Read our Advertising Guidelines Here

The Ethereum ecosystem remains optimistic, anticipating the approval of new ETFs in the coming weeks. Some of its Layer-2s, such as Optimism, Base, and Arbitrum, continue to grow their user bases. Of all of them, ARB is leading the RWA race, with Robinhood launching nearly 500 tokenized US stocks on its blockchain.

Meanwhile, DeepSnitch AI presale hit a new record and raised over $440,000, attracting small traders to whales. This shows that investors are confident that this could be one of the most promising AI projects in 2025. Combining the power of artificial intelligence with cryptocurrency trading, DeepSnitch offers a real opportunity to make 100x gains!

Robinhood tokenizes US stocks on the Arbitrum blockchain

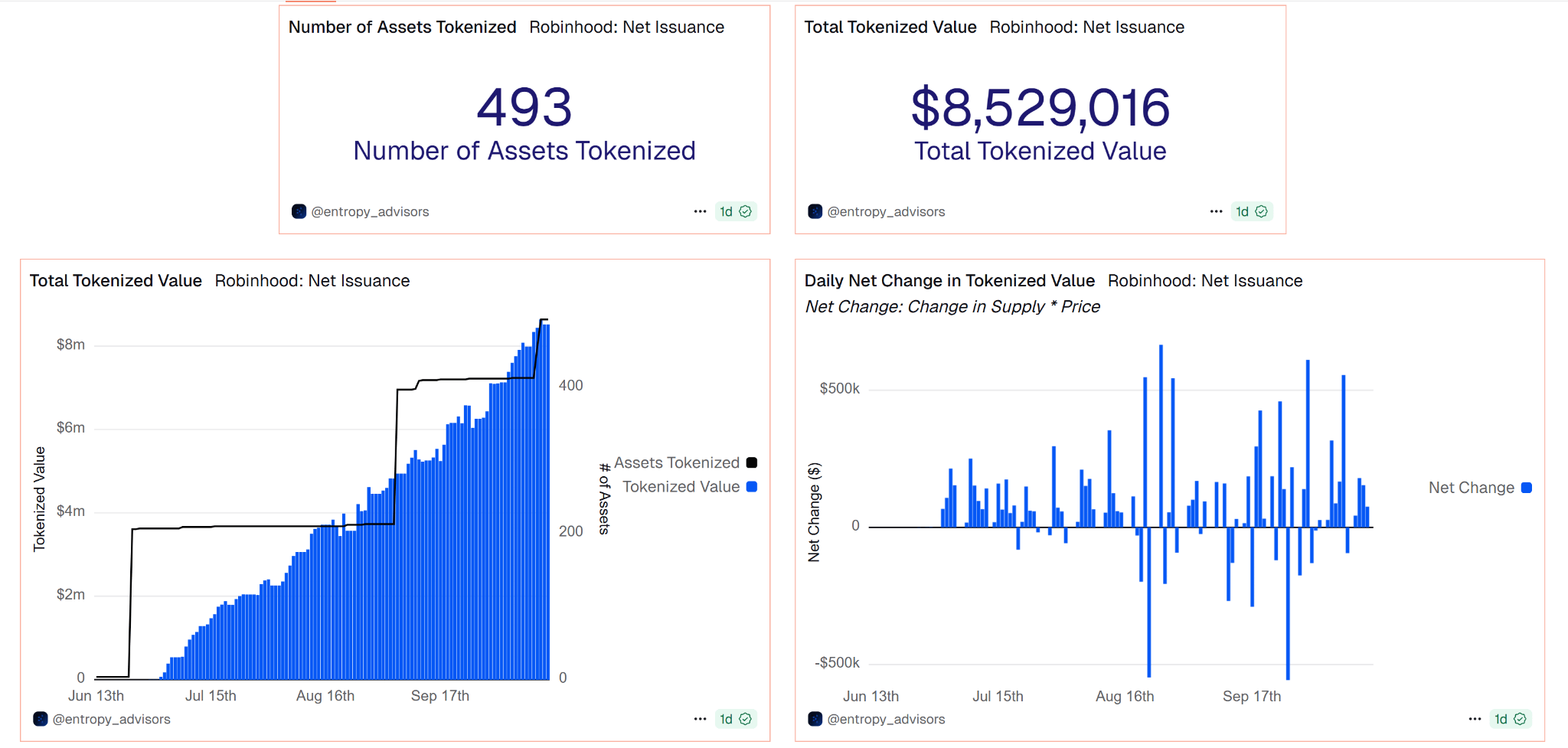

Robinhood has expanded its real asset tokenization program (RWAs) on the Arbitrum blockchain, bringing the total to 493 tokenized assets (including US stocks and ETFs). Initially available only to EU users, it should soon be expanded to other regions.

This will allow users to purchase fractionalized stocks, trade 24/7, and have access to instant liquidity, reducing costs and intermediaries, and increasing accessibility to US stocks for retail investors. All buying and selling on the Robinhood platform is done using Arbitrum’s Layer-2 infrastructure, with a total value of $8 million already tokenized.

