TLDR

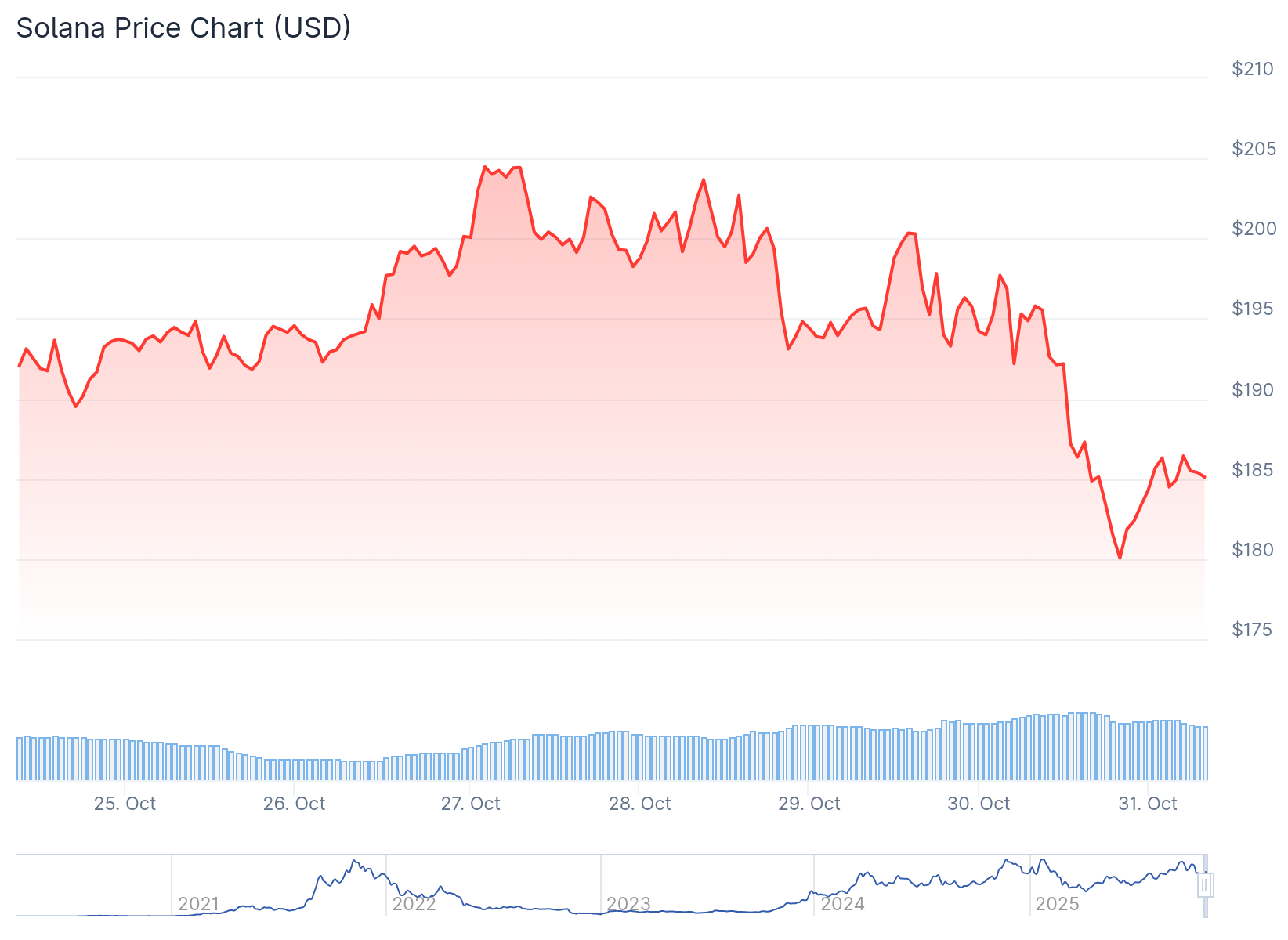

- Solana (SOL) dropped 8% on Thursday, falling below $180 and erasing all year-over-year gains, now down 4% for 2025.

- The Bitwise Solana Staking ETF (BSOL) attracted $116 million in net inflows during its first two trading sessions after launching Tuesday.

- Jump Crypto moved 1.1 million SOL tokens worth $205 million to Galaxy Digital, possibly rotating into Bitcoin, which may have hurt market sentiment.

- Bitwise’s Matt Hougan believes Solana has strong potential in the growing stablecoin and tokenization market despite currently trailing Ethereum.

