Blockchain and the Insurance Industry

Blockchain and the insurance industry show compatibilities in such a way that you can expect blockchain to significantly alter the way insurance companies do business. Ethereum creator Vitalik Buterin says as much. In an interview with Simon Phipps of KPMG China on November 27, 2016, Buterin states:

“I think insurance actually is one of those areas in finance that could be relatively easy to apply to blockchains. I think the reason is that it’s an area where it’s basically just about finance and data. So fairly simple building blocks and I think data has been fairly freely available ever since the internet. And the finance side, you know, is becoming more and more accessible, especially with blockchain technology coming in. So there’s a fairly natural combination, and I think we’re seeing like both individual companies starting to develop some applications like those like flight insurance pilots, no pun intended, and like some fairly large insurance companies just getting interested in the technologies, just dipping their feet.”

Vitalik also declared his support on Twitter for blockchain development in insurance processing.

Yes, I’m an advisor of wetrust. No, I do not have tokens. No, my interest in decentralized insurance should NOT be construed….

— Vitalik Non-giver of Ether (@VitalikButerin) October 8, 2017

The History of Insurance

In ancient China, merchants indemnified themselves against loss by distributing cargo over multiple vessels. So if one vessel sank, the rest of the shipment remained safe. Here, we already see the value of decentralization in insurance.

Danger at Sea

Historians often pinpoint the origin of modern insurance in western culture to a London coffee house in the late 1680’s. Edward Lloyd opened Lloyd’s Coffee House at this time on Tower Street in London, and this provided a gathering place for ship owners, merchants, and seafaring men.

The insurance industry grew out of the deals made to spread risk among multiple parties and bet on a favorable outcome of a trading voyage. Edward Lloyd established Lloyd’s of London as a result of his success in this business.

These beginnings show insurance to be a catalyst for business development. Without insurance, some successful voyages would never have started. Consider the development of emerging technology as a modern equivalent.

Gambler’s Odds

Then in 1654, mathematician Blaise Pascal contacted fellow French mathematician Pierre de Fermat. Together, they developed a theory of probability. Probability theory gives insurers a rigorous tool for calculating the amount of risk involved in a given venture. Pascal’s work provided the basis for the first actuarial tables, and this approach continues to be used by the insurance industry today.

So, in the history of insurance, we clearly see significant areas where blockchain and the insurance industry coincide. Decentralization spreads risk. And mathematics provides smart contracts for the basis of transactions.

Blockchain Benefits to the Insurance Industry

Trust

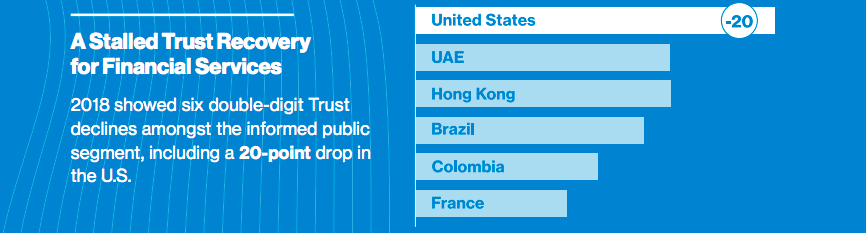

Throughout the world, trust declines in established powers, whether they are governments or business. The 2017 Edelman Trust Barometer documents this decline. Blockchain technology, at its core, creates a system of trust regardless of whether parties involved in a transaction trust each other or not.

Transparency

In the United States alone, around $7.4 billion remains unclaimed through life insurance where people died, but their funds fall through the cracks. Blockchain technology and smart contracts enforce payment, and transaction data appear openly on the blockchain.

Efficiency

As an established industry, insurance companies use mainframes, outdated database technology, and incompatible systems that experience great difficulty in communicating with each other. Data on a blockchain alleviates these problems. Emerging economies such as those in Asia present opportunities to explore new systems based on blockchain because these economies exist free of established and outdated systems.

Immutable Record of Truth

Insurance depends on knowing the facts properly. When you insure valuables, the insurance company needs to know the condition of those valuables, their location, and even simple proof of their existence. Blockchain provides an immutable record of truth capable of storing all this data and tracking any change of ownership.

Transactions

The insurance industry essentially makes contractual obligations between parties. One party pays the other, and circumstances obligate the other party to pay when conditions meet the proper criteria. Blockchain technology provides a system for contracts to be honored and payments to be made efficiently.

Fraud Prevention

As an immutable record of truth, blockchain’s capabilities include the ability to reduce fraud. Transactions on a blockchain provide information relevant to uncovering suspicious claims and suspicious persons.

Auditing

The transparency of blockchain technology enables improved auditing. Blockchain provides ready access to the criteria used for establishing the price of premiums and how these criteria changed over various timeframes. Consequently, proof of compliance with governmental regulations grows simpler.

