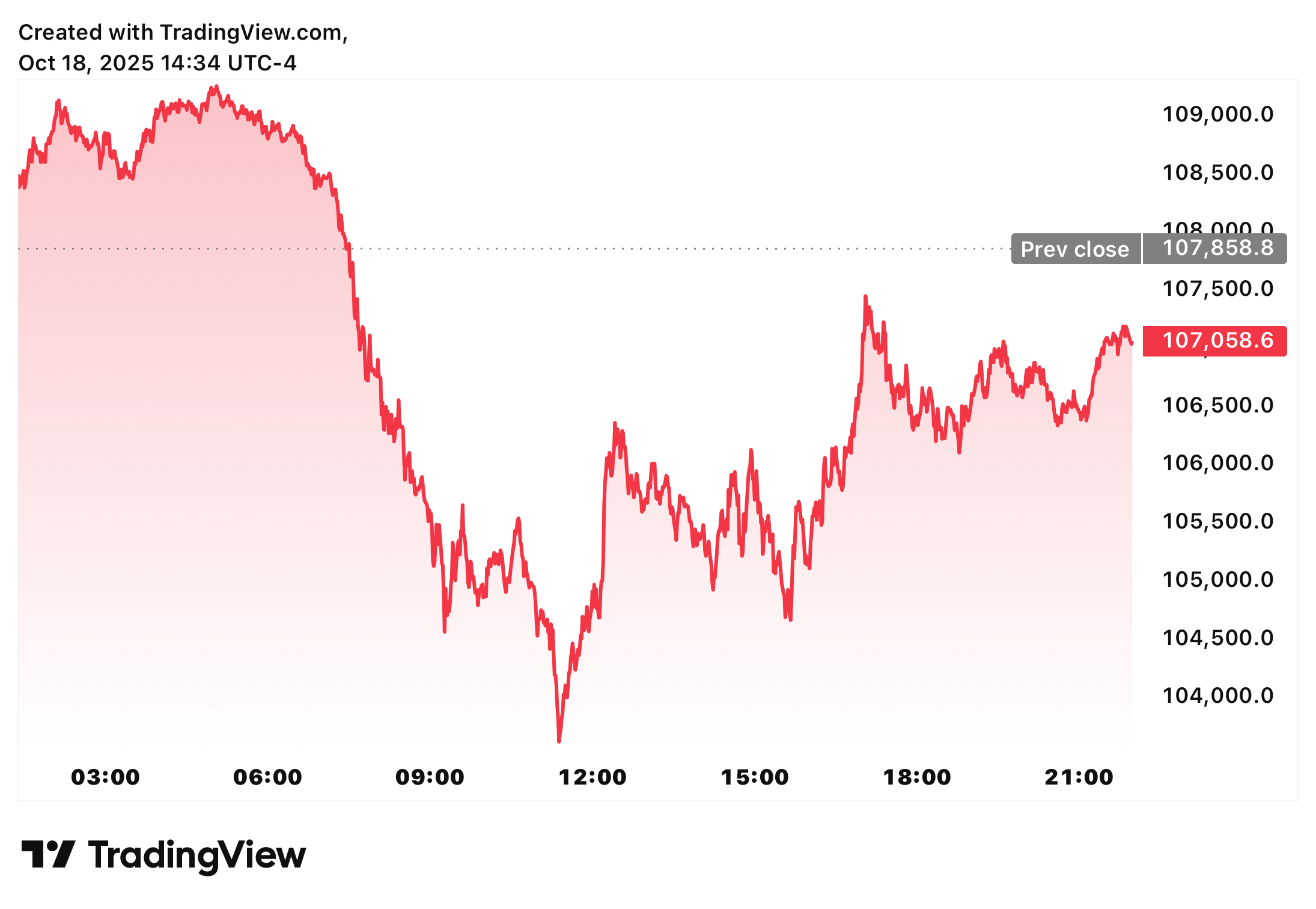

The world’s biggest cryptocurrency has had a turbulent few weeks. After dipping below $125,000 earlier in the month, Bitcoin (BTC) has bounced back to around $107,058, leaving traders wondering if the rally will resume before the month ends. The latest Bitcoin price prediction data suggests there’s still room for another leg up, though resistance remains strong.

Analysts say October could still bring fresh highs if momentum holds, but much depends on macro conditions and institutional inflows now being shaped by the Ethereum ETF rollout and renewed optimism in DeFi projects.

Bitcoin Price Prediction: Consolidation Before The Next Move

Bitcoin is currently trading in a tight range, between $101,000 and $104,000, as traders wait for a clear breakout signal. The short-term outlook remains cautiously bullish, with a confirmed close above $105,000 likely to open a move toward $110,000–$115,000.

Market sentiment is improving after several weeks of uncertainty. Spot ETF inflows continue to rise, and major institutional buyers appear to be returning to accumulation mode. Analysts say this could be a signal that BTC is setting up for another strong quarter.

However, the next few weeks may stay choppy. Global headlines around tariffs and inflation are still weighing on investor confidence. That’s why many are hedging their exposure by diversifying into upcoming crypto projects and low cap crypto gems that could perform even better during a sideways Bitcoin market.

How Bitcoin’s Movement Shapes Altcoin Momentum

Bitcoin’s consolidation has created opportunities across the altcoin market. Historically, whenever BTC stabilizes after a rally, funds often rotate into smaller-cap tokens and DeFi projects with high growth potential. This pattern is starting to repeat again in October.

Many traders believe that Bitcoin’s strength gives confidence to the rest of the market, but real gains now come from diversification. Instead of waiting for BTC to break all-time highs, they’re targeting crypto with real utility and lower market caps where exponential growth is still possible.

Why Analysts Are Watching Remittix (RTX) Alongside Bitcoin

As Bitcoin consolidates, Remittix (RTX) has quietly become one of the best crypto to buy now, thanks to its unique mix of payments and DeFi features. The Remittix DeFi project allows users to send crypto directly to bank accounts in more than 30 countries, offering instant conversion and low gas fees.

Remittix has already raised $27.5 million, gained 40,000+ holders, and launched its wallet beta, which supports real transactions.

Remittix (RTX) highlights:

- $27.5 million raised and 40,000+ investors

- Wallet beta live, enabling instant crypto-to-bank payments

- Ranked #1 on CertiK Skynet for project security

- 15% USDT referral rewards, paid daily

- Confirmed listings on BitMart and LBank

- Active $250,000 Remittix Giveaway

While Bitcoin provides market stability, Remittix offers growth potential. Analysts believe RTX could rise over 7,000% post-listing, making it one of the fastest-growing crypto 2025 opportunities and a strong early-stage crypto investment during Bitcoin’s consolidation phase.

Remittix Could Be The Next Big Altcoin Surge While Bitcoin Builds Its Base

The Bitcoin price prediction for October remains cautiously optimistic. BTC may not see massive breakouts immediately, but it’s building a solid base for the next rally. Analysts believe holding Bitcoin for security and pairing it with strong growth tokens like Remittix (RTX) offers the best mix of stability and upside.

If Bitcoin can hold above $100,000 and break $105,000 soon, new highs are possible before November. And if that happens, altcoins, especially Remittix, with its real-world payment model, could be the biggest winners of the quarter.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.