This expansion is significant for Arbitrum, putting it directly involved in the integration of traditional finance (TradFi) and decentralized finance (DeFi). This new demand will help increase network usage, bringing more TVL and exposure, and positioning Arbitrum as the leading Ethereum Layer-2.

This expansion is significant for Arbitrum, putting it directly involved in the integration of traditional finance (TradFi) and decentralized finance (DeFi). This new demand will help increase network usage, bringing more TVL and exposure, and positioning Arbitrum as the leading Ethereum Layer-2.

This move could help boost the price of the ARB token in the long term, as well as position Arbitrum as one of the best crypto to invest in and safe cryptos for 2025.

Top 3 Best crypto to invest in: DSNT, ARB, and ETH

DeepSnitch AI (DSNT): Promising presale with 100x potential

This is a project that has attracted a lot of attention from small traders to whales, recently raising over $440,000 in record time. DeepSnitch AI is a cutting-edge platform using advanced artificial intelligence to democratize crypto market insights.

It deploys five intelligent agents developed by traders and analysts to monitor on-chain activity. These agents track whale movements, detect potential rug pulls, and identify contract risks in real time. All insights are delivered directly to users through Telegram alerts.

By translating complex blockchain data into simple information, DSNT empowers retail investors to trade like whales. Its focus on accessibility brings high-level tools to everyday users, bridging the gap once held by institutions. This practical approach enhances decision-making speed and confidence. It’s not just hype, but it’s real-world functionality.

Its early-stage presale status and technological innovation hint at DeepSnitch AI having a massive upside. This is the type of project that whales buy for long-term crypto investments and can generate 100x returns.

Arbitrum (ARB): Wyckoff structure points to long-term accumulation

On October 20th, ARB was showing interesting signs as on-chain activity and technical structure aligned, hinting at a potential breakout from its current accumulation range.

In the last 30 days, the price has fallen 34% to $0.32, but this may be part of a long accumulation trend.

Chart analysis suggests that ARB may have entered what is known as a “Wyckoff structure.” This is when the asset begins a phase of accumulation, distribution, and market manipulation. The price may accumulate between 0.24 and 0.62 for a while, until finally breaking out upwards and seeking even a new price discovery.

Wyckoff structures are often good times to buy assets that are in an accumulation phase. Once the Wyckoff ends, the asset usually breaks out and seeks a new ATH.

With Arbitrum activity surging past 800M transactions, and partnerships with Robinhood positioning it as the most promising Layer-2, all of this makes ARB one of the best cryptos to invest in now.

Ethereum (ETH): Bull flag bounce in play

Ethereum’s price has fallen 10% in the last 30 days, trading at $4,030.00 on October 20th. But the good news for investors is that a potential bull flag may be forming on the charts.

This setup usually points to the uptrend continuing after a quick cooldown. If it plays out, ETH could break higher and test the top of the channel near $4,450-$4,500.

If the resistance is broken upward, it could push the price toward the bull flag above $5,200, creating a new ATH and triggering a possible new price discovery momentum.

If the resistance is broken upward, it could push the price toward the bull flag above $5,200, creating a new ATH and triggering a possible new price discovery momentum.

Bull flags are usually patterns that break out upwards. Also, add new ETFs that are about to be approved, and the entire Layer-2 ecosystem that continues to grow; all these things make Ethereum one of the best altcoins for portfolio growth now.

Conclusion

The Ethereum ecosystem continues to grow and is increasingly proving itself as a good long-term crypto investment option. But while altcoins like Ethereum and Arbitrum are entering an accumulation phase, awaiting a possible upward breakout, presales like DeepSnitch AI appear to offer a better opportunity for those seeking more explosive gains.

ETH and ARB are established projects with a high market cap, which limits their upside potential to less than 10x gains. Meanwhile, DeepSnitch AI is a presale project, meaning it has more price upside, especially in the long term, with the potential to make 100x gains.

Right now, DeepSnitch AI is a stage-2 presale sitting at just $0.01953, a cheap price entry that could easily turn into 100x gains in the long run.

Visit the official website for more information.

FAQs

FAQs

- What makes DeepSnitch AI a promising investment?

DeepSnitch AI is an early-stage presale project with a significantly smaller market capitalization, allowing for much higher percentage growth to reach 100x returns.

- Why is Ethereum a good option for long-term crypto investments?

Ethereum is the main blockchain used for DeFi, with increasing institutional interest, including potential new ETFs. Even Wall Street is investing, making it one of the best altcoins for portfolio growth.

- How does Arbitrum contribute to crypto market?

Arbitrum is a Layer-2 blockchain that offers faster and cheaper transactions on the Ethereum network. This has positioned it as a market leader, attracting the highest TVL among Layer-2 blockchains, leading the RWA market, and making it a safe cryptos for 2025.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above. Read our Advertising Guidelines Here.