TLDR

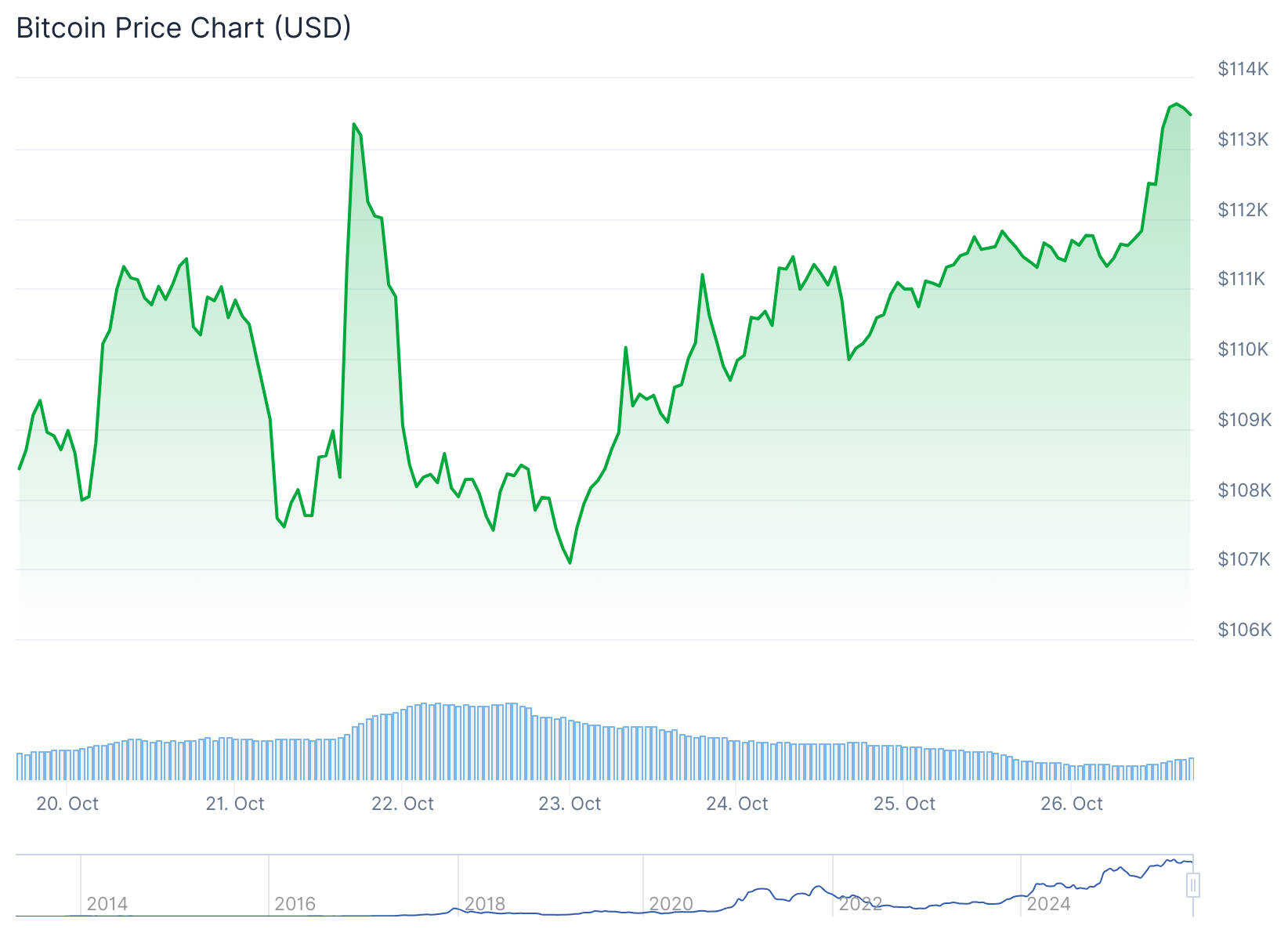

- Bitcoin rose 5.3% to $112,866 while total crypto market cap climbed 14% to $3.73 trillion from October lows

- US inflation data showed CPI at 3.0% and core inflation dropped to 3.0%, raising hopes for Federal Reserve rate cuts

- President Trump and Chinese President Xi reached a framework agreement to halt 100% tariffs, easing trade tensions

- Major altcoins including Hyperliquid, Virtuals Protocol, and Zcash gained over 10% in 24 hours

- Stock markets hit all-time highs with Dow Jones, S&P 500, and Nasdaq 100 rallying on renewed risk appetite

The crypto market experienced strong gains over the weekend. Bitcoin reached $112,866, marking a 5.3% increase from $107,088 a week earlier.

The total cryptocurrency market capitalization rose 14% to $3.73 trillion. This represents a recovery from October’s low of $3.24 trillion.

Altcoins joined the rally with substantial gains across the board. Hyperliquid, Virtuals Protocol, Zcash, and Aerodrome Finance each jumped more than 10% in 24 hours.

The rally followed positive economic news from the United States. The Bureau of Labor Statistics released inflation data on Friday showing the headline Consumer Price Index rose from 2.9% in August to 3.0% in September.

Core inflation, which excludes food and energy prices, dropped from 3.1% to 3.0%. These figures were lower than many analysts expected.

The inflation data increased expectations for Federal Reserve rate cuts. ING Bank analysts predict the central bank will cut rates at this week’s meeting and potentially again in December.

Traditional stock markets also rallied on the news. The Dow Jones, S&P 500, and Nasdaq 100 indices all reached all-time highs.

Trade Agreement Eases Market Tensions

A major catalyst for the crypto rally came from diplomatic developments. US Treasury Secretary Scott Bessent confirmed that Washington and Beijing reached a framework agreement on trade.

The deal halts the 100% tariffs President Trump threatened earlier this month. Bitcoin surged past $113,000 following the announcement, reaching its highest level in nearly two weeks.

President Trump arrived in Malaysia on Sunday as part of a three-country Asia tour. He is scheduled to meet Chinese President Xi Jinping at the APEC Summit in South Korea.

The trade agreement helped shift market sentiment from risk-off to risk-on. Asian and US equity futures climbed while gold prices fell.

Technical and Institutional Factors

Bitcoin maintained its position above the 200-day moving average. Analysts view this as a bullish technical signal for continued upward momentum.

Institutional activity has increased following October’s market downturn. Major funds and corporate treasuries have begun moving back into crypto assets.

Some analysts warn the rally could be a dead cat bounce. This occurs when an asset in decline temporarily rebounds before resuming its downtrend.

Bitcoin faces resistance at the 100-day moving average. This technical level could indicate the bull run is losing momentum.

Market participants are watching several upcoming events. The Federal Reserve will announce its rate decision this week.

#earnings for the week of October 27, 2025https://t.co/hLn2sKQhEY$META $AMZN $SOFI $UNH $MSFT $AAPL $GOOGL $PYPL $VZ $COIN $BA $UPS $CLS $CMG $ENPH $RDDT $LLY $GLW $CVS $WDC $XOM $MSTR $RKT $CVNA $RIOT $MRK $KDP $NET $OKE $NOW $CAT $CAR $BE $FI $HSBC $NXPI $SFM $CVX $BKNG… pic.twitter.com/zawZZN3ZtO

— Earnings Whispers (@eWhispers) October 24, 2025

Big tech companies including Apple, Microsoft, and Meta Platforms will also report earnings. These results could influence broader market sentiment and crypto prices.

Bitcoin traded at $113,000 on Sunday, with the framework trade agreement between the US and China finalized after meetings in Malaysia.