TLDR

- Bitcoin dropped to a four-month low of $104,000 after a record $19 billion market liquidation event on October 10, 2025

- Standard Chartered’s Geoff Kendrick maintains his $200,000 Bitcoin price target by the end of 2025 despite recent volatility

- The ‘dolphin’ cohort holding 100-1,000 BTC per wallet now controls 26% of total Bitcoin supply and added 681,000 BTC in 2025

- Bitcoin ETFs saw $477 million in net positive inflows on Tuesday after breaking a four-day losing streak

- Analysts view the current dip as a potential buying opportunity with institutional investors continuing to accumulate Bitcoin

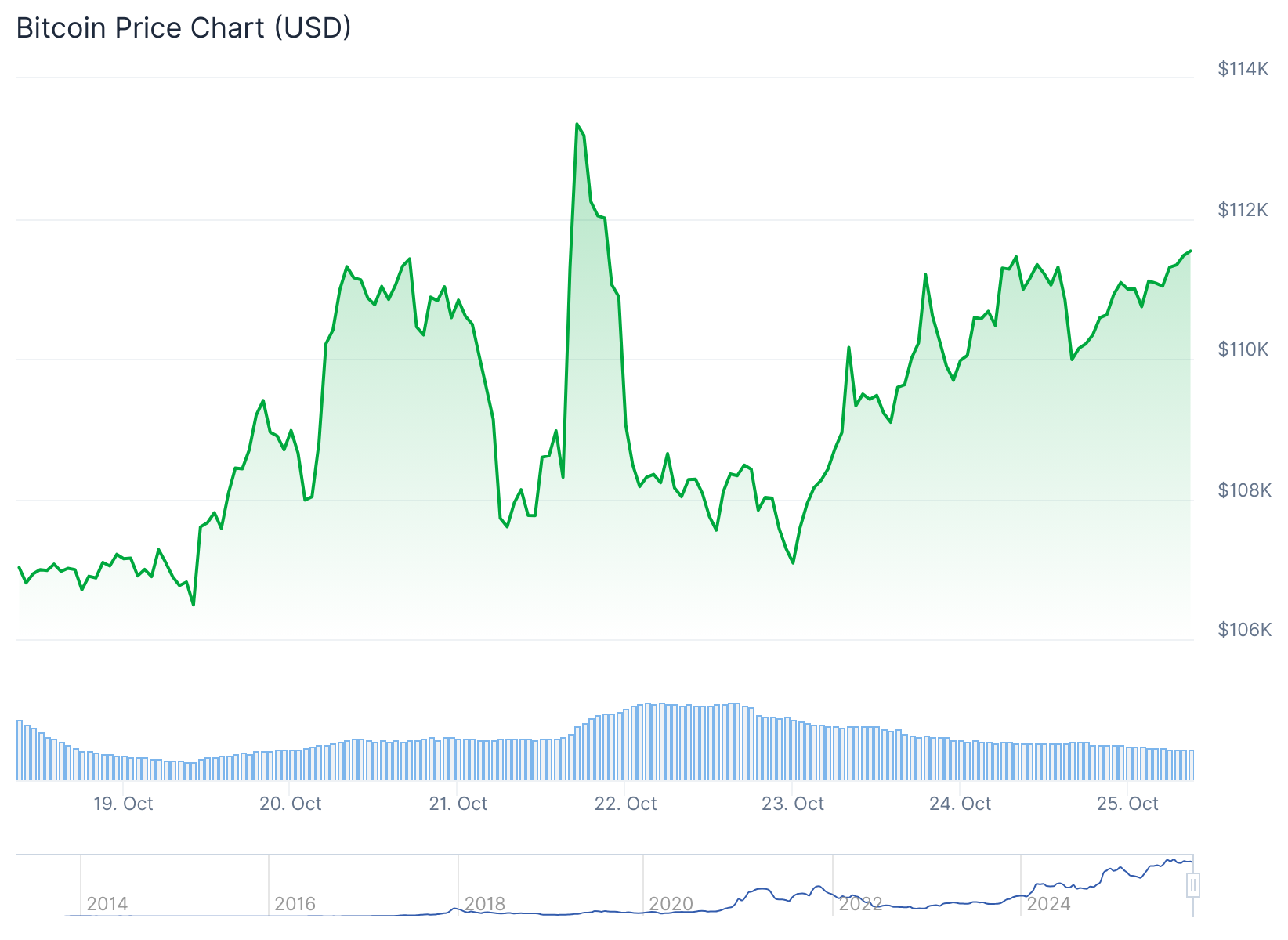

Bitcoin experienced a sharp decline on October 10, 2025, dropping to $104,000 in what became a record $19 billion market liquidation event. The cryptocurrency fell to its lowest level in four months.

