TLDR

- Aster (ASTER) dropped 3.26% in 24 hours and 9.83% over the past week, currently trading at $1.16-$1.18.

- Coinbase listed ASTER for trading, potentially increasing liquidity and exposure to new investors.

- The token is testing critical support at $1.10-$1.13, with technical indicators showing early signs of a possible reversal.

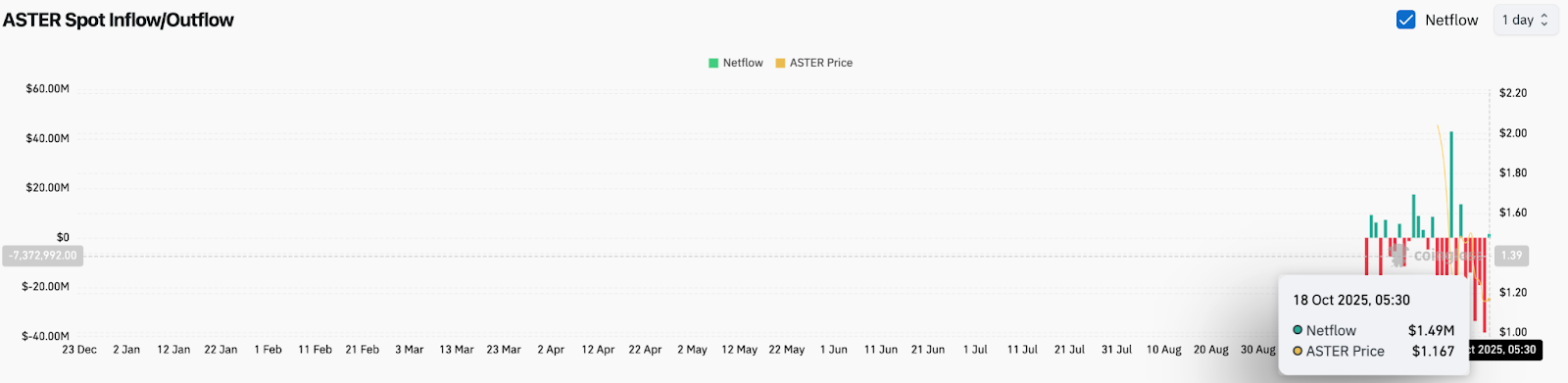

- On-chain data reveals $1.49 million in net inflows on October 18, the first positive reading after weeks of outflows.

- Analysts suggest recovery targets of $1.50 and $1.80 if support holds, but a break below $1.10 could push prices toward $1.00.

Aster is trading at $1.16 to $1.18 after falling 3.26% in the last 24 hours. The weekly chart shows a steeper decline of 9.83%.

The token’s 24-hour trading volume reached $478.73 million. However, this represents a 58.82% drop from the previous session. The market capitalization stands at $2.37 billion, down 3.46% from earlier levels.

Coinbase officially listed ASTER for trading on October 19. The listing gives users in eligible regions access to the token on one of the largest cryptocurrency exchanges. This move could bring more liquidity to the market.

The exchange continues to expand its asset offerings based on user demand. Traders expect increased volatility in the early hours of trading as new money enters the market.

Coinbase Listing Brings Fresh Attention

Social media activity around ASTER increased following the Coinbase announcement. Discussions focus on potential price movements after the listing.

🚨 ALERT: COINBASE WILL BE LISTING $ASTER @coinbase pic.twitter.com/DhAMt9R3Mu

— Jason Ai. Williams (@GoingParabolic) October 19, 2025

The addition to Coinbase’s platform marks a step forward for Aster’s market visibility. The exchange serves millions of users across multiple countries.

ASTER is now trading just above a critical support level at $1.10 to $1.13. The token has defended this zone multiple times over recent sessions. Each dip into this area brought short-term buyers back into the market.

Crypto analyst @CryptoKaviYT pointed out that the token recently crossed above a downtrending line. This could signal a short-term bounce. The analyst identified near-term targets at $1.50 and $1.80 if the current support holds.

$ASTER Updated new trade plan 🔥

If you are looking for an entry, this is a good one. First target is $1.5 then consolidate a bit, next flight to $1.8 🚀 pic.twitter.com/mIbblhebUo

— Crypto Kavi (@CryptoKaviYT) October 18, 2025

Technical Signals Show Mixed Picture

The token faces resistance at $1.25, where multiple moving averages are stacked. The 20, 50, 100, and 200 exponential moving averages sit at $1.17, $1.19, $1.26, and $1.37. These levels create a ceiling that limits upward movement.

On the 4-hour chart, the MACD indicator shows a new bullish crossover. The histogram turned positive at 0.01089. Both the MACD and signal lines remain below the zero line, suggesting the recovery is still early.

The RSI reads 43.05, up from oversold levels. It now sits above its moving average at 38.19. This indicates declining selling pressure. The RSI has not crossed the 50 neutral level yet, meaning buyers have not gained full control.

On the 30-minute timeframe, the Supertrend indicator flipped neutral near $1.19. The Parabolic SAR dots align just above the current price. This confirms resistance between $1.18 and $1.20.

Exchange data from Coinglass shows $1.49 million in net inflows on October 18. This marks the first positive reading after several sessions of heavy outflows. Earlier sessions saw outflows exceeding $10 million.

A move above $1.25 would confirm a short-term break of the descending pattern. Failure to break this level could lead to another test of $1.10. A fall below $1.10 would expose the $1.00 support zone.