Senate Democrats submitted a counterproposal to the Responsible Financial Innovation Act last week that industry advocates say could effectively ban decentralized finance in the United States.

This standstill is another blow to the blockchain industry’s hopes for a legal framework that could unlock institutional capital. Senate Banking Committee Chair Tim Scott initially expected passage by late September, but partisan divisions have descended into accusations of bad-faith negotiating.

For crypto markets, regulatory uncertainty extends the information vacuum, and when frameworks shift and rules remain unclear, traders who can monitor sentiment and capital flows in real time hold decisive advantages over those waiting for headlines. That’s why DeepSnitch AI has enormous purchase right now, offering AI-driven intelligence that functions regardless of regulatory outcomes.

ETH ETFs diverge from Bitcoin as institutional appetite shifts

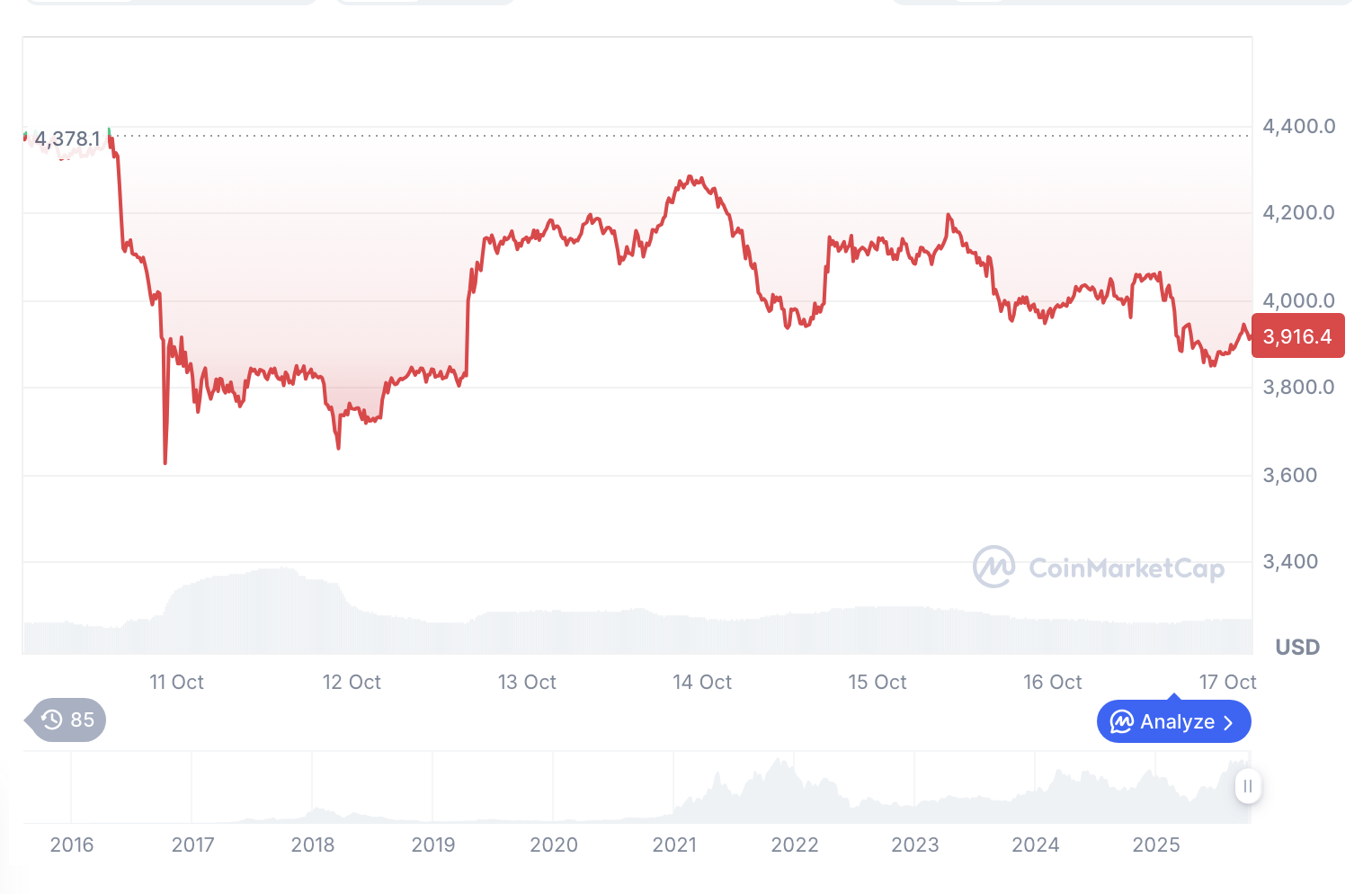

Ethereum ETFs recorded $5.32 million in net inflows on October 15, pushing cumulative inflows to $14.72 billion even as Bitcoin ETFs bled $94 million in outflows. The divergence suggests institutions view ETH differently than BTC, particularly with the SEC’s October 23 deadline looming for decisions on 16 crypto ETF applications, including products that would enable staking functionality.

If regulators approve ETH staking rewards within ETF structures, institutional investors could earn yield while holding exposure to the second-largest cryptocurrency, a feature Bitcoin products cannot replicate. That potential differentiation could accelerate adoption among pension funds and endowments seeking income generation alongside capital appreciation.

The contrasting flows between BTC and ETH ETFs signal that institutional stories are getting tangled. Bitcoin remains digital gold, but Ethereum’s programmability and staking yield offer additional value propositions that appeal to different allocators.