Despite the market turbulence, Standard Chartered’s global head of digital assets research Geoff Kendrick maintains his forecast that Bitcoin will reach $200,000 by the end of 2025. He shared this prediction during an interview at the 2025 European Blockchain Convention in Barcelona.

At the time of writing, Bitcoin traded at approximately $108,260, down 6% over the past month. The price remains well below its previous highs but has shown some recovery from the October lows.

Kendrick told reporters the aftermath of the liquidation event may take several weeks to settle. However, he expects investors to view the sell-off as an accumulation phase once the dust clears.

Even in a bear case scenario, Kendrick expects Bitcoin to reach “well north of $150,000” by year-end. This forecast assumes the US Federal Reserve continues cutting interest rates as markets expect.

The analyst pointed to Bitcoin exchange-traded fund inflows as the primary driver for future price growth. ETFs recorded a sharp rebound this week after several days of politically driven outflows.

On October 24, Ethereum spot ETFs recorded a total net outflow of $93.6 million, marking three consecutive days of outflows, while Bitcoin spot ETFs saw a net inflow of $90.6 million, with no outflows among the twelve funds. https://t.co/Hj2Gs49bWa pic.twitter.com/ajJL9i7tvO

— Wu Blockchain (@WuBlockchain) October 25, 2025

On Tuesday, Bitcoin ETFs saw $477 million in net positive inflows according to Farside Investors. This broke a four-day losing streak and demonstrated renewed investor interest.

On-Chain Data Shows Continued Accumulation

CryptoQuant released a report on Friday highlighting Bitcoin’s structural demand remains strong despite short-term weakness. The firm focused on the ‘dolphin’ cohort, which holds between 100 and 1,000 BTC per wallet.

This group includes ETFs, corporations, and emerging large-scale holders. The dolphin cohort currently controls approximately 5.16 million BTC, representing 26% of the total supply.

In 2025, the dolphin cohort was the only group to increase its total balance year-over-year. The group added over 681,000 BTC while five other cohorts saw net decreases in their holdings.

CryptoQuant characterized the current market as the “late-stage maturity segment” of the ongoing uptrend cycle. The firm noted the annual growth rate of dolphin assets remains positive.

However, CryptoQuant warned that Bitcoin needs a new phase of accumulation to break past $126,000. The firm identified $115,000 as short-term resistance and $100,000 as immediate support.

Tiger Research Raises Price Target

Tiger Research released its own analysis on the same day with a bullish $200,000 target for the fourth quarter. The firm argued the October crash showed evidence of market transition from retail-driven to institutionally-led.

📈#Bitcoin LTF Liquidity Hunt 📈

Another liquidity sandwich 🥪

If the top gets taken out with momentum I think the bottom will be left behind as #Bitcoin is likely to push for new ATHs before give anyone time to jump back in lower.

However I could see 1 more stab into the… https://t.co/qbFsWcbGa9 pic.twitter.com/Yj6btq3nZ9

— AlphaBTC (@mark_cullen) October 24, 2025

Unlike the late-2021 decline with widespread panic selling, the recent adjustment was limited. Tiger Research stated institutional investors continued buying after the correction.

The firm expects continued Federal Reserve rate cuts to serve as a catalyst for a fourth-quarter rally. They view further institutional entry during the current consolidation phase as supportive for continued price growth.

Kendrick also noted gold’s recent all-time highs will translate into momentum for Bitcoin as its safe-haven asset narrative reemerges. Bitcoin ETFs recorded their strongest inflows this week after the Tuesday rebound.