TLDR

- Coinbase, Uniswap, and Ripple push for clear U.S. crypto regulation rules.

- Crypto CEOs unite with Senate Democrats to define market oversight.

- Armstrong, Nazarov, and Adams urge balanced crypto innovation policies.

- Lawmakers and crypto leaders seek clarity amid SEC–CFTC tensions.

- DeFi and centralized firms align on fair, future-ready crypto laws.

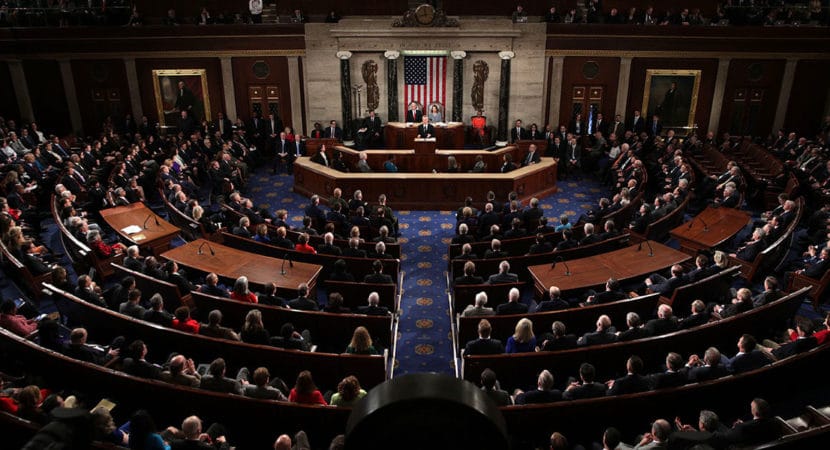

A group of leading crypto executives will meet with Senate Democrats this Wednesday to address stalled crypto market structure legislation. This gathering highlights continued efforts to shape crypto regulation and revive momentum around a national regulatory framework. With bipartisan talks stalled, this meeting focuses on reconciling priorities and redefining the future of the US crypto market.

Coinbase CEO to Discuss Clearer Regulatory Jurisdiction

Coinbase CEO Brian Armstrong will attend the roundtable, focusing on crypto regulation and exchange oversight across federal agencies. Coinbase remains a central figure in debates over which regulator the SEC or the CFTC should oversee crypto assets. Armstrong’s participation signals industry support for unified and transparent rules.

He aims to discuss jurisdictional clarity, which remains a top concern for centralized exchanges. Without consistent crypto regulation, companies face conflicting enforcement from multiple regulators. Coinbase supports a framework where ancillary assets fall outside the SEC’s scope.

This aligns with a Republican proposal, but Democrats continue to pursue stricter rules focused on DeFi concerns. Thus, the meeting may help identify shared goals. Armstrong’s input could influence the final direction of US crypto regulation.

Chainlink and Uniswap to Address Decentralized Finance Oversight

Chainlink’s Sergey Nazarov and Uniswap’s Hayden Adams will join discussions on how crypto regulation can support DeFi innovation while ensuring compliance. Both projects operate decentralized platforms that challenge traditional regulatory structures. Their concerns differ from centralized platforms, yet remain critical to the market structure.

Democrats have circulated a six-page proposal targeting illicit finance in DeFi, which has raised concerns across the industry. Nazarov and Adams will likely emphasize the need to avoid overregulation that could hamper protocol development. They advocate for a collaborative approach that includes technical stakeholders.

This section of the meeting could determine how lawmakers define accountability in decentralized ecosystems. Crypto regulation must evolve to reflect how DeFi differs from legacy finance. Therefore, input from protocol founders is essential to fair policymaking.

Ripple, Circle and Others Push for Balance Between Innovation and Compliance

Ripple’s Stuart Alderoty and Circle’s Dante Disparte will focus on crypto regulation that supports innovation while promoting consumer protection and market stability. They argue that clarity, not restriction, will foster responsible growth. Both firms face unique compliance challenges across global markets.

The roundtable comes as Senator Gillibrand pushes to revive bipartisan negotiations with Republicans like Senator Cynthia Lummis. Their previous bill, the Responsible Financial Innovation Act, proposed a functional split between regulators. It now serves as a possible foundation for compromise.

Participants like Kristin Smith of the Solana Policy Institute and Jito’s Rebecca Rettig will also contribute legal and policy insights. This gathering reflects a unified industry effort to reengage lawmakers. With midterm elections nearing, advancing crypto regulation remains urgent.