For retail traders, the question becomes whether Ethereum network upgrades can drive price appreciation fast enough to compete with early-stage AI projects offering 100x potential from sub-$0.02 entry prices.

Best crypto to buy now

DeepSnitch AI: AI surveillance that levels information asymmetry

October’s momentum is lifting AI sector tokens even as regulatory uncertainty weighs on majors. DeepSnitch AI sits at the convergence of two explosive trends, blockchain adoption and artificial intelligence growth. Audited by both Coinsult and SolidProof, the platform offers security transparency that separates legitimate projects from cash grabs, prolonging fundraising without delivering products.

DeepSnitch AI will deploy five agents trained on blockchain data and token mechanics to clarify on-chain confusion and deliver clear answers directly through Telegram. Instead of spending hours researching contract addresses, liquidity locks, and developer histories, users will ask questions in plain language and receive instant analysis backed by real-time data.

Together, the AI agents are likely to become more and more valuable as markets get more complex, creating utility that compounds rather than dilutes over time. The presale crossed $429K at $0.01915, and the staking program allows early participants to earn rewards, with free withdrawals and zero lock-up periods once claiming opens post-presale.

While Ethereum price prediction models target $4,800 to $5,000 near term, those gains represent 20% to 25% from current levels. DeepSnitch AI, priced for asymmetric returns, offers potential for 100x if the AI agents prove indispensable when markets turn volatile again.

Ethereum: Network upgrades support long-term bull case

Ethereum price prediction analysts point toward $4,500 to $4,650 by mid-October if ETH sustains above $4,000 support, with potential extension toward $4,800 later this month if volume supports breakout attempts. The Fusaka upgrade scheduled for December 3 will introduce PeerDAS sampling to improve network scalability, continuing Ethereum’s technical evolution toward handling mainstream adoption.

Citigroup forecasts ETH closing 2025 at $4,300, noting recent strength appears driven more by sentiment than fundamentals. Standard Chartered raised its target to $7,500, citing increased industry engagement and an expected eightfold rise in stablecoin issuance by 2026.

The ETH long-term price outlook consensus hovers around $5,000 to $7,000 for 2026 if adoption continues, potentially reaching $10,000 by 2030 under optimistic scenarios where Ethereum network upgrades could deliver promised scalability improvements.

That said, Ethereum’s $475 billion market cap limits explosive percentage gains at this stage, so those seeking 100x returns would be wise to look elsewhere. A substantial climb to $7,000 equates to roughly 75% upside from current prices, which is sizeable for an established asset but modest compared to presale projects like DeepSnitch AI.

Layer-2 activity keeps climbing and staking participation remains steady, with over 66 million ETH locked, tightening circulating supply and supporting long-term bullish narratives.

BNB: Coinbase listing adds liquidity after exchange debate

BNB appeared on Coinbase’s roadmap for listings on October 16, following public debate over exchange listing requirements. The discussion began when Limitless Labs CEO CJ Hetherington contrasted Binance’s alleged 2 million BNB security deposit requirement with Coinbase’s approach of simply building “something meaningful on Base.” Binance initially threatened legal action before apologizing for excessive communication, while Coinbase’s head of Base Jesse Pollak argued listing should cost zero percent.

The exchange speaks to growing tension around listing transparency as the number of tokens explodes. Former Binance CEO CZ, who controls roughly 64% of BNB’s circulating supply, praised the Coinbase listing but urged the exchange to list more BNB Chain projects. BNB trades around $1,149 with a $160 billion market cap, making it the third-largest cryptocurrency and a safe bet for stability.

For traders seeking blue-chip exposure with institutional backing, BNB is a solid option. For those hunting asymmetric returns, DeepSnitch AI is the better avenue, requiring only modest market penetration to deliver exponential gains, while BNB would require surpassing Ethereum entirely to achieve 10x from current levels.

Conclusion

Democrats’ counterproposal stalled the crypto framework bill indefinitely, extending regulatory uncertainty that makes whale surveillance tools more valuable. Ethereum price prediction targets $4,800 to $5,000 if Ethereum network upgrades and ETF momentum build, with ETH staking rewards adding yield components that Bitcoin cannot match. The ETH long-term price outlook remains constructive through 2026, though at $475 billion market cap, upside is capped compared to earlier cycles.

DeepSnitch AI, on the other hand, is fast-approaching sell-out, and its combined AI-driven surveillance and presale timing are magic in the making. SnitchGPT and AuditSnitch will deliver instant analysis and contract verification, tools that become essential when regulatory frameworks shift and market complexity increases.

For those seeking asymmetric bets, the choice between 25% gains in ETH and potential 100x in DeepSnitch AI effectively boils down to risk tolerance and time horizon.

Check out DeepSnitch AI’s presale before the next jump.

FAQs

What is the Ethereum price prediction for late October 2025?

Analysts forecast ETH could test $4,500 to $4,800 by month-end if it holds above $4,000 support. The Ethereum price prediction depends on ETF flows, network upgrades, and broader risk appetite.

How do ETH staking rewards compare to traditional investments?

Staking rewards range between 3% and 5% APY, competitive with bonds but offering exposure to price appreciation. With over 66 million ETH staked, the network combines yield and security.

Why consider DeepSnitch AI alongside Ethereum?

Ethereum offers stability with 20% to 30% potential gains near term. DeepSnitch AI, priced at $0.01915 with audited security and AI utility, offers 100x potential that large caps cannot match at current valuations.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.