[thrive_leads id=’5219′]

The Blockchain Insurance Industry Initiative (B3i)

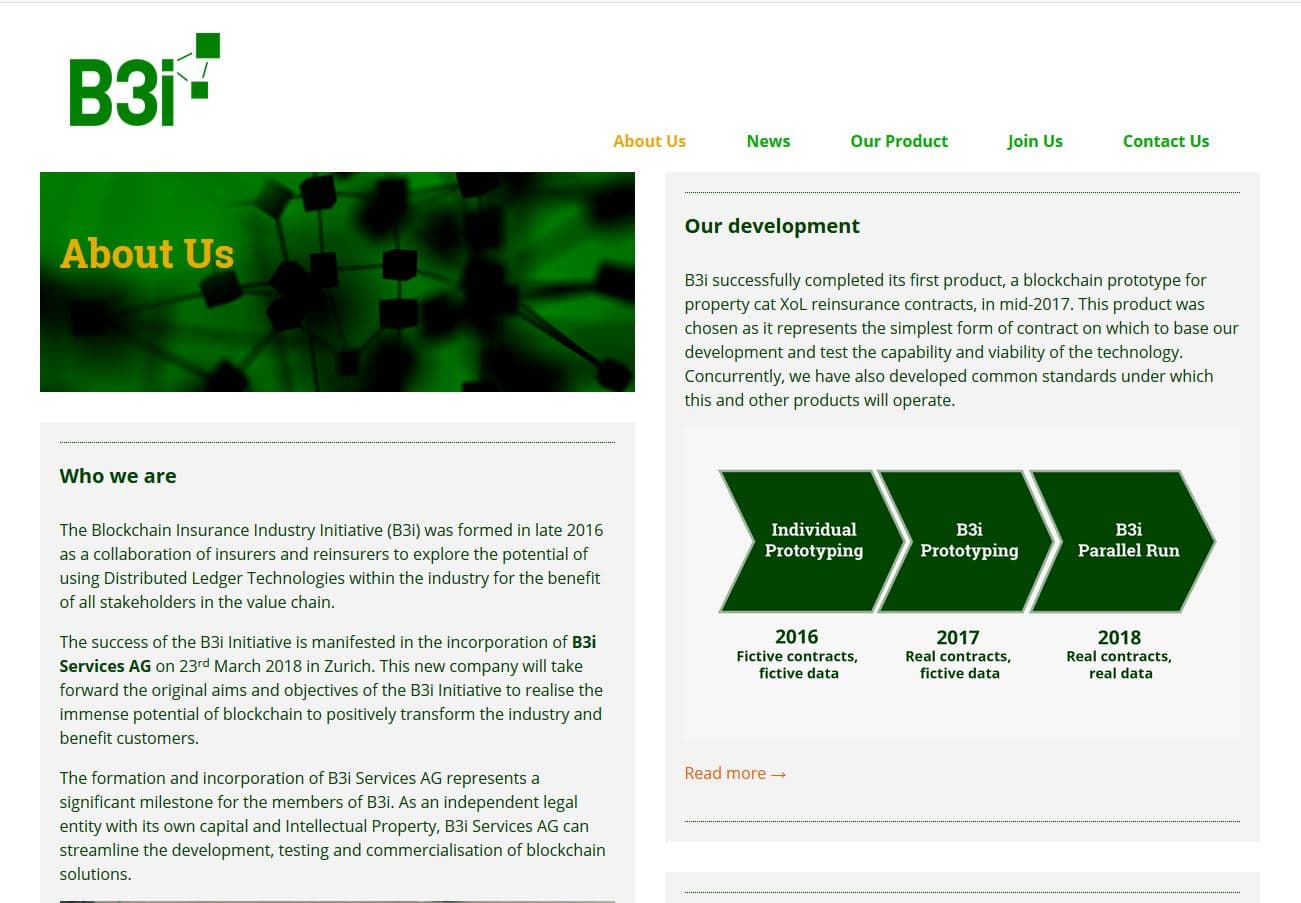

The Blockchain Insurance Industry Initiative (B3i) formed in Europe in late 2016. B3i represents a collective of insurance companies collaborating to research the opportunities of blockchain and the insurance industry. After a successful first couple of years, B3i Services AG incorporated in Zurich in March of 2018. As its own organization, B3i Services AG looks to develop and test commercial blockchain solutions for insurance.

The organization released a blockchain prototype for property catastrophe excess of loss reinsurance contracts as its first product. Providing the simplest form of an insurance contract, this also paved the way for common standards to operate going forward.

Final Thoughts

Blockchain and the insurance industry present a myriad of opportunities. Blockchain transparency and transaction processing give both customers and vendors better data and trust. Improved efficiency of the existing industry provides only one path forward. Aspects of blockchain technology expose new ways to think about the business itself. The insurance industry grew out of a need to reduce risk, and it accomplished this by spreading risk over multiple parties. Consequently, the dangers of maritime trade initiated the modern Western insurance industry we know today.

You can see in the decentralization of blockchain the possibility of spreading risk over multiple parties in new ways. Blockchain enables people to insure ventures in a way similar to crowdfunding. And while the cost of overhead of outdated systems limits established insurance companies, blockchain enables microfinance. Therefore, profit from smaller ventures that would normally fly under the radar of the existing industry waits to be found.

A brave new world of possibility exists for those willing to set sail on the adventure of a new insurance industry.