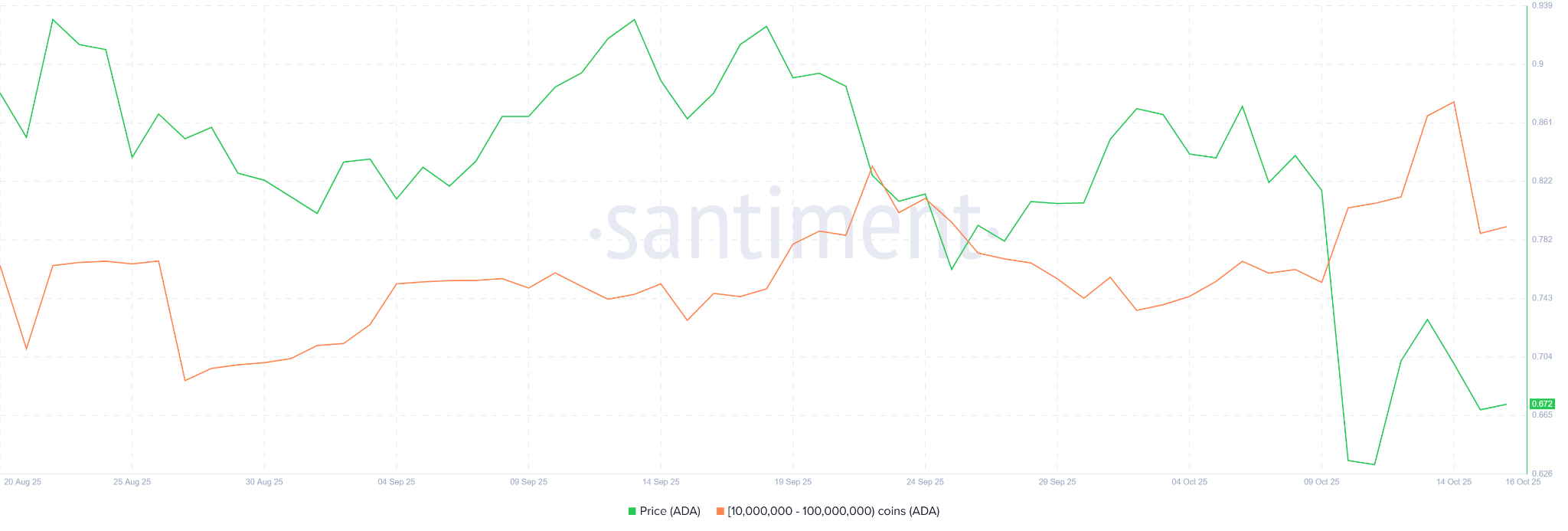

Cardano might regain $1 once the sell-off stops

Cardano is showing signs of life, with the Chaikin Money Flow hitting a three-month high. That signals capital flowing back in, mostly from retail traders jumping in after the latest pullback.

But the rally has stalled. Whales holding 10M-100M ADA dumped 180 million tokens in just 24 hours, worth over $120 million. That heavy sell-off has erased most of the retail gains.

ADA now trades near $0.66, stuck between pressure zones. A drop below this could drag it to $0.60, while a push past $0.69 might send it toward $0.75. The structure remains weak. Until whales slow down and buyers step up, ADA stays trapped in a sideways pattern.

Closing thoughts

Every crypto cycle brings a breakout star. In 2020, it was Cardano. In 2021, Solana stole the show with its 30x rally. But in 2025, DeepSnitch AI is the one to watch.

Now priced at just $0.01915, it still has room for the kind of exponential rally that made those giants famous. Cardano and Solana have matured into blue chips, more like stocks than crypto moonshots. DeepSnitch is different.

With whales already backing the presale and a real AI utility built for 100M+ traders, it’s well-positioned to enter the top cryptos by market cap.

Check out the website for more information.

FAQs

What is the latest Solana price prediction for 2025?

The Solana price prediction for 2025 varies widely. Some analysts believe SOL could trade between $220 and $350. However, recent user activity declines may limit short-term upside unless usage recovers.

What’s the current SOL forecast?

As of mid-October 2025, SOL price hovers around $195, with resistance at $200. A strong move above this could trigger a short-term rally. But with weak RSI and MACD signals, the SOL forecast remains neutral unless volume surges.

Can DeepSnitch AI outperform Solana or Cardano?

In terms of percentage gains, yes. While SOL and ADA are blue chips now, DeepSnitch is still in its early presale phase, where real 100x upside is possible, especially as AI adoption grows in crypto.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above. Read our Advertising Guidelines Here.