The global crypto market has taken a sharp downward following Donald Trump’s proposal to impose 100% tariffs on China, triggering widespread volatility across stocks and digital assets.

While the US president walked back on his tariff stance shortly after, the crypto market bled, with Bitcoin (BTC), Ethereum (ETH), and other leading altcoins losing billions in market caps.

Although the market did witness a significant recovery, with the likes of ETH climbing back to $4k levels after dropping to $3,700, investors appear to be quietly rotating capital into PayDax Protocol (PDP), a new presale-stage project that’s drawing attention as a rare safe haven amid rising bearish sentiments.

Trump’s Tariffs: Why PDP Emerges as Safe Haven in Crypto Bear Market

When bearish sentiments rise, most investors retreat to stablecoins or simply exit crypto altogether. But this time, a new pattern is forming. Presale-stage projects like PayDax Protocol (PDP) are seeing record inflows while blue-chip assets stumble, and there’s a simple reason for that. Presale tokens are insulated from the market’s day-to-day volatility.

Unlike traded assets such as XRP, Solana (SOL), or Cardano (ADA), which can lose 20% in a single bad week, presale tokens like PDP aren’t listed yet. Their value is determined by project growth and demand, not fear-driven selloffs. That makes PDP appealing as a bear-market shelter, especially since its entry price is still measured in cents.

Investors looking for the best crypto to buy now are also attracted by the upside. While large-cap altcoins might 2x or 3x at best as the market recovers following Trump’s reversal on his tariff stance, early-stage tokens like PDP have historically produced 100x–1000x returns, similar to how BNB exploded after its ICO.

PayDax Protocol: The People-Powered Banking Revolution

PDP combines protection from the crash with exponential upside, creating a rare balance that’s almost impossible to find during a market downturn. But that’s just one reason for the surging PayDax presale traffic alongside the project’s USP.

Every major innovation in crypto starts with frustration, and PayDax was no exception. Its founders built the PayDax Protocol (PDP) after watching banks and even major DeFi platforms fail to serve everyday users with inaccessible loans to inflated fees and broken insurance systems.

PayDax Protocol (PDP) is designed to redefine lending, borrowing, and insurance into a single ecosystem where users control their own liquidity and profits.

Lending: A Fairer Way to Grow Capital

Traditional banking offers savers under 1% interest, while DeFi lending has often been unstable or limited to risky pools. PayDax flips that script into one where savers themselves become the banks.

A user can deposit $5,000 into the protocol and earn up to 15.2% APY, powered by real on-chain borrowing demand and protected by institutional-grade insurance through the Redemption Pool. The result is up to 15x gains for the same money savers hand out to banks.

Borrowing: Instant Liquidity Without Selling

Borrowing through PayDax is not just simple but also comes with unprecedented flexibility. A trader can lock their Bitcoin or Ethereum as collateral and instantly unlock stablecoin loans (USDT/USDC) without selling their holdings. This model provides liquidity and lets borrowers retain their original assets and their price appreciation.

In another case, through collaborations with Sotheby’s and Brinks for asset authentication and custody, a user can tokenize a real-world asset (like a Rolex watch or physical gold) and borrow against it. Integrations with Chainlink Oracles also provide real-time price feeds.

For investor protection, borrowing against volatile assets comes with fixed LTV ratios (loan-to-value ratios) of 50%, 75%, 90%, and 97%.

Insuring: Protecting the People Who Power the System

All participants are protected by PayDax’s Redemption Pool. Insurers can underwrite loans to earn premiums or stake in the protocol to earn up to 20% APY. If a borrower repays, the insurer bags the premium, but in case of defaults, the Redemption pool covers the losses.

This closes the loop, as every participant in the system benefits. No middlemen or hidden spreads. Just a unified, community-driven economy where risk and reward are shared fairly.

