TLDR

- Ethereum price fell below $4,000 to around $3,900, dropping 2.2% after Federal Reserve Chair Jerome Powell suggested the latest rate cut may be the last of 2025

- Institutions now hold 4.1% of Ethereum’s total supply, surpassing Bitcoin’s 3.6% for the first time, driven by clearer regulatory framework from the GENIUS Act

- Ethereum ETFs recorded $81.44 million in outflows led by Fidelity’s FETH, though BlackRock’s ETHA showed $21.36 million in inflows

- CoinCodex predicts Ethereum could reach $4,272 by November 30, 2025, representing an 11.66% increase from current levels

- On-chain activity hit record highs with daily transactions and unique active addresses breaking all-time records, while gas fees remain near historic lows

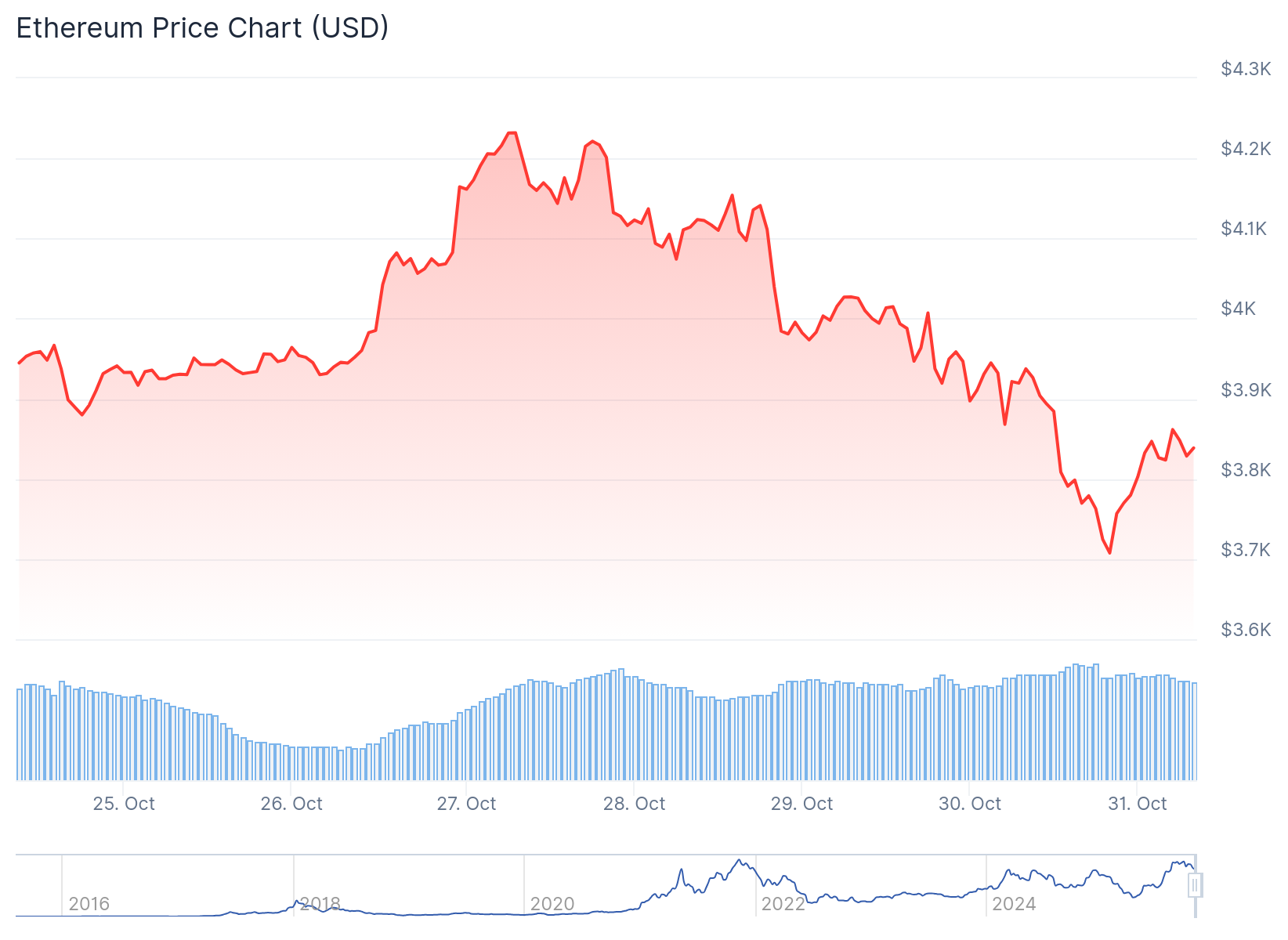

Ethereum currently trades around $3,900 after falling below the $4,000 mark. The drop represents a 2.2% daily decline.