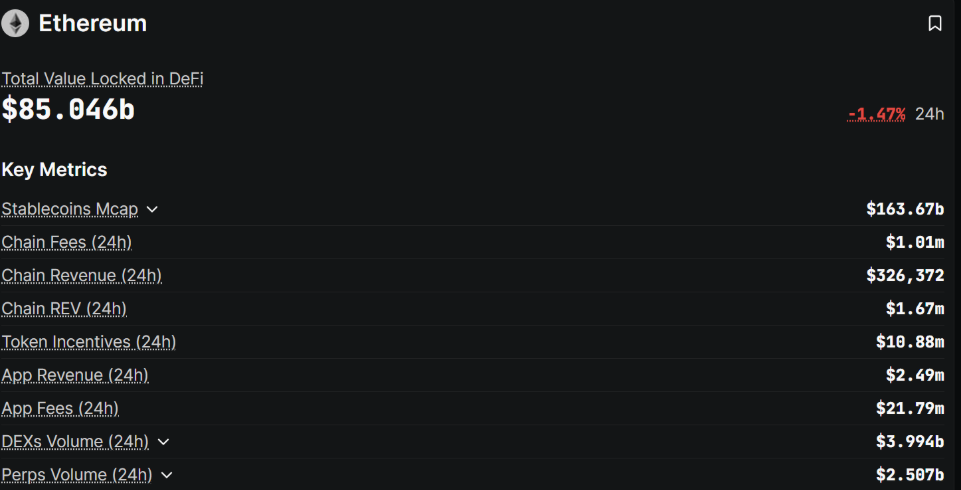

- Ethereum maintains market leadership with $163 billion in stablecoin market cap compared to Solana’s $14.9 billion.

Solana fell 8% on Thursday, continuing a weekly decline that has now erased all of the token’s year-over-year gains. The drop pushed SOL below $180, leaving it down 4% for 2025.

The decline came despite the launch of the first spot-based Solana ETFs in the United States. The Bitwise Solana Staking ETF began trading on Tuesday and pulled in $116 million in net inflows across its first two trading sessions. This came on top of $223 million in seed investment, according to data from Farside Investors.

The NYSE welcomes @BitwiseInvest to celebrate the launch of the Bitwise @solana Staking ETF $BSOL! @teddyfuse | @HHorsley | @aeyakovenko | @rajgokal https://t.co/kRyzbEbc6M

— NYSE 🏛 (@NYSE) October 30, 2025

The Grayscale Solana Trust also converted from a closed-end fund into an ETF on Wednesday. It attracted $1.4 million in inflows during its first day of trading as an ETF.

Despite these capital inflows, SOL has posted a 12% decline from Monday’s highs. The token’s performance stands in contrast to Bitcoin and Ethereum, which both maintain year-over-year gains of more than 40% despite their own recent price weakness.

Large Transfer Weighs on Sentiment

Market observers noted a large onchain transaction that may have impacted sentiment around Solana. Blockchain data showed Jump Crypto, one of the most prominent crypto trading firms, moved 1.1 million SOL tokens to Galaxy Digital. The transfer was worth approximately $205 million.

Around the same time, Jump Crypto received roughly 2,455 BTC valued at $265 million. Blockchain sleuth Lookonchain speculated the firm may be rotating out of Solana and into Bitcoin.

Bitwise Executive Maintains Bullish Outlook

Despite the price decline, Bitwise chief investment officer Matt Hougan expressed a bullish view on Solana’s long-term prospects. In a Thursday post on X, Hougan said he believes Solana offers “two ways to win” as an investment.

1/ The best crypto investments give you two ways to win. A thread exploring one reason I’m so bullish on Solana.

🧵

— Matt Hougan (@Matt_Hougan) October 30, 2025

Hougan explained that Solana is betting the stablecoin and tokenization infrastructure market will grow. The blockchain is also positioned to win an increasing share of that market.

“I think people dramatically underestimate how much and how quickly these technologies will remake markets,” Hougan wrote. “It’s easy for me to imagine this market growing by 10x or more.”

Hougan praised Solana’s technology as fast and user-friendly. He also highlighted the blockchain’s community and ship-fast attitude as strengths.

Current Market Position

Ethereum currently maintains market leadership in the stablecoin and DeFi sectors. Data from DefiLlama shows Ethereum has a stablecoin market capitalization of over $163 billion and total locked value exceeding $85 billion.

Solana trails with a stablecoin market cap of over $14.9 billion and total locked value of more than $11.3 billion. Hougan identified Tron, Solana, and BNB Smart Chain as the top challengers to Ethereum’s dominance.

Institutional interest in Solana has been growing. Financial services company Western Union announced on Tuesday it would adopt the Solana blockchain for its stablecoin settlement system.