The crypto market is finding some strength again as institutional investors return after months of somewhat risk-averse positioning. Digital assets are in optimistic territory, driven by a renewed interest in utility-based projects. Traders are pointing to big-cap coins like XRP leading this shift, a sign that smart money is quietly returning to the market.

The confidence bounce back indicates the growing trust in blockchain systems, which are being adopted by massive enterprises and banks. Analysts believe this might signal the beginning of a new accumulation period for the top-performing tokens. MAGACOIN FINANCE makes it to the list of projects that are gaining more attention during this recovery phase and has started making waves for early institutional-style traction.

Ripple Expands Institutional Reach Through GTreasury Acquisition

Ripple’s acquisition of GTreasury for $1 billion has shifted how it operates within global finance. The deal has provided Ripple with access to over 1,000 enterprise customers in 160 nations. By integrating blockchain efficiency with GTreasury’s cash management systems, Ripple can now provide real-time liquidity and cross-border payment options to big corporations.

This combination of features enables financial officers to move funds within seconds, not days. Experts view this move as a major step towards making Ripple an essential infrastructure provider for the institutional market. The acquisition also bolsters the use case for the XRP Ledger and the RLUSD stablecoin, which are the center of Ripple’s ecosystem.

Ripple Strengthens Global Presence With Absa Bank Partnership

Ripple’s business growth strategy extended further this week with a partnership with one of Africa’s largest banking institutions, Absa Bank. Under the agreement, Absa will deploy Ripple’s digital custody solution to manage digital securities across multiple markets in Africa.

This partnership accesses Absa as the first African custodian in Ripple’s network, serving over 12 million customers. Company officials said the partnership reflects Ripple’s mission to provide regulated, safe, compliant financial solutions.

For XRP holders, this partnership strengthens the company’s legitimacy and shows how conventional banks are starting to trust blockchain-based systems.

Institutional Confidence Boosts XRP Market Sentiment

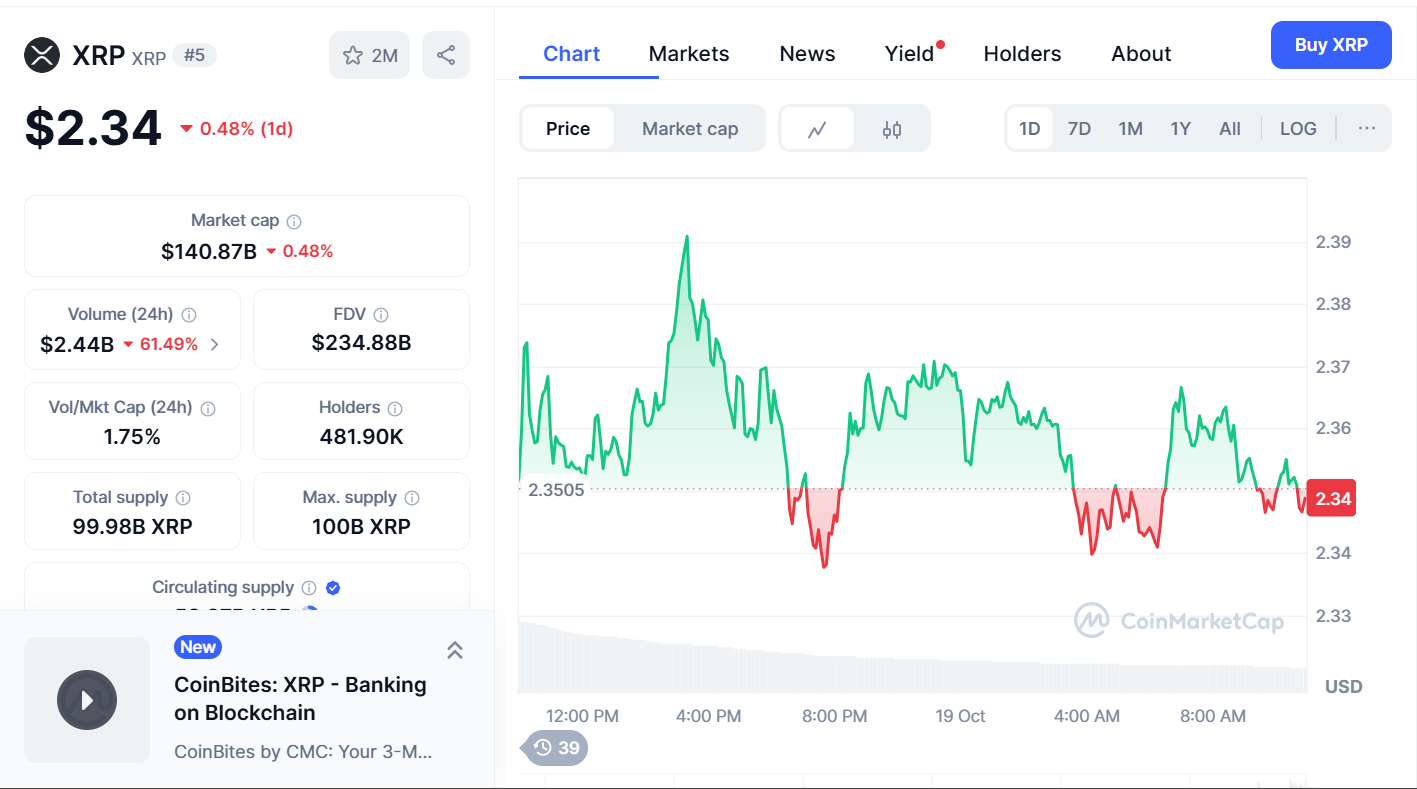

Ripple’s growing partnerships have cemented market sentiment for XRP, bolstering faith in the asset. Currently, the token is priced at close to $2.36 with a market capitalization of over $141 billion. The daily trading volume is $2.6 billion, indicating a return to active participation.

Source: CoinMarketCap

A confirmed breakout from the $2.39 support is anticipated to create a run on the $2.64 and $2.84 levels. The positive institutional news, combined with the improved technical structure, implies that XRP might be entering a more stable accumulation phase.

Overall, the mood in the crypto market appears to be improving as traders get better aligned for the next leg of bullish cycles.

MAGACOIN FINANCE Gains Traction Amid Renewed Capital Rotation

Beyond XRP’s resurgence, MAGACOIN FINANCE has started to draw serious attention from early investors. On-chain data reveals steady accumulation by large wallets, a behavior often associated with institutional-style confidence.

These accumulations have sparked discussion across X and Telegram, where traders now describe MAGACOIN FINANCE as one of the most-watched new projects. Its low entry price and visible liquidity growth have fueled demand from both retail and early smart-money buyers.

As funds rotate toward high-upside assets, MAGACOIN FINANCE appears positioned to benefit from renewed capital inflows during this recovery phase.

Technical Setup — XRP Near Breakout Territory

Technically, XRP is at just below key resistance at $2.39. The 50-period moving average is still a short-term resistance, but higher lows around $2.18 and $2.02 show increasing accumulation.

RSI is near 51, indicating fading selling pressure and a relatively neutral momentum profile. A breakout above $2.39 on stronger volume could indicate the beginning of a medium-term uptrend. However, should momentum fade, the $2.18 level will serve as key support for continuation.

Final Outlook

Ripple’s recent actions show a clear strategy focused on institutional adoption. Its partnerships in global finance and treasury systems have established a strong foundation for long-term growth.

At the same time, MAGACOIN FINANCE’s early accumulation trend highlights how investor capital is rotating toward newer, undervalued projects. Together, these developments show how institutional demand and early investment cycles often move in parallel.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.