Federal Reserve Chair Jerome Powell recently indicated that the latest 25-basis-point rate cut may be the final one for 2025. This statement sparked caution across crypto markets. Bitcoin and other major altcoins also posted losses during the same period.

The pullback follows two consecutive days of positive ETF activity. Ethereum ETFs recorded $81.44 million in outflows on the most recent trading day.

On October 30, U.S. Bitcoin spot ETFs saw a total net outflow of $488 million, with all 12 funds recording zero inflows. Ethereum spot ETFs posted a total net outflow of $184 million, also with no inflows across nine products. In contrast, Solana spot ETFs recorded a net inflow… pic.twitter.com/ZaIfLRwkkH

— Wu Blockchain (@WuBlockchain) October 31, 2025

Fidelity’s FETH led the outflows with $69.49 million leaving the fund. Only BlackRock’s ETHA fund bucked the trend. It posted $21.36 million in inflows during the same period.

Traders appear to be taking profits and reducing risk exposure. The shift comes after weeks of steady gains for Ethereum.

Technical indicators show mixed signals for the asset. The RSI currently sits at 44. The MACD line remains below the signal line.

Both metrics point to fading bullish momentum. Analysts warn that failure to reclaim $4,000 could push prices lower. Support zones exist around $3,850 to $3,750.

Institutional Interest Grows

Institutions now hold 4.1% of Ethereum’s total supply. This marks the first time institutional holdings have surpassed Bitcoin’s 3.6%.

Analysts credit the GENIUS Act for driving this change. The legislation provides a clear framework for stablecoin and on-chain finance regulation. Policy clarity has boosted institutional trust in Ethereum.

Many funds view Ethereum as the backbone of DeFi and tokenized real-world assets. Despite current price weakness, institutions continue adding exposure.

Santiment data shows major short positions opening across exchanges. When major shorts dominate, price bounces become more likely. The funding rates suggest traders expect upward movement.

📊 Ethereum has dropped back to $3.7K, and traders are showing signs of panic. The past 2 months, funding rates across exchanges dictate where $ETH goes next. When major longs dominate (greed), prices correct. When major shorts dominate, there's a high probability of a bounce. pic.twitter.com/3s47hlDgZr

— Santiment (@santimentfeed) October 30, 2025

CryptoOnChain noted that Ethereum’s altcoin activity reached new highs. This record-breaking on-chain activity provides strong fundamentals for the ecosystem.

Network Performance and Price Predictions

Ethereum’s network fundamentals remain strong despite price pressure. On-chain activity has surged to record highs. Daily transactions and unique active addresses broke all-time records.

Gas fees remain near historic lows. This signals improved scalability driven by Layer-2 networks. Arbitrum, Optimism, and Base contribute to this efficiency.

The improvements stem from Ethereum’s proof-of-stake transition. The upcoming EIP-4844 upgrade will further enhance performance.

Analyst Javon Marks believes Ethereum could explore new highs. He suggests prices could reach $8,500 with a break above $4,811.71.

$ETH Called to Precision.

Next leg could be in the works and can send prices towards $8,500+ with a break of a key $4,811.71…

(Ethereum) https://t.co/BTMUZlDxfB pic.twitter.com/vvG3r7Q8RZ

— JAVON⚡️MARKS (@JavonTM1) October 12, 2025

CoinCodex forecasts Ethereum will reach $4,272 by November 30, 2025. This represents an 11.66% increase from current levels. The platform’s technical indicators show bearish sentiment. The Fear & Greed Index registers 29, indicating fear among traders.

Ethereum recorded 15 out of 30 green days over the last month. Price volatility measured 6.20% during this period. A decisive close above $4,100 could renew bullish sentiment toward $4,400 to $4,500.