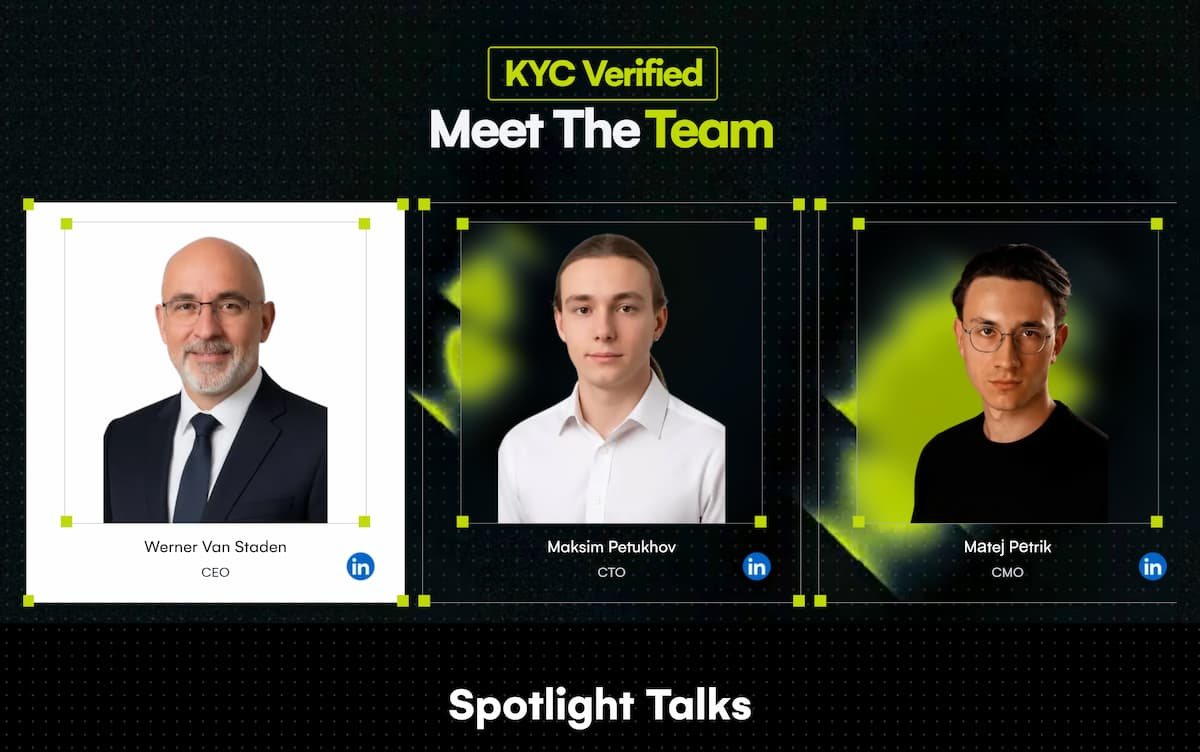

The Trust Factor: Real People, Real Transparency

Trust has become the currency of DeFi, and PayDax’s team understands that better than anyone. The PayDax team, led by CEO Werner Van Staden, is fully doxxed and KYC-verified, quelling fears of rug pulls that have plagued presales.

Further strengthening its credibility, PayDax Protocol has passed an Assure DeFi audit, ensuring its smart contracts are secure and resistant to exploits. Spectators say this level of transparency has become a growth-driver itself, as the PayDax presale raised over $1 million just weeks after launch.

PDP Presale: Best Crypto To Buy Now in Bear Market?

With the market still rattled by Trump’s tariff announcement, capital is clearly rotating toward utility-driven early-stage projects. PayDax Protocol (PDP) sits right at that intersection of security and explosive potential, making it one of the best altcoins to buy now.

The PDP presale has already drawn significant inflows as investors hedge against the market downturn, positioning themselves before the next major bull leg. At Stage 1, investors can still acquire PDP for its lowest-ever price of $0.015, and this has been made cheaper by the 25% discount made available with the PD25BONUS code.

But this presents a problem for interested investors. Bear market pressures have skyrocketed presale traffic, pushing Stage 1 progress past 29%. Essentially, time is running out to acquire PDP at its initial price and position for the maximum gains.

Join the Paydax Protocol (PDP) presale and community:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.